The Future of Freight Festival in Chattanooga, Tennessee, is the event of the fall. Subscribers to Check Call have a special discount code for F3 registration. This is going to be one of the best deals on F3 tickets. Use the code CheckCallF324 or go to this link, and the discount will be applied. There is no better party than a Chattanooga party. This is not one to miss.

It’s the summer of research, and another study has come out for 3PLs: the 19th annual “Inbound Logistics Perspectives 3PL Market Research Report.” It finds that this year’s shippers are worrying about issues that were less significant in 2023’s report.

For example, while just 37% of shippers cited cutting transportation costs as a top challenge in 2023, this year 41% are seeking ways to spend less. The gaps grow larger from there. Concern about business process improvement has increased by 8 points since 2023, concern about improving customer service has gone up 10 points, and concern about supply chain visibility has gone up 12 points.

There seems to be a common theme across the board as 3PLs cite rising operational costs as an issue. Actually, 73% of 3PL respondents cite operational costs as the top concern this year, compared with 62% in 2023. On the flip side, 45% of 3PLs mention finding and retaining customers as a challenge, up by 12 points since 2023.

As for the reason for a failed 3PL partnership, 36% of shippers cite poor customer service. That’s not as alarming as 29% of shippers saying that failed expectations are why they sought a new alternative. Last year that number was 17%. Cost is also a major factor for shippers: About 21% say that’s the reason. In any event, gone are the days of making empty promises to shippers. 3PLs have to start putting their work where their mouth is.

Shippers say they’re unhappy with service and they’re unhappy with cost. Unfortunately those tend to go hand in hand as the better service a 3PL offers, the pricier it is and vice versa. The study found that when it comes down to it, 74% of shippers say service is more important than cost. Shippers know it costs a little more to work with a good 3PL. As long as that partner follows through and delivers, literally and figuratively, shippers are on board with paying more.

Rounding out the survey is a look at sales: 67% of 3PL respondents have seen sales increase since last year. That pales beside the 81% who were enjoying higher revenues in 2023. Meanwhile, 33% of this year’s respondents have seen revenues hold steady or fall, compared with 19% last year.

As a whole, shippers have higher demands and expectations for 3PLs and freight brokers. With the market anticipated to turn at the end of this year or in Q1 2025, getting a firm understanding now of shippers’ perspectives is vital to avoid their jumping ship when the turn comes.

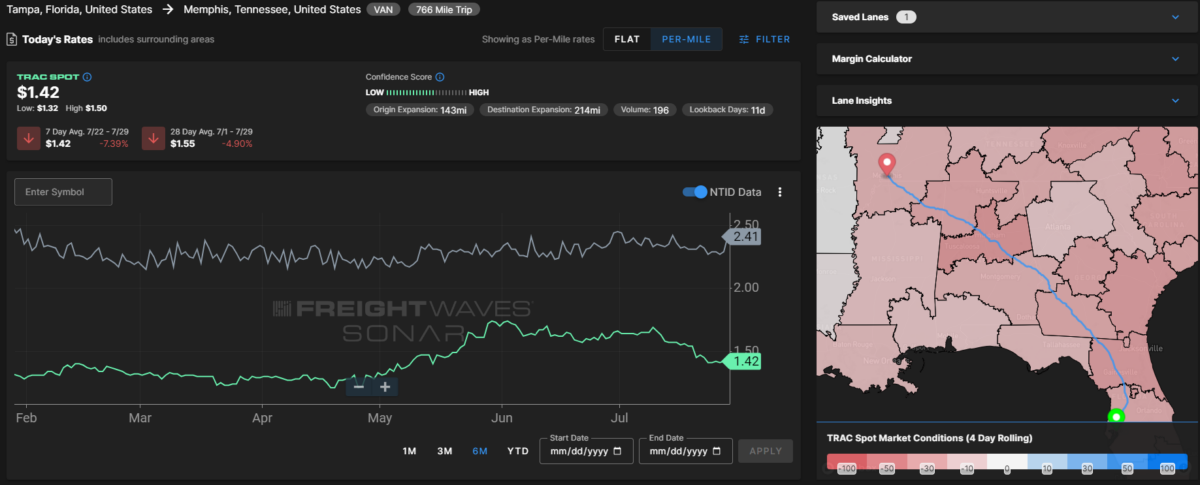

TRAC Tuesday. Spot rates from Tampa Bay, Florida, headed into Memphis, Tennessee, are on the decline as the month comes to a close. The spot rates for this lane are almost $1 less per mile than the National Truckload Index, which is hovering around $2.41 per mile. Outbound tender rejections in Memphis have increased from 7.39% to 7.82%, a 164-basis-point increase week over week. No doubt the reason for the drop in spot rates is Tampa Bay, with an OTRI of 1.49%. That is a 64-basis-point decrease w/w. An increase in Lakeland’s outbound tender rejections is about the only thing that will revive spot rates for this lane.

Who’s with whom?

While it might not be very complicated, there is a 25-year history between Werner Enterprises and Mexico. Werner launched its Mexico-based operations in 1999 with a handful of employees and an office. Fast forward to now, and there are more than 150 associates and 10 offices.

FreightWaves’ Noi Mahoney writes: “The company has many of the same cross-border customers from 25 years ago, Lance Dixon, senior vice president of Mexico, Canada and temperature-controlled divisions at Werner, said. ‘We still do business with Rheem, who makes water heaters and air conditioners; Toro, which makes lawn mowers; and Schneider Electric is another one that was with us early on and is still with us today.’”

Mexico has maintained its status as the top trading partner with the U.S., and given that this is still the upswing of the rise of Mexico, there’s a big future for Werner and other carriers looking to make headway there.

The more you know

Truck driver charged in Ohio crash that killed 6, including 3 students

CEVA supports Paris 2024 Games’ logistics needs

‘We’re too fat’: TFI International CEO targets costs at US LTL operations