Welcome to Check Call, our corner of the internet for all things 3PL, freight broker and supply chain. Check Call the podcast comes out every Tuesday at 12:30 p.m. EDT. Catch up on previous episodes here. If this was forwarded to you, sign up for Check Call the newsletter here.

In this edition: Brake Safety Day results released; noncompetes return to the limelight; and Nikola has to get creative.

The Commercial Vehicle Safety Alliance has had quite the busy April and May. May included a 72-hour Roadcheck event and April 19 was everyone’s favorite, the unannounced Brake Safety Day. The results from Brake Safety Day are in. The overall takeaway is that while there were fewer vehicles inspected this year, there was a higher compliance rate of vehicles that were inspected.

According to John Kingston’s article: “CVSA said it found ‘brake-related critical vehicle inspection items’ on 11.3% of the 6,829 vehicles that it inspected. Making such a finding means that the vehicle is ‘unfit and unsafe for roadways.’ That 11.3% translates to 774 vehicles, and they were removed from service ‘until the violations were corrected.’ By comparison, there were 9,132 vehicles inspected last year with 1,290 removed from service due to brake issues. That translates to a 14.1% removal rate.”

The top brake-related defect forcing trucks out of service was called “20% brakes violation,” which basically means 20% or more of the brakes have an out-of-service condition that makes a brake defective, something like air leaks, defective pads or a brake out of adjustment. Those violations totaled 479. These inspections were across all of North America. Don’t forget that Brake Safety Week is scheduled for later this year, Aug. 20-26.

It’s a rough time out there for brokerages that are trying to trap employees with noncompete agreements. At the beginning of the year, the Federal Trade Commission proposed a rule that would ban noncompetes on a national level. After more than 27,000 comments on both sides of the argument, a majority appears to be for the ban. The FTC has announced it will issue a ruling in April 2024, leaving us with just under a year to ride out any more noncompete issues.

Until the FTC rules on noncompetes, there is some hope for those in certain states. California, North Dakota, Oklahoma and the District of Columbia ban noncompete agreements outright, with a few exceptions. Colorado, Illinois, Maine, Maryland, New Hampshire, Oregon, Rhode Island, Virginia and Washington prohibit noncompete agreements unless the employee earns above a certain salary threshold. Other states, like Iowa and Kentucky, limit the use of noncompetes for certain professions such as health care workers.

Unfortunately, there are plenty of noncompete cases to go around. Back in the headlines is TQL for suing a former broker, Jacob Patterson, for an alleged second violation of his noncompete. When Patterson founded Hyperlux Logistics, TQL claimed that Hyperlux became a direct competitor of TQL, despite not being open for business for another four months.

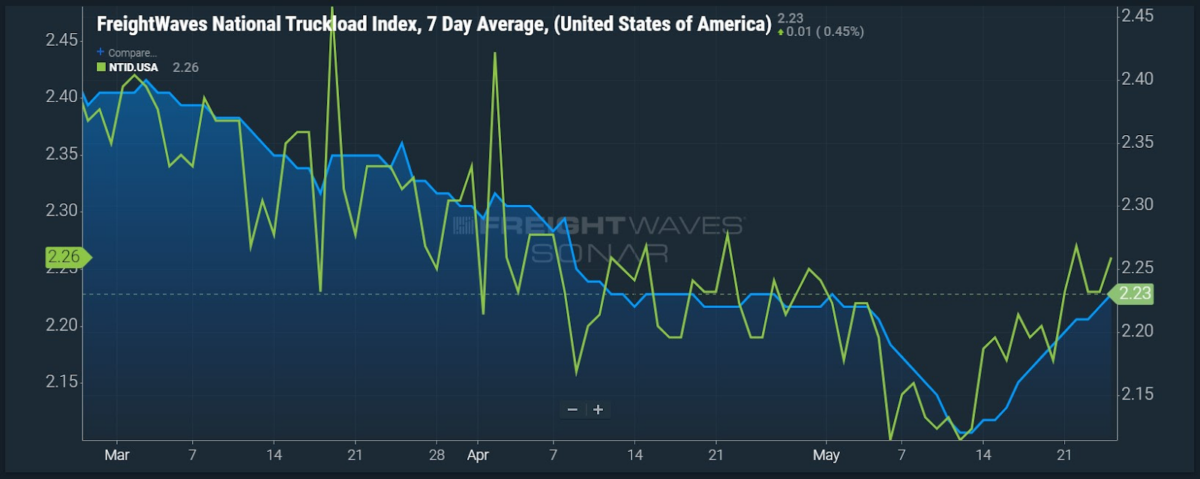

Market Check. Spot market rates continue to rise as the impacts of CVSA Roadcheck and the Memorial Day weekend decrease available truckload capacity. The FreightWaves National Truckload Index (NTI), a seven-day moving average of spot rates representing 8.7 million loads, rose 2.74% or 6 cents per mile from $2.17 on May 18 to $2.23 per mile. The NTID, the daily version of the National Truckload Index, rose higher at $2.26 per mile as of Thursday, with the NTIF forecast rates expected to plateau and remain around $2.26 per mile for the first half of June.

Who’s with whom? It’s more like who’s not with whom. Nikola Corp. is about to no longer be with Nasdaq. It turns out when the share price of a company is below $1 for more than 30 days, said company gets a delisting warning. If the company continues to fail to meet the requirements, it can be delisted from the stock exchange involuntarily.

Nikola is left with two possible options: a reverse stock split or acquisition. According to Alan Adler’s article: “Lordstown Motors Corp. approved a 1:15 reverse stock split that raised its share price but had no impact on its financial condition. Without the split, the Nasdaq could have removed Lordstown from trading on Friday.” There also is a chance that Iveco could come to the rescue.

Double broker red flags

Double broker red flag No. 2: “0 fmcsa inspections = broker, and unwillingness to share driver info upon booking the load.” Courtesy of Adnan Velic.

Zero FMCSA inspections isn’t always a bad thing as carriers don’t have any control over getting inspected. The biggest red flag there is that unwillingness to share the driver info upon booking. That is a hallmark of the sketch masters. When you ask for the driver’s contact information and are met with some hostility on the other end of the phone, run far and fast.

Got any tips that are your favorite? Let me know or share on LinkedIn. I’d love to share them with everyone.

The more you know

Texas-based trucking company files for Chapter 11 bankruptcy protection

Borderlands: Laredo remains nation’s No. 1 gateway for international trade

Can EPA’s electric truck proposal survive political scrutiny?

Bathroom access allowed for commercial truck drivers in Washington state