New year, new 3PL study from NTT Data, Penn State and Penske. This year’s study, aptly named “The Power of Partnerships: Exploring Collaboration Through Data and Innovation,” focuses primarily on the role of partnerships in the shipper and 3PL industry. It homes in on three key areas: the power partnerships provide, the flow of data and looking beyond the hype of technology – something we’ve all fallen prey to as the latest and greatest tech has come out.

How shippers and 3PLs perceive their relationship is always an interesting point of comparison. This year 78% of shippers were satisfied with their 3PL providers’ IT capability, which seems positive, but it’s a 3% drop from last year. Shippers’ outsourcing of logistics services saw a similar dip. Last year 89% of shippers were using outsourced logistics services. This year it’s 87%. It’s a small decrease, but compared to 2021’s 94%, it’s a significant drop over the course of three years.

In a small victory for some 3PLs and a loss for others, 85% of shippers are reducing or consolidating 3PLs, almost a 10% increase year over year. As for what services shippers are starting to outsource, that’s the ultimate value-add for 3PLs to tack on to existing business and highlight for prospective clients. The most outsourced things are day-to-day tasks, with about 50% of reported outsourced services being domestic transportation, freight forwarding, warehousing, customs brokerage, international transportation, and transportation planning and management. On the warehousing front, this year 65% of shippers are reported to be outsourcing the work, compared with 43% from the 2022 study.

The all-important IT solution that 3PLs provide to shippers took one of the biggest hits this year. “Nearly all shippers, 97%, said IT capabilities are a necessary element of overall 3PL provider expertise. In the current study, 49% of shippers indicated they’re satisfied with 3PLs’ IT capabilities, down from 54% last year and 58% in 2022. Interestingly, shippers identified more IT capabilities than they have in the past.”

The downward trend of shippers being satisfied with their 3PLs’ IT capabilities isn’t ideal and shows that now, more than ever, there needs to be a push to maintain and improve the technological aspects of the business.

The must-have pieces of technology that shippers are looking for from 3PLs are more transaction-based, such as transportation management planning. Sixty-two percent of shippers consider this vital. Rounding out the top four are warehouse/distribution center management (59%), transportation management scheduling (57%), and advanced analytics and data mining tools (50%).

As for what these findings mean for the dynamics of the relationships between 3PLs and shippers, well that has also changed. According to the study, “This year’s research supports the concept that the power dynamic has had impacts on both shippers and 3PLs. In the past, shippers had more leverage. Among respondents: 39% of shippers and 38% of 3PLs said shippers have gained leverage over the past three years; 30% of shippers and 31% of 3PLs said 3PLs/4PLs have gained leverage; and 31% of both shippers and 3PLs said there’s been no change.”

To check out the full 75-page study, head on over to the 3PL study website and either hit the highlights or read the whole study. The 2025 data collection side of things is also open if that speaks to you.

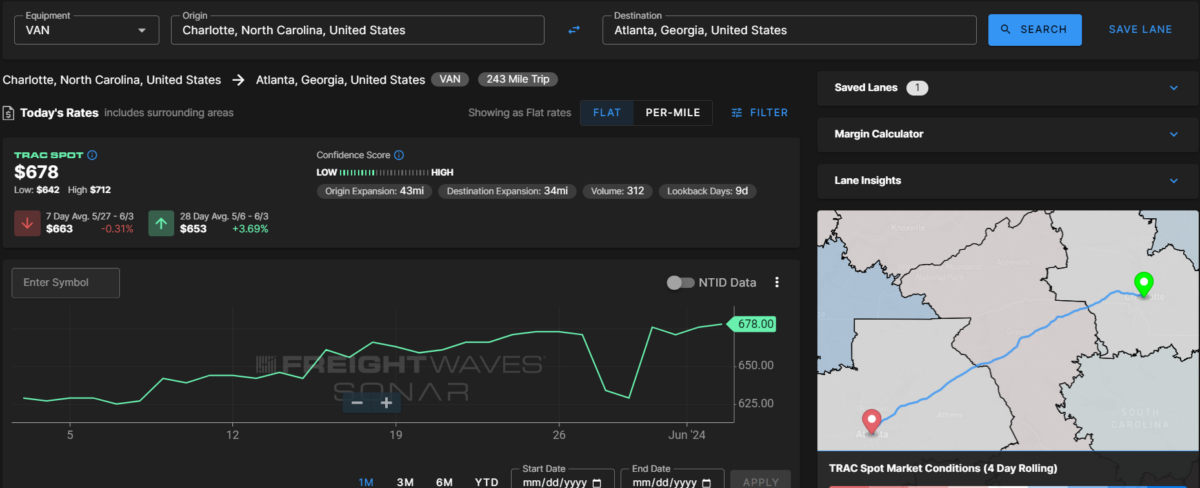

TRAC Tuesday. This week’s TRAC lane goes from Charlotte, North Carolina, to the home of the Future of Supply Chain 2024, Atlanta. The all-in rate on this lane, before margin, should be around $678 for a short little 234-mile jaunt through the mountains. Outbound tender rejections on Monday were sitting at 5.82% coming down from the 6.64% rejections over Memorial Day weekend. Meanwhile, in Charlotte, there wasn’t a significant jump in rejections as a result of the holiday. Rejections are sitting at 4.1% compared to 4.2% at this time last week.

Since both markets have rebounded from the Memorial Day jump, spot rates should be leveling off and mimic mid-May levels as June gets underway.

Who’s with whom? Earlier this year, Convoy’s technology and intellectual property were acquired by global freight forwarder Flexport. It’s official: The Convoy Platform for brokers has returned under Flexport and is looking to create a marketplace that pools small carriers and owner-operators into a single platform with enhanced tracking capabilities, 24/7 operations and additional flexibility.

“This is a pretty notable departure from how Convoy had executed before we relaunched the Convoy Platform,” Bill Driegert, Flexport executive vice president and head of trucking, told FreightWaves in an article by Noi Mahoney. “Specifically, we architected it to be much more neutral and open to all brokers.”

The more you know

Kinimatic introduces WareView, a centralized 3PL warehouse integration platform

How supply chain management advances health care for women in rural communities

Yellow’s shareholders get desired ruling in Delaware bankruptcy court

Borderlands Mexico: Kuehne+Nagel expanding in Texas to meet rising manufacturing demand