Welcome to Check Call, our corner of the internet for all things 3PL, freight broker and supply chain. Check Call the podcast comes out every Tuesday at 12:30 p.m. EDT. Catch up on previous episodes here. If this was forwarded to you, sign up for Check Call the newsletter here.

(GIF: GIPHY)

Laredo, Texas, is channeling its best impression of Whitney Houston as it retains for the seventh straight month the top spot among all 450 international gateways for trade in August with a casual $28.6 billion. Coming in on Laredo’s heels is the Port of Los Angeles and Chicago O’Hare International Airport. In a surprise to few, the top imports from Mexico to the U.S. were auto parts, passenger vehicles and commercial trucks. It’s not much of a surprise given automotive manufacturing makes up the majority of what has been nearshored to Mexico.

It’s the boom before the bust for Laredo. With truckload demand rising dramatically year over year, it’s a matter of time before Laredo comes to be one of the top freight markets, in regard to volume, in the country.

FreightWaves’ Zach Strickland called it back in August: “Phoenix has experienced a similar developmental boom, becoming a proxy for California’s old warehousing capital in Southern California’s Inland Empire. This shifting demand pattern is changing transportation networks and will subsequently impact future pricing structures.”

(Image: 9GAG)

Increased fraud, double brokering and now an increase in new-entrant out-of-service (OOS) orders — these are not items I had on my 2023 supply chain bingo card. The Federal Motor Carrier Safety Administration started keeping track of new-entrant OOS orders in 2012, and 2022 held the record of 24,363 until this year. As of June, that number has climbed to 25,955, with six months to go in the year.

A new entrant is classified as “a motor carrier not domiciled in Mexico that applies for a U.S. Department of Transportation identification number in order to initiate operations in interstate commerce” per the FMCSA.

As of right now, there is no reason behind the surge, but the prevailing theory is that the amount of new entrants to the trucking market has caused a rise in the number of OOS orders. Basically, when a carrier is new to the industry, it is required to get a safety audit within the first 18 months. If the carrier refuses or fails the audit, it is placed OOS. Any carrier that continues to operate faces federal fines and penalties.

So what does that mean for brokerages? There is some possibility of a reduction of available carriers in the market leading to tightened capacity. It also could lead to carriers requesting higher rates to make money to update and maintain equipment.

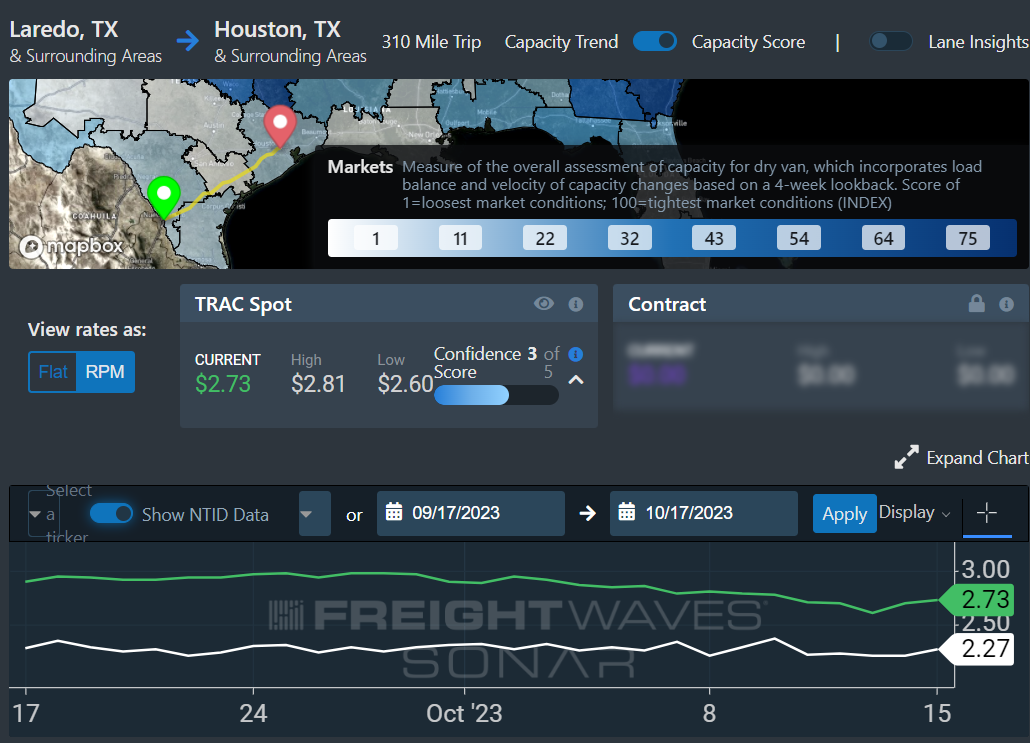

TRAC Tuesday. This week’s TRAC lane goes from Laredo to Houston. Capacity is loosening in Houston, which is putting downward pressure on spot rates. Outbound tender rejections are slowly on the rise but overall the Outbound Tender Rejection Index (OTRI) is at 1.36%, which is extremely high contract compliance for carriers and would make sense given the amount of cross-border freight that typically goes via contract. If there was a load from Laredo to Houston that made it to the spot market at an all-in rate of $846, before margin, this load should be secured with little problems.

(GIF:GIPHY)

Who’s with whom? It’s the most wonderful time of the year: general rate increase (GRI) season. Coming out of the gate swinging are UPS and FedEx. UPS announced its GRI for the year and, would you look at that, it’s eerily close to FedEx’s. Considering the battle with the Teamsters this year, the GRI could have been worse.

Although the GRI hovers around 5%-6% for most packages, the exact amount depends on weight. It’s more important than ever to make sure there is a strong audit process for shipments running through the network. There is a chance that some higher accessorial fees could be snuck in and paid unnecessarily.

FreightWaves’ Mark Solomon wrote in his article: “UPS’ challenge in building its 2024 rate-setting strategy is to balance the need to boost yields with the desire to not alienate shippers whose volumes it is trying to recapture in the wake of the contract negotiations. About 1.1 million daily parcels were diverted to rivals in the weeks and months of often-volatile negotiations.”

The more you know

Freight recession unlike any other in history

Flexport CEO Petersen overhauls top management

Roadrunner’s new service waives shipment costs on late deliveries