Automate the things you hate. In a world in which everyone is racing to improve daily processes and create more time in the day, it’s easiest to start with those things that are a daily pain point within an organization.

Digital freight matching is designed so that a carrier can just tap and go, meaning the carrier taps to accept a load at a posted rate and then it hits the road. It serves as one of those things that can help alleviate some of the issues brokers have with getting the right freight in front of the right people.

This process can solve a lot of problems both carriers and brokers face during the negotiation process. It speeds up the time it takes to get a load covered and reduces the amount of “post and pray” and time-consuming phone calls.

When it comes to tools that are available for digital freight matching, there are an overwhelming number of options and that can sometimes cause decision paralysis. Any tool should be able to provide digital messaging and paperwork, seamlessly connect partners, provide a quick-pay option, integrate into TMSes and mobile devices, and more.

The most powerful freight-matching platforms use AI-based analytics and machine learning to optimize for service, efficiency, capacity and costs. Digital freight matching is the logistics world’s equivalent of Airbnb for travelers.

There are roughly three types of players going after digital freight marketing: tech companies that offer freight matching such as Descartes MacroPoint and Cargo Chief; digital freight-matching startups such as Uber Freight, Convoy and Transfix; and 3PLs and brokers that are building their own capabilities such as C.H. Robinson and J.B. Hunt.

Uber Freight, while maintaining the most competitive rates, does have a fully digital platform. You don’t have to talk to anyone to book your load. Everything is run through its app.

Transfix allows ELD tracking and load board functionality, but you still have to manually enter a bid and follow up with a call. The only automation part is in the order flow process.

Convoy is fully digital but doesn’t have as wide of a scope of lanes/volumes. With competitive rates and ELD tracking available on its driver app, Convoy has a unique power-only option with which you can borrow a trailer.

Cargo Chief has C4 automated up to the final call. It presents carriers looking for the lane with real-time data of what that lane is being booked at. It focuses on carrier relationship building to remove the transactional nature and keep the human touch component alive and well.

Almost any digital freight-matching product will drastically cut down on the amount of time individual brokers have to post a load and start hammering away at a load all day hoping to get the right person to answer the phone.

The ability to fully automate how a shipper enters a load all the way through a carrier delivering it is a few years away. But we are well in the realm of being able to present the right carriers the right loads without having to spend the whole day on the phone.

Avocado toast anyone? Mission Produce opened an avocado import facility in Laredo, Texas. It’s no secret that Laredo is the spot for importing goods into the U.S. from Mexico, and clearly Mission wants in on the game.

Their 274,000-square-foot facility is the new hub for importing avocados. Not only is it a millennial’s dream, it has ripening rooms, storage for dry goods and offices for USDA and CBP — plus a dedicated mango room, which seems like it would smell amazing.

More than $4.2 billion worth of fresh produce was imported during 2020 from Mexico through Laredo’s port, including $1 billion worth of avocados. Think of all the houses you could buy with that many avocados.

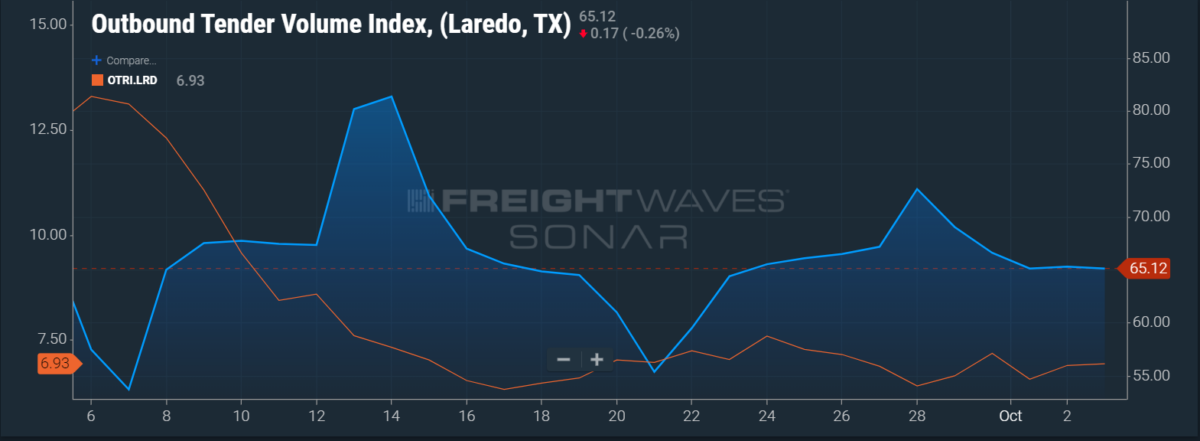

Laredo’s import growth isn’t going anywhere anytime soon. It’s a market to watch to know what is happening throughout the year.

Laredo is good for more than just importing avocados. Last year alone, Customs and Border Protection processed $180.9 billion in imports. Laredo’s trade with the world has risen 31.2% this year over 2020. The Port of Laredo is the No. 1 inland port along the U.S.-Mexico border and the fourth-busiest inland port in the country.

Importing through Mexico isn’t going to ease anytime soon. Laredo will continue to be a crucial market to be in the know about for the foreseeable future, especially as we head into retail’s peak season.

Laredo’s top imports, thus far this year, are motor vehicle parts, passenger vehicles, tractors, commercial vehicles, cellphones, and related equipment. While those aren’t typically subject to retail peak season surges, those commodities are all presently experiencing shortages. There could be potential surges as supply chains catch up, unrelated to the peak retail season.

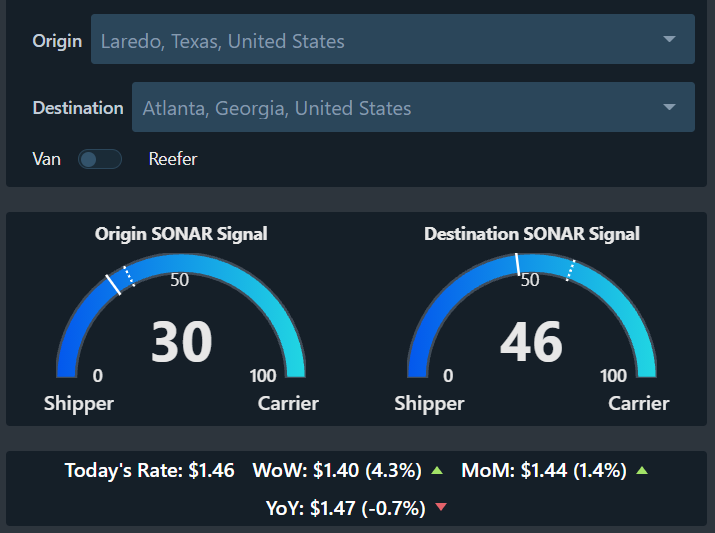

Currently on the Laredo-to-Atlanta lane, the negotiation power is more in favor of the shipper out of Laredo. However, the current rate per mile ($1.46) is showing to be on trend with the rate for the entire year. We love some consistency. However, as more companies build import warehouses and facilities in Laredo, that could change.

Who’s with Whom

Providence Equity Partners has acquired Tenstreet. Tenstreet’s software works as a universal clearinghouse for truck driver employment applications while streamlining onboarding and post-hire management. Providence Equity Partners has invested in transportation and logistics companies before. Read more here.

Last week ArcBest acquired Chicago-based broker MoLo Solutions. ArcBest will pay $235 million upfront. However, with the added revenue MoLo will bring in 2021 alone, the cash payout for years to come will well exceed the $235 million paid. MoLo’s culture is one of the major reasons it was so successful so quickly. Hopefully cultures can be melded successfully to continue to maintain the growth MoLo achieved. Read more here

The More You Know

Mission Produce boosts market footprint with Texas avocado import facility

Carriers grip pricing power firmly as Q3 comes to a close

FedEx Express drone lands at Irish port, kicking off key month of testing

Rivian files for what could be the 4th-largest IPO of the decade