If you’re half the man (or woman) you used to be, this you feel as the dawn, it fades to gray, don’t worry, we can fix that at F3 in Chattanooga, Tennessee, Nov. 19-21. If the opening line didn’t give a hint, the musical guest at the event is the Stone Temple Pilots. Subscribers to Check Call can get a special discount on tickets, which might be the best deal on tickets now compared to normal price. This link or the promo code CheckCallF324 will be all you need to make your fall dreams a reality.

For the first time in 47 years, the International Longshoremen’s Association, the union that employs dockworkers on the East and Gulf Coast ports, has gone on strike. There was a lot of speculation around whether the strike was going to happen, because at the final hour Monday night, some progress was made in the hopes of an extension to the master contract. Sadly it wasn’t enough.

The main sticking points on the negotiation table mimic what other unions have threatened to strike for this year: wages and health care benefits. However, this battle has a sticking point of automation enhancements made at ports as well.

The strike is expected to cost the U.S. economy $5 billion a day. In the weeks leading up to the strike, President Joe Biden has said he will not intervene and hopes the parties can reach an agreement together. “We’ve never invoked Taft-Hartley to break a strike and are not considering doing so now,” a Biden administration official told Reuters, referencing a law that empowers the president to order striking workers back to work under certain circumstances.

A national poll conducted by the U.S. Chamber of Commerce found that 57% want the administration to act “to keep the ports open and operating while negotiations continue,” while roughly 20% oppose federal intervention. The poll’s margin of error is about 2.8%. The poll surveyed 1,467 voters.

What does this strike mean for supply chains? It’s not great. The East and Gulf Coast ports handle a significant portion of U.S. import volumes. Over the weekend, individual ports were urging shippers to collect anything they could, some even providing extra gate hours to get shipments out, with a priority placed on perishable goods including food and pharmaceuticals.

How long the strike goes on will determine its impact to the supply chain. Should the strike last only a few days, there will be minimal impacts as most retailers were already pulling forward goods for retail’s peak season.

Smaller carriers and those that specialize in drayage moves on the East Coast will be in a tight spot should the strike carry on too long, as that is their primary business revenue. Markets with excess freight and slightly elevated spot rates should see some excess capacity coming to the market should the strike last longer than 24-48 hours.

Right now there appears to be little impact to consumers. Shippers have contingency plans in place. However, a longer strike could create a much different story as everyone tries to navigate around this issue.

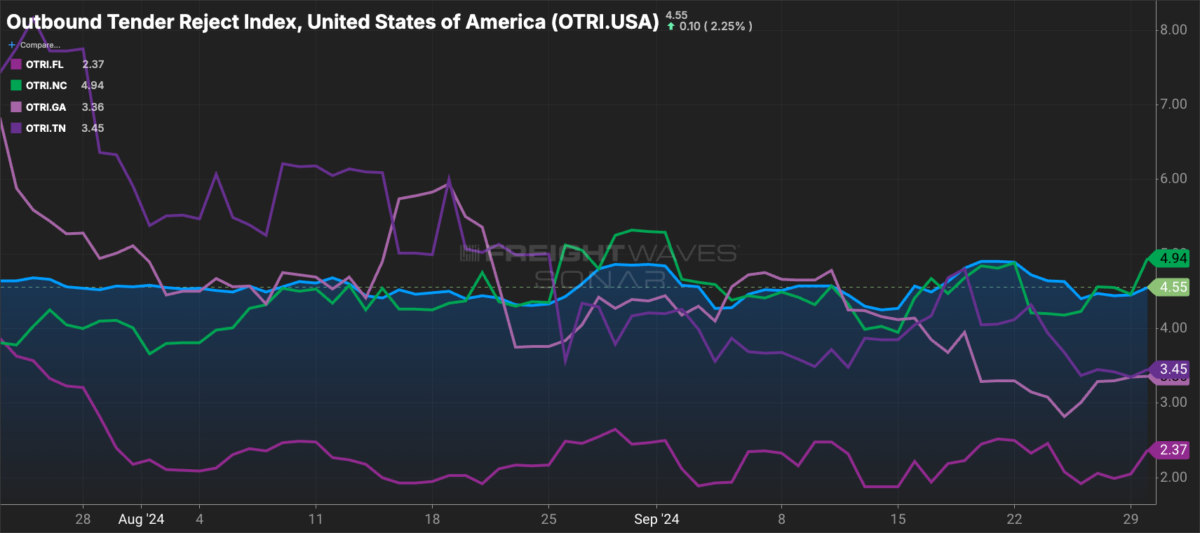

Market Check. Last week Hurricane Helene and its destruction charted an atypical path. Instead of going across Florida and up parts of the Southeast coastline, Helene ravaged a large part of the Southeast with catastrophic rain and flooding. Massive flooding in North Carolina and Tennessee have forced road closures. Interstate 40 is closed around Asheville, North Carolina, and honestly most of Asheville is pretty impassable.

While outbound tender rejections at a state level for those states have seen minimal upticks in volumes, please advise drivers, shippers and anyone else to avoid the area and come up with an acceptable alternative route. There’s going to be an increase in out-of-route mileage charges or higher rates for shipments needing to go around the damage.

Who’s with whom? It’s a good time to be a good neighbor. Following the devastation left in Helene’s wake, hundreds of local roadways are closed and thousands of people are without power in North Carolina, as well as other parts of the Southeast. The full disruption to the supply chain and trucking market is yet to be seen. Some carriers are still assessing any property damage from the storm, some are already contracted on Federal Emergency Management Agency loads, and some are having to route around the area, adding time to deliveries and potentially putting carriers on routes that aren’t meant for heavy-duty trucks. The rebuilding and recovery efforts will be slow. The crumbling infrastructure in the devastated areas and the now real port strike will make aid harder to get to those who need it.

FEMA has already sent, “25 trailer-loads of food and 60 trailer-loads of water to North Carolina. A C-17 cargo plane full of food, water and other supplies arrived at a base in Asheville. Eighteen helicopters were on standby to deliver supplies to affected communities,” writes Freightwaves’ Brinley Hineman.

The article also quotes Kathy Fulton, executive director of American Logistics Aid Network, a nonprofit that coordinates aid requests after natural disasters. “This particular disaster is very much like Hurricane Maria, in that we have immense loss of power. The people in North Carolina are cut off because we’re on the top of a mountain or the side of a mountain, and the roads are washed away,” Fulton said.

The more you know

Digital freight broker furloughs workers after losing key customers

CVSA data on International Roadcheck confirms that many drivers stayed home

National Guard deploys air assets in North Carolina in response to Helene

Union Pacific says it’s already moving record West Coast container volume

Self-flying drones, self-driving robots combine to deliver in Dallas