Environmental rules threaten to create more ‘stranded assets.”

The start of new environmental rules in China is hurting the market for second-hand ships as the country’s once reliable buyers face a stricter environmental regime.

The shift shows the risk now facing many asset-based transportation companies as new regulations potentially devalue the cost of their equipment.

At the start of September, China’s Ministry of Transport regulations required all imported ships to be compliant with IMO Tier II emissions standards.

The Tier II standards, which was required of all marine engines in ships built by 2011 or later, aim to reduce nitrogen oxide emissions from engines up to 22% from the previous standard. The cost of retrofitting an older ship to the Tier II standard ranges from $100,000 to $900,000

The result is that Chinese buyers are becoming more wary of older ships. This summer saw fewer second hand vessel transactions than even the most holiday hungry shipbroker could have hoped for.

According to Italian broking house Banchero Costa just 44 vessels were reported sold in August, compared to an average this year of 49 per month.

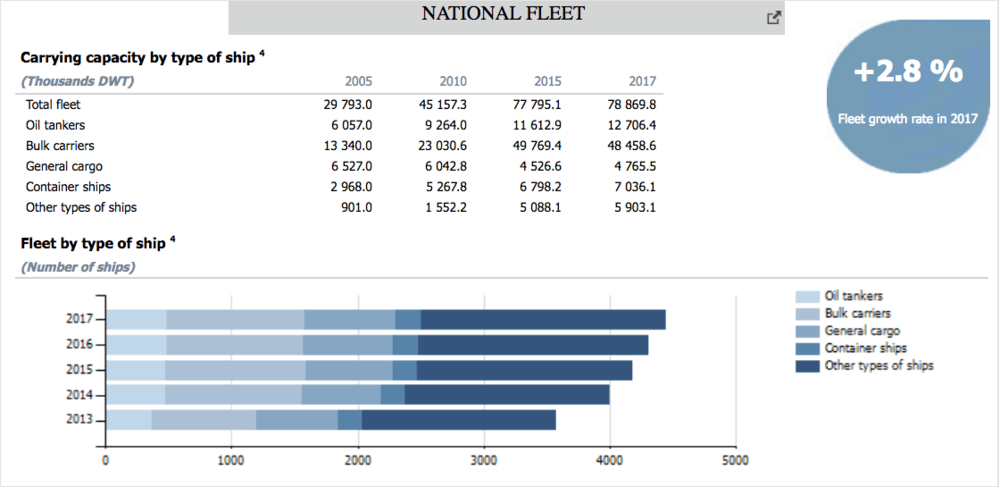

As the world’s biggest consumer of iron, coal and soy beans, China is the largest dry bulk shipping market in the world. The country’s dry bulk fleet at 48.5 million deadweight tons is more than double its size from 2010, according to the United Nations.

Many of the world’s older ships usually end their life with Chinese buyers, but less so now.

“Dry bulk vessels older than 7 years are being totally shunned by the Chinese buyers”, leading S&P broker Federico Priarone told FreightWaves in Singapore today. “They, the Chinese – represented up to 80% of the second-hand demand so far this year, but now they’ve gone and we see that in the lack of transactions of older ships this summer”, Priarone said.

Secondhand sales in August included 13 Capesizes, 1 Post-Panamax, 5 Panamaxes, 15 Supramaxes, and 10 Handysizes.

In the first 8 months of 2018, 393 units were reported sold, of which 152 were Supramaxes, 95 were Handysizes, and 88 were Panamaxes, Banchero Costa said in their monthly dry bulk report released this week.

The absence of Chinese interest is forcing bids 10% below current market values. The Japanese built Supramaxes from 2006 and 2007 were sold for $13.5-14 million earlier this year, and the perception is that vessel prices are falling as the few bids that have materialised have been in the range of $12-12.5 million, depending on heritage.

When asked why prices seem to be falling, Priarone said: “It’s not that values are actually falling, it’s just that there are so few buyers around and we are only seeing low-ball bids”, adding, “This gives the impression of a weaker market and the uncertainty brought by the 2020 sulphur cap, doesn’t help either.”

According to Banchero Costa’s monthly report, the first 8 months of 2018 saw only 32 vessels of 3.1 million deadweight tonnes sent for scrap, compared to 158 units amounting to 10.5 million dwt scrapped the same period in 2017.

This lack of deletions from the global fleet is being confounded by a 50% increase in new building orders from shipyards.

Of course, the Tier II regulations, which are already supplanted by Tier III regulations in the U.S. and Europe, are just one issue facing the shipping industry. All ships face the prospect of having to lower their sulphur emissions from 3.5% to 0.5% by 2020 according to rules from the International Maritime Organization (IMO).

Ships face the prospect of burning higher cost low-sulphur bunker fuel or installing sulphur scrubbing devices. Those higher potential costs from IMO 2020 “poses a threat to existing ships’ profitability and may result in certain ships becoming stranded assets,” said a 2015 research paper from UCL Energy, Hartland Shipping and Lloyd’s Register.

Priarone says: “So far this year 120 new orders totalling 13.6 million dwt were placed with shipyards in Asia, compared to just 81 units of 9.5 million dwt in the same period of 2017. He added: “Make of it what you like, but the lack of buyers of older tonnage, the looming sulphur cap and the increasing global fleet is going to impact freight rates and second hand values for the older ships, one way or the other.”