Editor’s note: This file has been updated with additional information.

Global commodity traders and U.S. importers that rely on maritime data out of China for their work continue to be in the dark – and U.S. federal officials are now investigating.

The data, called the Automatic Identification System (AIS), tracks all vessels that carry commodities and containers. American Shipper’s initial investigation revealed this data breakdown was reduced by almost 100%, according to VesselsValue.

Josh Brazil, vice president of Supply Chain Insights, tells American Shipper that a vast majority of the AIS terrestrial data remains blacked out, with only small pockets of data visible.

Federal Maritime Commissioner Carl Bentzel told American Shipper that the lack of terrestrial AIS data not only is a very concerning development, it could be a possible violation of the Maritime Transportation Security Act of 2002.

“It seems to me, that on the other side of the supply chain, that they [China] are turning out the lights,” Bentzel said. “We need to do more to enhance connectivity through the maritime supply chain, not less.

“I am also going to be talking with the U.S. Coast Guard to get their assessment about international obligations promoting the use of AIS in the International Ship and Port Facility Security (ISPS) Code because there are also safety and security implications concerns in restricting AIS access, and this action could possibly negatively impact the welfare and safety of merchant mariners.”

AIS is designed to make sure the vessels don’t crash into one another or the vessels don’t crash into port.

Jan Hoffmann, chief of the United Nations Conference on Trade and Development’s (UNCTAD) trade logistics branch and division on technology and logistics, wrote in a Dec. 1 blog that all stakeholders that collect, transmit and consolidate the AIS data need to work together to maintain its use.

Hoffman stressed the current supply chain crisis only highlights the importance of AIS, saying that “at times there may arise concerns about ensuring that commercially sensitive or personal data is well protected and respected in the maritime world.”

Added Hoffman: “While addressing such concerns is important, we also need to ensure that the global comprehensive coverage achieved based on AIS data in recent years is maintained and enhanced. The challenges faced by those providing maritime transport services are getting more complex by the day. They include the need to reduce port congestion, responding to environmental concerns and ensuring transparency and visibility.”

Based on the interpretation of UNCTAD’s AIS participant commentary, the deliberate act of China turning off its terrestrial AIS data because of its privacy laws, the country’s AIS data stream is no longer transparent.

Not only critical for the safety of seafarers on vessels, the terrestrial AIS data provides specific commodity and port information so trading decisions can be made. Retailers and manufacturers also use this information for their logistical and payment plans.

Peter Sand, chief analyst at the ocean and air freight analytics firm Xeneta, explained that AIS data provides key information of cargoes on the move – from the mine to the end buyer.

“In short, what you do with AIS data is that you track commodity flows,” Sand told American Shipper. “This information has a value, as it assists the trader in analyzing the impact on the price it may have at the destination point. Knowledge about the supply chains, and movements of goods from loading port to discharge gives insight. This you can leverage as a trader.

“It may also enable you to redirect a cargo, if you can control the destination to bring it in at the right time and place. Without the feed coming from the terrestrial Chinese antenna for the time being, the trader has little real-time data to access – leaving him/her with less information than the buying part.

“Surely, some ways around the issues are currently being developed, including AIS data feeds from satellites,” Sand said.

For those who trade commodities, this data offers real-time information on volumes of commodities arriving and departing from specialized ports that handle commodities. Traders use the volume of material moving as a way for them to calculate their investments.

For example, if you are a steel trader/analyst and you see a surge of iron ore arriving into a specific Chinese port that processes the commodity, that would give you the tea leaves of China starting to increase steel production.

Around 40% of all dry bulk trade starts or ends in China, so clearly what China is consuming or manufacturing and exporting can have a huge impact on finished commodities like steel, aluminum, etc. Without the feed coming from terrestrial AIS, the trader has one less tool to make educated trade decisions.

China is also the largest crude importer in the world. Any sign of Chinese ramping up crude imports would be a bullish signal for oil prices.

If China is viewed as importing less crude, that will be interpreted as bearish, pushing crude prices lower. At the same time, this would give China the opportunity to return to the market to buy crude at a lower price. AIS is a real-time supply and demand barometer.

Maritime Wall Street analysts tell commodity traders to keep an eye on the following ports and the volume of trade that passes through each gateway as tools in their trading arsenals:

| CHINESE PORT | COMMODITY |

| Shanghai | Coal, petroleum, machinery and metal-ore |

| Ningbo-Zhoushan | Raw materials, as well as manufactured goods from North and South America |

| Guangzhou | Oil, coal, grains, chemical fertilizers, steel, ore, automobiles, agricultural products, and industrial and manufactured products |

| Qingdao | Oil and iron ore |

| Dalian | Coal |

| Yingkou | Oil tar, steel, timber and sugar |

| Taicang | Petrochemicals |

| Lianyungang | Coke, ore, bulk grains, coal, liquid chemicals and breakbulk cargo |

| Qinhuangdao | Coal |

| Tianjin | Chemicals |

Ben Nolan, managing director of maritime, rail and energy infrastructure at Stifel Institutional, said that the “lack of AIS data clouds the picture for cargo velocity across multiple modes of transportation, but we believe the greatest impact may be on dry cargo shipping.”

Explained Nolan: “China accounts for just under half of all trade in this category for things like grain, coal, iron ore and steel, timber, aluminum, etc. Ship movements into and out of certain ports can give color on consumption, production and flows of these commodities, which then has an impact on the outlook and prices.

“To a lesser extent, the same is true for crude and refined product tankers. The where and when tankers load and discharge are important indicators of supply, demand and inventories.”

For the retail and manufacturing industry, this data is key for importers on when they pay for the product, all of which is based on the loading of the containers on the vessel in China.

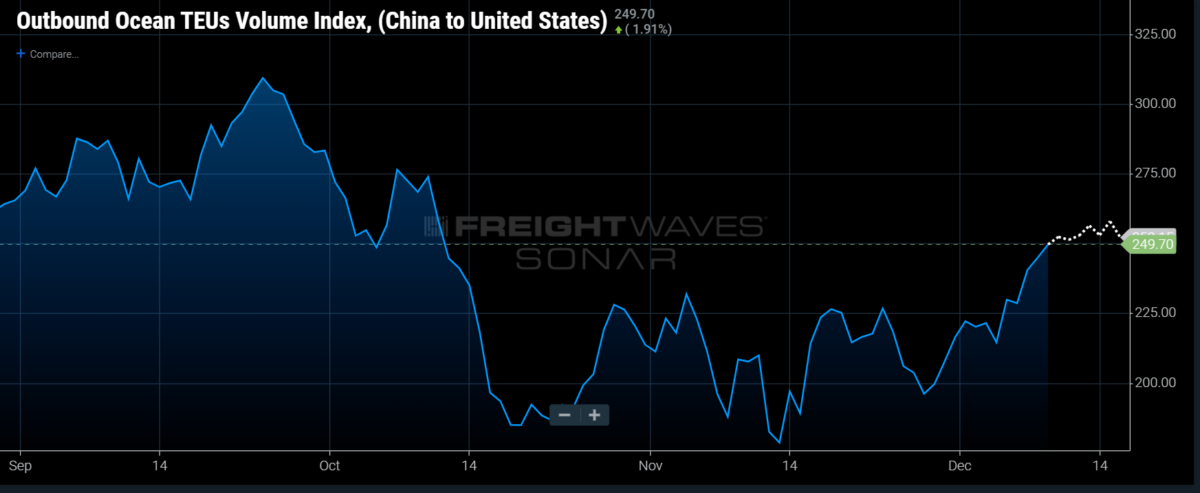

SONAR: TEUs volume index, China to US

Rick Helfenbein, a retail and fashion industry consultant and former chairman, president and CEO of American Apparel & Footwear Association, said not having this data is clouding the paying picture.

“USA retail supply chain markets are fighting hard to return to a ‘new degree or normal’ as America closes out the holiday shopping season,” Helfenbein said. “However, just when everyone thought that shipping issues were about to settle down, a new AIS supply chain ‘variant’ has suddenly appeared.

“This ‘variant’ relates to the China AIS terrestrial ship tracking data that stopped functioning due to new privacy laws in China. USA importers literally don’t know where the ships are, and that adds another line for supply chain gurus to articulate – when they can say the truth, ‘I don’t know exactly where the goods are or when they will be delivered.’”

During 2020, Helfenbein added, many retailers shed debt by declaring bankruptcy, and new management teams in 2021 have been asking importers for longer payment terms from their suppliers and brands.

“Their interest in many cases is to change the payment terms from landed duty paid (LDP) net 60 days to landed duty pay plus net 90 days so they can carry the goods longer without having to pay,” Heifenbein said. “Importers and brands, on the other hand, want to shorten the payment terms back to free on board (FOB), where the payment is issued when shipped.

The FOB payment pulls the liability – for unpredictable late delivery – away from the importer, thus sparing them additional charges for late delivery from the retailer.

“The loss of AIS tracking has now added a new degree of urgency to making that conversion from LDP to FOB.”

Janis Wood

Start working at home with Google! It’s by-far the best job I’ve had. Last Wednesday I got a getting a check for $19474 this – 4 weeks past. I began this 8-months ago and immediately was bringing home at least $170 per hour. I work through this link, go to tech tab for work detail.

Open This Website…………………………………..>> http://Www.NETCASH1.Com