Christmas in July for Crete Carrier’s Halloween and Christmas freight

For the dry van and reefer segments at Crete Carrier, holiday and Halloween freight volume increases may be less “summer doldrums” and more “Christmas in July” based on a recent company video highlighting customers pulling forward shipments. Tim Aschoff, president and COO at Crete Carrier Corp., noted on a LinkedIn video, “The holiday season is near and dear to us, because it creates a lot of freight, and we’re starting to see that move.”

In a recent operations meeting, Aschoff noted the company has many customers moving Christmas freight and forward deploying shipments to their distribution centers. “In fact, some of them are talking about getting it to their stores, not necessarily in the aisles but in their back rooms to have it ready to get out there.” Ashchoff mentioned that one of the large retail customers increased its sales projections, a positive sign for Crete’s freight volumes.

In addition to dry van volumes, Crete’s reefer segment is seeing increased activity as customers stage Halloween candy shipments to distribution centers to then send out to stores.

TruckingDive’s Colin Campbell wrote, “The Hershey Co. was Shaffer’s original customer, and the carrier has been shipping chocolate since its first run in 1937, according to the Crete Carrier website. Acquired by Crete Carrier in 1974, Shaffer has one of the largest reefer fleets in the country, offering national, regional and local service with more than 1,100 tractors and more then 2,800 trailers. Crete Carrier has more than 5,000 tractors and 13,000 trailers.”

Trucking and leasing company Pride Group to wind down operations

Pride Group, a privately held transportation, leasing and supply chain company is winding down operations after stakeholders rejected the founders’ $56 million plan to save the company. Pride group originally filed for bankruptcy protection on March 28 after owing lenders $637 million. According to TruckNews, the bankruptcy protection filing came after Mitsubishi HC Capital filed lawsuits accusing Pride Group’s Sulakhan “Sam” Johal, president and CEO, and Jasvir Johal, vice president, of defaulting on payments they had personally guaranteed. According to the creditor protection filing, Johal founded and controlled 16 transport companies and 45 real estate holding companies, in addition to 10 other holding companies.

The impact of Pride Group ceasing operations may impact freight rates, as the company’s various holdings also included private fleets. Mike Millian, president of the Private Motor Truck Council of Canada, told FreightWaves in an email, “The Pride Group of Companies being sold off and ordered to wind down operations will certainly have a ripple effect in the industry. The group controlled over 20,000 trucks in Canada and the U.S.”

Millian adds: “The wind down of operations should place some upward pressure on freight rates, however the level of that increase is hard to quantify, as we are still in a depressed, if not slightly improving cycle. Pride Group was known to be very aggressive on bidding down rates however, so this in itself may help to see some rates/lanes recover back to a proper rate structure.”

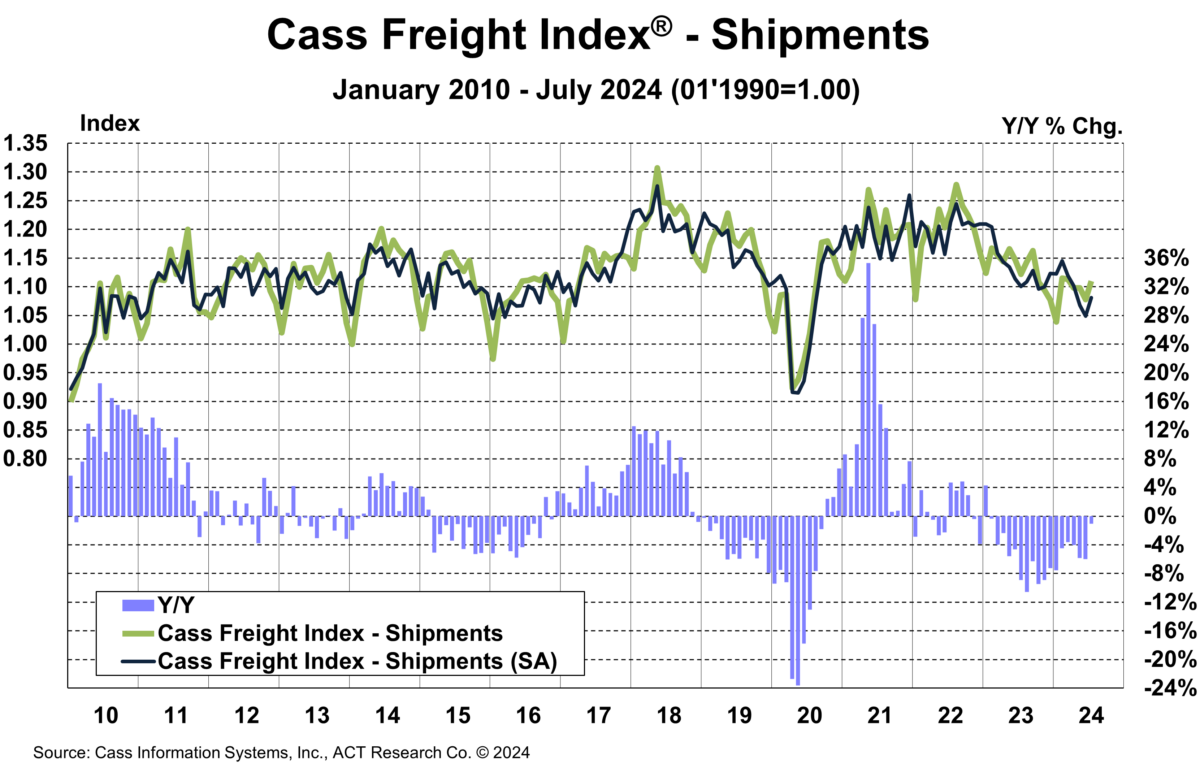

Market update: Cass July data shows a bounce in shipments

Freight audit and data platform Cass Information Systems recently released its July Transportation Index, which saw a bounce in the shipments component after four months of sequential declines. The index’s shipments component rose 3% in July compared to June but was 1.1% lower compared to July 2023. This is an improvement compared to June data, which showed shipments down 6% y/y. Looking at seasonality, the index is projected to decline 3% y/y in August and 4% for the full year.

The expenditures component of the Cass Freight Index measures total freight spend and increased 0.7% m/m in July. Year-over-year declines narrowed from 9.4% in June to 6.2% in July. The report expects further declines due to seasonality, stating, “The expenditures component of the Cass Freight Index fell 19% in 2023, after a record 38% surge in 2021 and another 23% increase in 2022. It declined another 16% in 1H’24, and assuming normal seasonal patterns from here, will decline about 11% this year.”

Looking ahead, the report adds the increase in the Cass Freight Index (shipments) component ties in to lower Class 8 sales. Private fleet capacity additions from insourcing and increased spot market activity continue to drag down the for-hire space. For-hire fleets continue to cut costs. The report noted publicly traded truckload fleets were on track to operate with 6.6% fewer tractors than last year in Q2.

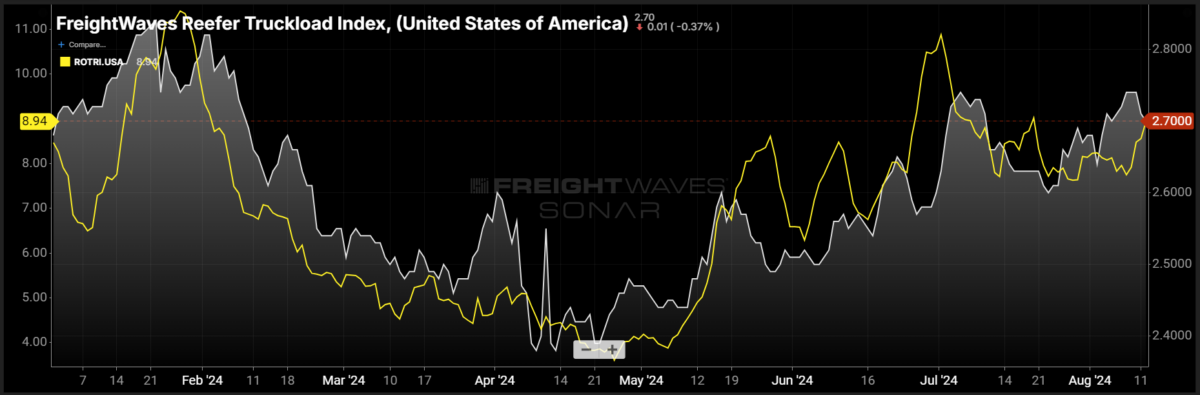

FreightWaves SONAR spotlight: Reefer heats up compared to dry van’s doldrums

Summary: Produce season continues to deliver favorable conditions for the reefer truckload segment based on the all-in average reefer spot rate and reefer outbound tender rejection rate. Despite RTI remaining flat week over week at $2.70 per mile all-in, reefer spot rates are up 3 cents per mile m/m from $2.67 on July 13. Reefer outbound tender rejection rates saw an 81-basis-point w/w increase from 8.13% on Aug. 5 to 8.94%. For the month, ROTRI is up 123 bps compared to July 13’s value of 7.71%. Looking at year-over-year comps, all-in reefer spot rates are up 8 cents per mile from $2.62 per mile on Aug. 13, 2023. Tightening in the reefer truckload space is more evident when looking at y/y reefer tender rejection rates. ROTRI is up 374 bps y/y from 5.2% to 8.94%.

Compared to the reefer segment, the dry van space remains elevated year over year but is still in the summer doldrums below 5%. VOTRI rose 15 bps w/w from 4.46% on Aug. 5 to 4.61%. Year over year remains a bright spot, with VOTRI up 119 bps from 3.42% on Aug. 13, 2023, to 4.61%. Dry van spot rates did not fare better. The FreightWaves National Truckload Index 7-Day Average fell 1 cent per mile all-in from $2.31 to $2.30 but is 7 cents per mile higher than this time last year, when NTI was at $2.23 per mile. Truckload conditions are improving but at a slower rate for the dry van segment.

The Routing Guide: Links from around the web

Daimler recalls 3K trucks over steering failure concerns (Trucking Dive)

Brokers not liable for negligent hiring in truck crash lawsuits, 11th Circuit finds (Land Line)

ATA chief rips OOIDA stance on Biden independent contractor rule (FreightWaves)

Trucking firm abandons IC model in California, New Jersey (Staffing Industry Analysts)

Truckers, AV advocates present conflicting views on self-driving safety (Trucking Dive)

Unexpectedly strong import wave keeps rolling through peak season (FreightWaves)