Class 8 truck orders were soft as expected in June with manufacturers offering few build slots until they open order books for 2024 as soon as next month.

But even when OEMs begin taking orders, expect bookings to remain slow as the focus remains on bringing balance to months of orders yet to be produced. New orders are running below replacement demand as spot and contract rates continue to decline.

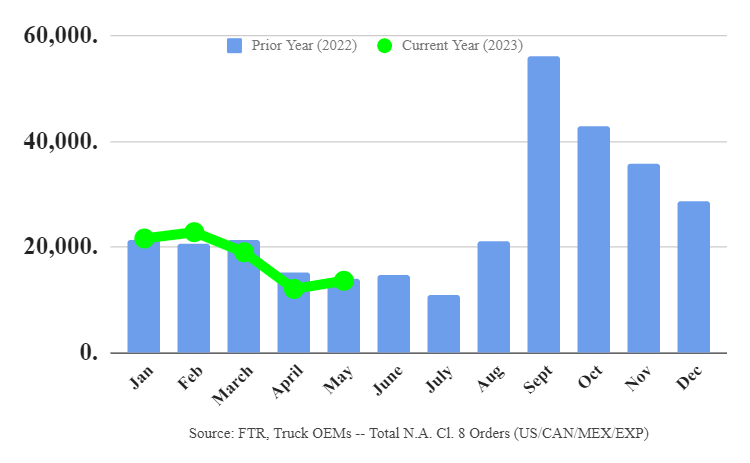

Depending on the estimate, preliminary orders for Class 8 trucks in June ranged from 13,800 to 16,200. The lower estimate is from FTR Transportation Intelligence. The higher number comes from ACT Research.

“With all the order slots filled for 2023 and 2024 slots yet to be fully opened, it is unclear when these ordered trucks will be built,” FTR Chairman Eric Starks said. “OEMs have hinted for months that they are willing to keep build activity elevated well into Q4. With the recent solid order totals, it is all but guaranteed that Q4 production will be strong.”

Pent-up demand slowly being met

Additional orders would have little bearing on that. Manufacturers are largely free of the supply chain disruptions that hampered production for more than two years. Pent-up demand for new equipment is slowly being satiated.

“Given robust Class 8 orders into year-end 2022 and the ensuing backlog support, coupled with normal seasonal order patterns, orders were expected to moderate into Q2 and remain at relatively soft levels into mid-Q3 ’23,” said Eric Crawford, ACT vice president and senior analyst.

Under ACT’s estimate, Class 8 orders rose 5% year over year and 4% over May. FTR’s more pessimistic guess showed orders flat compared to May and down 7% versus a year ago. FTR pegged total orders for the last 12 months at 297,800 units.

“The normally weaker orders due to a seasonal mid-year slowdown coupled with strong build activity will keep shrinking backlogs,” Starks said. “This will pull backlogs back into a normal range over the next several months as the backlog-to-build ratio is currently elevated and putting pressure on OEMs to keep building equipment.”

Related articles:

Rising May Class 8 orders less telling than backlog burn

April Class 8 orders tank but OEMs have ample backlogs