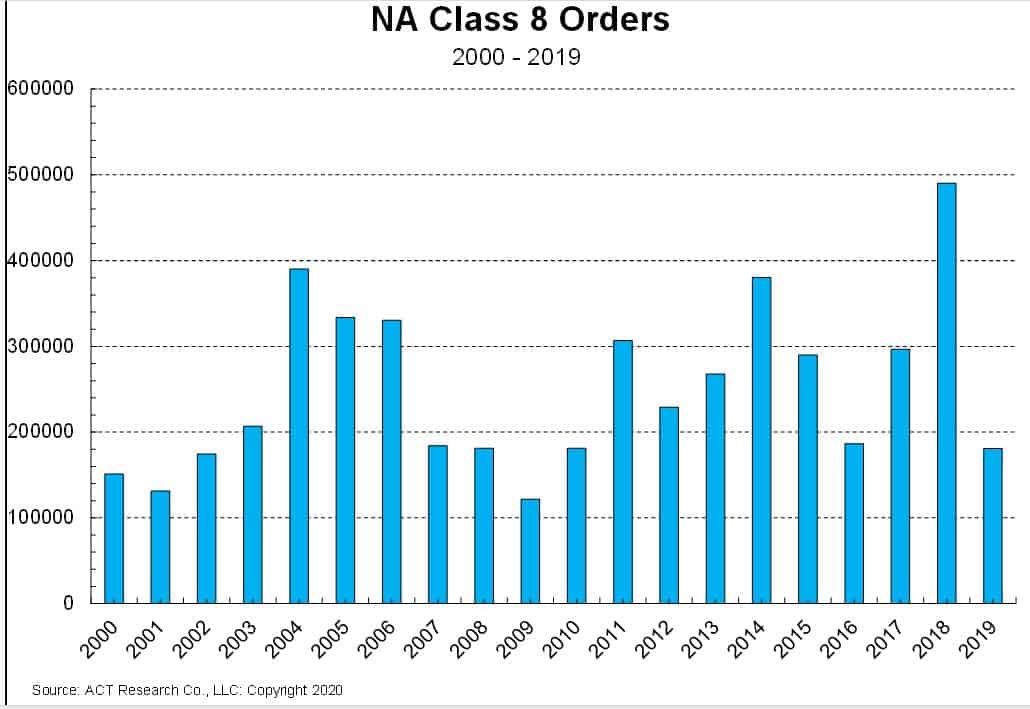

Orders of new Class 8 trucks tumbled to their lowest annual level in a decade in 2019 as a softening economy and a booking frenzy in 2018 combined to clobber orders.

Year-over-year new truck orders fell again in December, though the 20,000 bookings were up 14% over November, according to ACT Research.

“Overbuying through 2019 and insufficient freight to absorb the ensuing capacity overhang continued to weigh on the front end of the Class 8 demand cycle in December,” said Kenny Vieth, ACT president and senior analyst.

Truck makers saw the slowdown eat away at a record industry backlog of a year ago and cut production that resulted in thousands of job losses.

Daimler Trucks North America laid off 900 workers in October. Volvo Trucks North America is cutting 700 jobs this month. Paccar Inc. (NASDAQ: PCAR) trimmed 100 jobs at its Kenworth division in addition to attrition in November. Navistar International Corp. (NYSE: NAV) is laying off 1,300 workers this month.

The pinch also impacted major suppliers like engine maker Cummins Inc. (NYSE: CMI), which is cutting 2,000 jobs globally.

Mack Trucks, a Volvo Group unit, said in December it expects to lay off workers in January but declined to estimate how many. Mack lost two weeks of production to a United Auto Workers strike in October. It plans two down weeks late in the first quarter to adjust production and two additional down weeks in the second quarter for plant modifications.

“Recent industry orders have been running below replacement level,” Navistar CEO Troy Clarke said on the company’s fourth-quarter earnings call Dec. 17. “I believe the industry is working through a period of transition and then orders will pick up and recover in the second half of the year.”

If that doesn’t happen, more cuts may lay ahead.

The estimated number of trucks waiting to be built at the end of 2019 was about 123,000 compared with 297,000 in December 2018, Vieth told FreightWaves.

The year-ago December was the first month that orders began to fall after several record months in the second half of 2018, when carriers bulked up by investing savings from a cut in the federal corporate tax rate to 21% from 35%.

Year-over-year order comparisons are less extreme than earlier in the year. December 2019 orders were 6.5% below the same month a year ago, ACT said.

Deliveries of much of the equipment came in mid- to late 2019. Some fleets held off taking deliveries because of falling prices for used trucks.

“It will take some time for the used trucks they replace to be taken out of service,” Clarke said.

Retail sales, which follow orders and production, are expected to set a record of 310,000 to 340,000 when those numbers are tallied later in January. Most predictions call for about 100,000 fewer Class 8 sales in 2020.

@!#!@

Steering columbs come apart as your driving down the road and nobody buys Volvo anymore and their narrow sleepers with your head against the wall with your feet against the other wall while keep banging your toes in your sleep#@

Noble1

Quote from the article :

“Deliveries of much of the equipment came in mid- to late 2019. Some fleets held off taking deliveries because of falling prices for used trucks.”

LOL !

Now that goes to show you just how OFF their timing was and is . These are the “big boy”(fleets) getting squeezed , LOL ! They’re STUCK with OLD TRUCKS , LOL ! Drivers don’t like to drive old trucks ! This mishap of theirs will hurt them BB’s in more ways than one !

I don’t understand how they could have goofed that bad . Wow this makes them appear even easier to compete with than I thought .

Too bad drivers aren’t uniting . The BB competition is a JOKE !

IMHO

Noble1

Oops apologies I didn’t finish the count , LOL

So “demand” dropped to approximately 34,000 in Wave A in wave 4 , retraced proregressively(upwards) to approximately 38,000 in wave B , and then shot down in wave C to 28,000 forming/printing a typical zig-zag 3 wave corrective pattern . Then the “suckers” rally began in wave 5 purchasing overvalued trucks .

IMHO

Mike

Could the new insurance rates be an issue? When the insurance agency tells you that on the first of the new year, premiums will be going up anywhere from 30% to 100%+, I would bet that would kind of cut into sales. You know it is time to hang it up when the insurance costs you more than the equipment.

Noble1

Low hauling rates also have their part in weighing against truck demand , apart from truck price being overvalued .

When freight demand and rates increase it tends to trickle down in increasing demand for trucks . Currently the “rates” don’t justify the cost . This where forward thinking needs to be applied .

In fact the best time to buy a truck is during a recession(low rates) near early recovery . However, people don’t reason that way . They’ll usually do the opposite .

Within the late expansion cycle in the business cycle , consumer discretionary is a big no no .

In my humble opinion ……..

Noble1

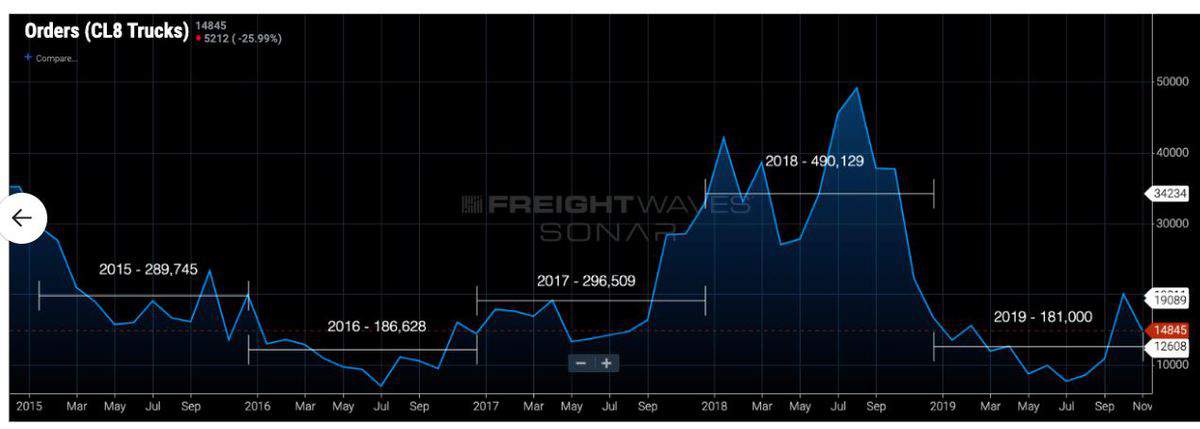

Furthermore , look at the graph above in the article .

Do you see the “Elliott Wave Principle” playing out ?

Look at the peak in August 2018 till it stopped in September . We’ll interpret it as wave 1 .

That sideways move that followed we’ll interpret as wave 2 . That big drop that occurred till January 2019 , we’ll label as wave 3 which is typically the steepest . That little surge that followed in February , we’ll label as wave 4 .

The following wave we’ll label as an ending diagonal fifth which subdivided in 5 smaller fractals/ waves .

This pattern suggests that a typical bounce will follow surging towards at least around the prior 4th wave price point . However , we can also apply certain ratios to help determine probable support and resistance points before they occur within a pattern recognition methodology .

Here is a rough example :

Let’s take the final leg that occurred between January 2019 & July 2019 cause the chart in the article really sucks ,but I can still manage to use it somewhat .

We will assume according to the primitive chart above that the peak in February 2019 was 15, 000 and that the low near May 2019 was 9,000 .

We will measure the difference in price between these two price points and take the sum and multiply it by a Fibonacci ratio of 38.2% and project that sum down from the peak price point in June(10,000) to give us an estimation concerning a potential pivot point low/support .

We arrive at a potential pivot point of 7,708 . Now we will take the 15,000 sum from the February high and measure the sum between that high sum and the 7.708 low sum . We arrive at a sum answer of 7,292 . We will now multiply it by a Fib ratio of 161.8%(you can round it off to 162%) . Our answer is the sum of 11,798 . Now we take that some and add it to the pivot low sum of 7,708 . We arrive at an answer of 19,506 . That’s pretty darn close to the peak pivot/resistance point in October 2019 before price/amount/value etc , reversed .

Wait now . Let’s go back to January 2018 in the “primitive”(LOL) chart above . The peak appears to be 41,000 and the low in April appears to be around 28,000 . The difference between the two is 13,000 . So we’ll multiply 13,000 by 162% and project the answer prom 28,000 to get a rough estimate for a potential pivot point target/resistance level . The answer is 49,060 .

Now if you look at the bigger fractal(complete pattern cycle on a higher time frame ) from the July 2016 low to the August 2018 peak , it’s a complete Elliott Wave pattern . I simply gave you an example by using the 4th wave within that pattern to project a potential fifth wave peak .

Interesting wouldn’t you say ?

LOL !

This was a very basic example . There’s a lot more that goes into this methodology that I apply . However , I wanted to give you a very “basic” idea .

In my humble opinion ………..

Noble1

How can this information be useful ? My god ,in so many ways that it could make your head spin with edge’s galore against competition .

As one very simple example , let’s assume you had an old truck(s) that you wanted to get rid of . Let’s also assume you wanted top dollar for it and to take advantage of the potential buyer’s irrational exuberance .

Once wave 4 in April 2018 completed and began to reverse , you would put that truck up for sale aggressively , and you would be smart enough to know that it’s not the opportune moment to buy one yourself .

But how do we anticipate this . You watch the chart(s) . Let’s say you understood this principle and how to play with it . At the peak of wave 3(41,000) , you noticed “demand” began to curtail . Demand dropped to approximately 34,000 . Knowing that “corrections” in the wave principle typically play out in 3’s(3 waves) .

You would anticipate a typical pattern in the form of a zig-zag or “W” , before a complex one . In this case it transitioned into a zig-zag 3 wave typical pattern ,compared to the complex expanded flat in wave 2 that printed between January 2017 & May 2017 .

Now keep in mind that the chart above is a primitive chart . With a practical chart you can go into lower time frames and check the fractals which is equivalent to using a scalpel compared to an axe . Therefore you can easily find a confluence of ratios to nearly the precise pivot point price will reverse .

So again as in my prior comment we assume that the low pivot/support was 28,000 in wave 4 .

We then project the fifth wave high as explained in my prior comment .

So now we would be quite confident that we’re in wave 5 where irrational exuberance tends to present itself in mass psychology within this principle .

You’re going to sell that truck to some sucker due to higher freight rates . Unsustainable higher freight rates are increasing demand for trucks . You want to take advantage of this to get rid of your old truck(s) for top dollar while demand is irrational and credit is lax .

Simply put , this methodology would be, and is, useful to indicate and or suggest when it would be preferable to buy or sell …….. Trucker’s don’t know this . They are in la la land . You can learn this methodology to give you an edge over your competition due to knowing where they are likely to get whacked etc , and to prevent yourself from becoming a victim to upcoming loosening/corrective circumstances .

You can cut your rate and offer your services to a shipper due to anticipating rates will curtail before rates decrease while they are high , and while most of the clowns are running around on load boards . It’s a form of legal “front running” your competition . You’re acting on legal knowledge that the general public is unaware of .

In my humble opinion ……….

Mike

Elliot waves are for traders, not the lone truck operator. I need to go back to day trading commodities. LOL!

Noble1

Mike

Apparently Truckers need to broaden their horizon .

Their fuel is a “commodity” that can be “traded”.

The cycles in their industry can be “traded”.

The freight rates in their industry can be “traded” .

Etc , ect, etc

Quote:

“Nodal Exchange and Nodal Clear are the regulated exchange and clearing house respectively for the Trucking Freight Futures market. Nodal’s role is to provide the trading platform and risk management for Trucking Freight Futures trading. The system is fully electronic; there will be no physical trading floor. Nodal also provides the regulatory compliance for the market, exchange activities and clearing house.”

Agreed liquidity is of importance .

If one traded a liquid market and is successful/profitable , those profits can compensate for low rates and high insurance costs and thereby diminish the cost of doing business and increasing business profitability .

Here’s another example :

Rather than applying a primitive mentality through attempting to unite to “shutdown” aka strike , truckers should unite and structure themselves where they can collectively reap from such “Wall Street” methods a la hedge fund style .

Oh what a concept !!!

Truck “DRIVER” mentality needs to evolve a bit .

In my humble opinion ………..

Noble1

Mike ,

Let’s take this a little step further .

In an attempt to tickle you imagination a little .

Let’s assume truck drivers united and created a Truck Driver Alliance .

Let’s assume that within that Alliance they created a subsidiary that trades for them . Call it what you will .

A division within that subsidiary concentrates on trading Carriers that are listed on exchanges .

We want that division to concentrate on trading the bejesus out of those corporations in order to accumulate “free shares” .

We want that division to trade into accumulating enormous positions .

Now with an accumulated position of importance , the subsidiary has negotiating power to create change within that corporation . It could even lead to a proxy fight to put in reasonable puppets to manage the corporation which would favor DRIVERS !

You can do that with the “truck” stops that are listed on exchanges as well . Your imagination is the limit and it’s unlimited !

If you want a real savvy sustainable change in the trucking industry , UNITE and think out of the primitive box .

The point to take from this . You’re right ! The truck driver “loner” is limited . However, UNITED it becomes a whole different game .

Most drivers have been complaining that their low wages are due to the unfair CEO compensation and corporate greed . Where do those CEO’s generally obtain their “Bonuses” from ? THE MARKET through stock options . Corporations boost the value of their shares through buybacks !

Truck drivers can profit from this as well , but they’re too busy fighting for pennies and regulations rather than concentrating themselves on positioning themselves to INFLUENCE regulations and major carrier lobbying .

You need to position yourselves in THEIR WALLET & on their BOARD OF DIRECTORS ! Work your way in and around them by being shrewd !

Fighting them is primitive . Outsmarting them is evolution to revolution(change) !

Isn’t that what THEY have been doing to drivers ? Outsmarting them and taking advantage of them ???

KARMA suggests it’s our turn to outsmart them and take advantage of their weaknesses . We can have these clowns work for us .

In my humble opinion …………

Noble1

Here is PROOF as an example !

Google it !

Quote:

Navistar Yields To Icahn To Avoid Proxy Fight

“Navistar International said today it would grant three board seats to its largest shareholders, avoiding a likely proxy fight next spring with activist investor Carl Icahn and his allies

The company said it would replace two existing directors, Eugenio Clariond and Steven Klinger, with two Icahn allies”

NOW THAT’S A WAY TO INFLUENCE CHANGE !

In my humble opinion ………

Truckguy

Fleets order trucks when they perceive they need capacity. Fleets stop ordering trucks when they perceive they have enough or too much capacity. Insurance rates are a very relevant issue for all truckers, but it’s not behind this pullback in orders.