On its earnings call with analysts and investors, food supply chain warehouse operator Americold Realty Trust (NYSE: COLD) said it isn’t seeing much scarcity throughout the cold food chain.

Asked about potential protein shortages, management said they have “a lot of full warehouses of chicken” and that some of the reports of impending meat shortages have been a little overdone.

The Atlanta-based real estate investment trust (REIT) reported that 15% of its warehouse revenue is tied to poultry, 7% to pork and 3% to beef. Further, the company attributes its more than 30% revenue growth during the first quarter to its two largest customer types — food manufacturers and retailers — with 76% of revenue coming from food manufacturers.

“This growth was driven by our core warehouse segment, which demonstrated our important role in the food supply chain, the diversity of the food commodities and channels our network serves, the benefit of our strategic acquisitions, and our entire Americold team’s extraordinary efforts,” said President and CEO Fred Boehler.

Recent acquisitions including the $1.25 billion purchase of Cloverleaf Cold Storage and the more than $250 million deal for Canadian-based cold storage facility operator Nova Cold Logistics have moved the needle as well.

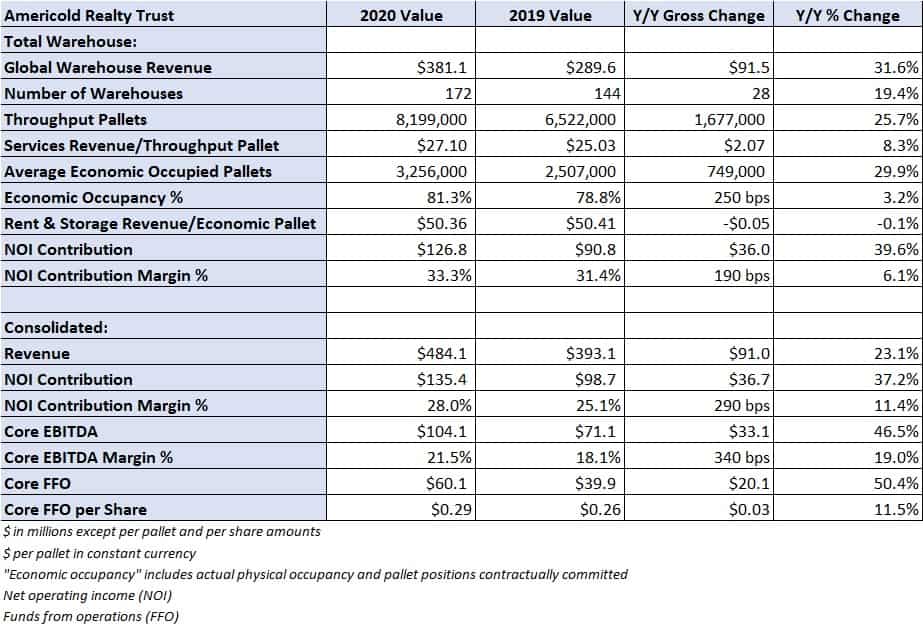

Americold reported a strong first quarter with core funds from operations (FFO) of 29 cents per share, 3 cents better than the consensus estimate and the year-ago period.

Pressed on the potential for food shortages, management said supply in the food chain is much larger than most people realize as there is normally a four-month supply of inventory in the system. At each level of the food supply chain — grocery stores, retail distribution centers, major market distribution centers, and production advantage sites attached to the manufacturer — there is 30 days of inventory.

While there has been a shock to the supply chain from the pandemic, management doesn’t see that as a catalyst for increased inventory levels moving forward as four months has proved adequate.

Americold reiterated its full-year 2020 guidance calling for adjusted FFO per share of $1.22-$1.30, compared to the current consensus estimate of $1.22 and the $1.17-per-share result it reported for full-year 2019.

Asked why guidance wasn’t increased after the first-quarter outperformance, management said people aren’t eating more, they have just procured more. Management expects a sequential slowdown during the second quarter, but demand will remain higher than normal.

On the concern over customers extending payment terms, management said that days sales outstanding has remained constant and that there has been no slowdown in cash collection.

The company had $1.2 billion in total liquidity at the end of the quarter with total debt of $2 billion, $1.8 billion of which is tied to real estate. The company’s net debt-to-core earnings before interest, taxes, depreciation and amortization (EBITDA), including anticipated contributions from acquisitions, was 4.2x.

Americold Realty Trust’s real estate portfolio includes 183 temperature-controlled facilities, including 11 facilities in its third-party managed segment, with more than 1 billion refrigerated cubic feet of storage in the United States, Australia, New Zealand, Canada and Argentina.