The views expressed here are solely those of the author and do not necessarily represent the views of FreightWaves or its affiliates.

Railroad freight growth might require fewer cars ahead. True or false?

As quarterly financial results were results by the Class 1 railroads, the expectation set by the individual railroads was that returning customers will help spur volume growth.

The year 2020, however, is starting out slowly. Still, most senior railroad executives and shipper logistics managers are talking about a possible recovery in the second half of the year.

But there is little statistical economic data published yet to support that optimistic outlook.

It might be mid spring – or later – before that kind of upward freight volume is plotted as a four-week or longer trend line.

It’s also possible that months of mostly negative year-over-year rail freight numbers during the first half of the year could mathematically result in a flat full-year 2020 pattern – even if there is nominal 2 to 4% volume growth.

Let’s be clear about what kind of growth is being discussed here. How is growth defined?

Railroads’ quarterly earnings reports focus mostly on changes in revenue, revenue per railcar, margins, cash flow, and my personal favorite – change in earnings per share.

Those metrics tell a tale of private company valuation.

As an economist with both a public service and a private railroad career, I balance those carriers’ private changes with these other measures of transport system-wide measures of growth:

- Tons of customers’ goods moved

- Units of traffic as loaded railcars

- Loaded cycles per available railcar

- Changes of market share of rail freight compared to truck-moved freight

The metrics above measure rail freight that are relevant to shippers and the community. These are not an internal computation of corporate wealth.

Here are the two core questions I’m asking: 1) Which one of these growth parameters requires more freight equipment? and 2) Is the size of the rail freight fleet increasing? (Or not?)

There are two opposing railcar theories in the industry. One theory sees a continuing but smaller rate of new freight cars being added to the North American fleet.

The other theory suggests a considerable slowing of new car orders – and a shrinking volume of railcar backorders.

At the railcar manufacturing level, both outlooks acknowledge a large surplus of railcars on-hand, but technically in a stored position. As much as 24% of the 1.62 million North American railcars are currently “parked” (stored).

In most industries, the fact that nearly one-quarter of the fleet is not being utilized would generally be considered a sign of economic distress.

It’s easy to ignore that low utilization if the railroads have increasing financial valuations. But once the corporate enterprise year-over-year valuation increases slow, the railcar storage and traffic units of change will become more obvious factors.

Here are the hurdles for rail freight through much of 2020 to anyone is expecting breakout growth.

- There is still plenty of truck capacity

- Truckers offer lower spot rates – and logisticians are buying such price opportunities

- Railroads generally don’t compete today by lowering prices

- Plenty of traffic moves in very short origin/destination lanes – where rails don’t often compete

- A large spike in business might not be easily handled by rails (after they took so many crew and locomotive assets out of their systems)

Considering these competitive factors, the resulting outlook for railcar replenishment during the first six months of 2020 looks somewhat bleak.

Expectations of many new freight car orders seems a speculative play.

Delaying delivery of railcars already ordered (the backlog) seems like a prudent plan until the fog of the U.S. economy clears a bit. No one is sure yet of what increase in traffic (if any) will come from the recent tariff agreements. There is an element of “wait and see.”

Let’s remember that the railcar ordering pattern in North America has been both highly cyclical and dominated by super-cycle thinking. Said simply, the periodic rushes to invest in railcars suggests that due diligence might be prudent.

In the past two decades the super-cycle in commodities has been in coal, later in ethanol, crude oil by rail, frac sand, etc.

Railcar orders spiked a few years ago at about 80,000 when the crude oil and frac sand volumes were predicted as high growth.

By comparison, it helps to recall that long-run nominal fleet replacement might be in the 40,000 to 45,000 range annually.

Among the most ordered railcar types over the past decade have been the covered hopper car, the tank car and the intermodal car.

But in recent years, the need for intermodal cars has decreased. And the once “hot market” frac sand hopper car has seen its market use decrease.

The outlook for railcars varies by commodity market.

The covered hopper accounts for one out of every two railcar types built between 2016 and 2018… that is just over 100,000 covered hopper cars that were delivered in that time period.

Source: Chicago Freight Car Leasing Company (March 2019)

I will not cover all car types. Yet the boxcar is interesting. The boxcar fleet has been trending as an “orphan” railcar over the long-term in the railway industry.

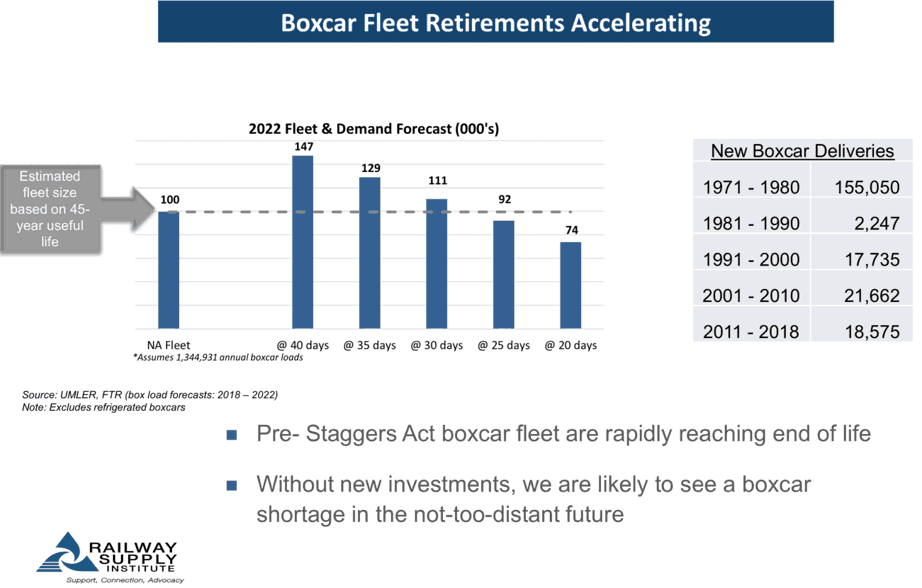

Figure 1 identifies the scale of that boxcar market according to the Railway Supply Institute in a presentation made 11 months ago.

Figure 1

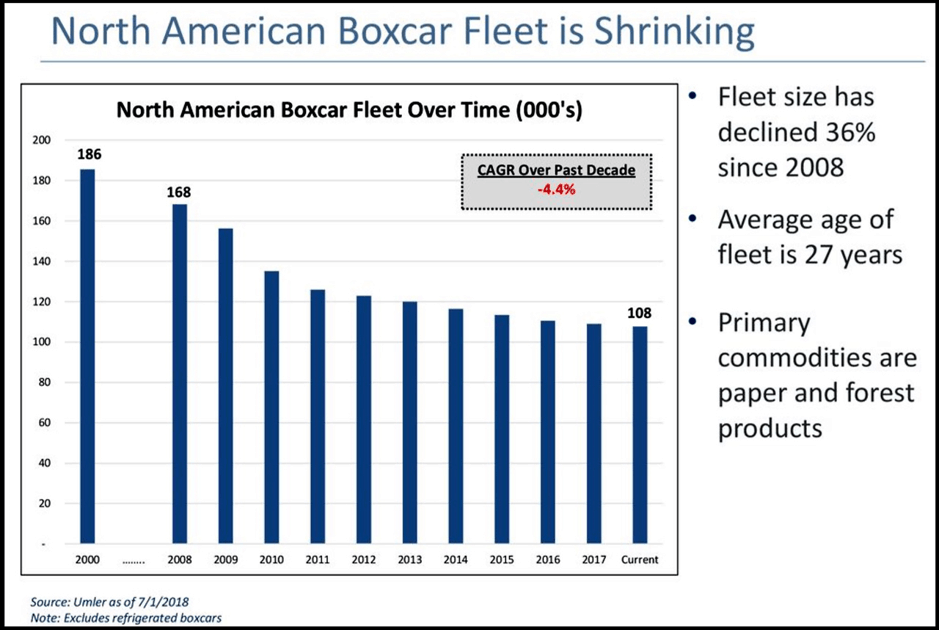

Figure 2 illustrates the steady decline of the boxcar fleet.

The overall trending compound annual growth rate decline in the North American boxcar fleet is about -4.4%. In contrast, the overall GDP rate is at about 2.5%.

Figure 2

There are various committees and shippers group examining the boxcar issue. But nobody seems willing to step up and write the necessary capital check.

With the precision scheduled railroading (PSR) business model, Class 1 railroads are experiencing capital returns in excess of 14%. The boxcar lacks a champion inside those big railroads.

Will a shipper (the users) have to make the investment commitment? It is another year, and the debate continues.

Scale-wise, we may be talking about an investment in 20,000 to 30,000 boxcars. That investment equates to about $2 billion to $3 billion.

As for all railcar types

There is a great deal of data about railcar building as a sector.

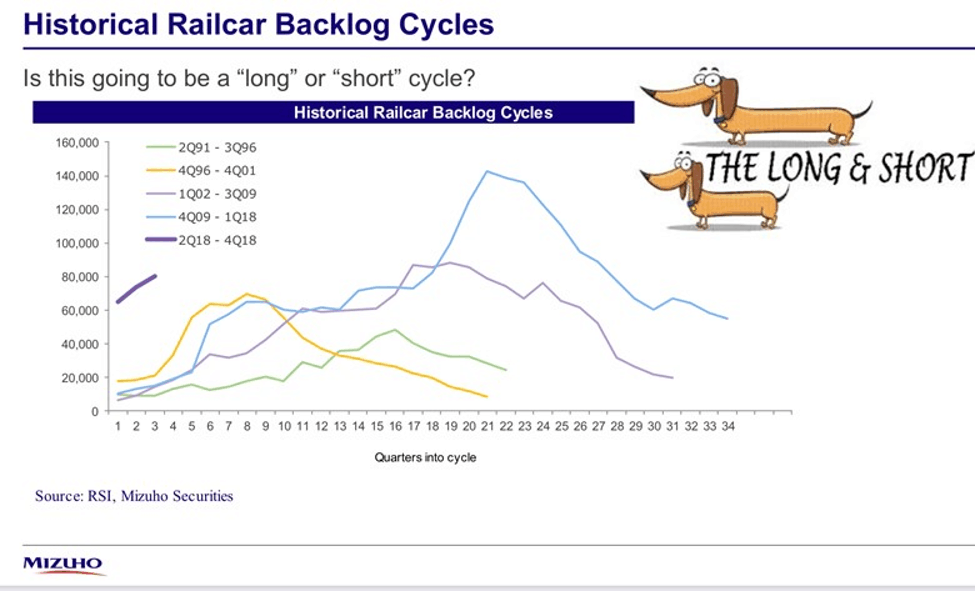

As Figure 3 shows, there have been several railcar market surges (and declines) over the past three decades. This graphic was recently presented by financial analysts Kristine Kubaccki, (CFA).

The period between the first quarter of 2002 to the third quarter of 2009 was the most recent high point of backlogged railcar orders – peaking at more than 140,000 railcars. This was during the so-called North American rail freight Renaissance period.

Those cycles are getting shorter in time length and less voluminous at their peaks.

Figure 3

As for the total rail car fleet, since 2010 the North American railcar fleet has expanded.

Will that overall pace y/y continue into 2020-2030?

Table: UMLER North American freight car fleet total registered size (in thousands)

2019 Railinc data; REF2019

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

| 1,481 | 1,483 | 1.500 | 1,514 | 1,555 | 1,608 | 1,633 | 1,639 | 1.650 |

Current conclusions as a checklist

By March or early April, it should be apparent what the outlook for railcar manufacturing is, since a pattern of both railcar deliveries and new orders should become more evident.

By late summer, there should be enough data to determine if railroads – even with more units year-over-year – are increasing market share – or not.

Here is my key about market share.

If trucking volume in tons or load units moved grows at a rate of about 2.5%, then rail volume must grow significantly faster. Why? Because trucking freight has such a huge market share compared to rail freight market share.

Rail freight cannot grow market share by tracking one for one units with trucking companies.

There still is little direct evidence offered by the railroads practicing PSR regarding the fundamental question – “Is PSR statistically improving freight carloads per year per car unit?” If that happens, then statistically this should reduce the need for more new cars.

Who is going to be the first to deliver those PSR car utilization and fleet re-sizing numbers?

As always, what are your business observations? What does the evidence suggest to you? Will you share?