Before the Canadian National (NYSE: CNI) or CSX (NASDAQ: CSX) rolled out precision scheduled railroading (PSR) under the leadership of the late E. Hunter Harrison, a much smaller terminal railroad company in the eastern United States was demonstrating aggressive cost reduction. It was Consolidated Railroad Corporation (Conrail).

What was Conrail?

Actually, there were two companies named Conrail. The first was created by the U.S. Congress (the January 1974 3-R Act) as part of the federal effort to restructure the re-organizable assets of failed railroads like Penn Central.

That larger network version of Conrail went into operation service on April 1, 1976. Among its cost reduction achievements were these.

Original Conrail PSR-like Improvements

1977 – 1999

- Reduced work force (from about 94,000 in 1977 to about 20,000)

- Reduced major railroad yards from more than 250 to fewer than 50

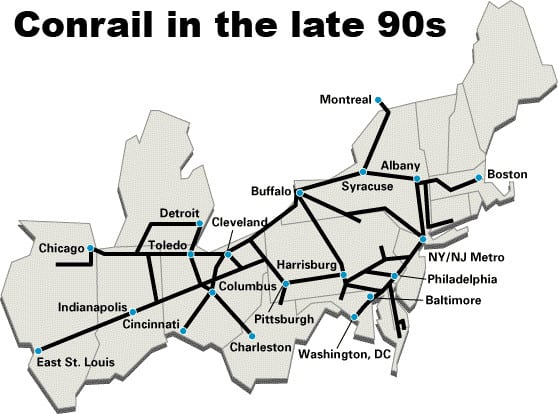

- Reduced track miles by about half (from 40,700 miles to 20,940 miles)

- Reduced locomotive fleet by more than 57%

- Eliminated a $350 million operating loss

- Reported positive operating income of $500 million by 1985

- Improved enterprise efficiency (operating ration) from 109+ to a relatively efficient 79.9 for the 1990s era

All of this was accomplished as the company resized its asset base to better serve a market demand that went down from more than 400 million annual tons of freight traffic to less than 200 million tons between about 1976 and 1981.

For a large size map of the original Conrail system log onto to this URL: https://www.bing.com/images/search?view=detailV2&id=4563C7FB77991C6B8CBB4E5D07DDFDE2C949F81D&thid=OIP.kqNnygFc17Chv5i0nZEt0QHaEZ&mediaurl=https%3A%2F%2Fwww.american-rails.com%2Fimages%2Fconrail-system-map.jpg&exph=2079&expw=3500&q=Conrail+System+Map&selectedindex=1&ajaxhist=0&vt=0&eim=0,1

Conrail as the current terminal operation?

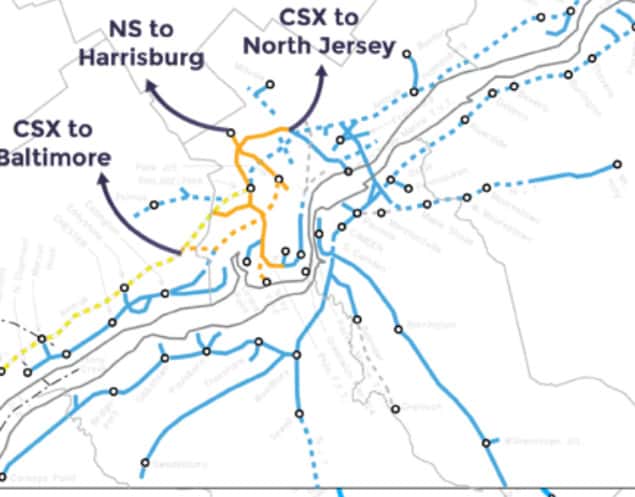

As part of the last of the mega-sized railroad mergers, key parts of Conrail were absorbed into Norfolk Southern (NYSE: NSC) and CSX. What remained of Conrail became a terminal company co-owned by the two railroads and renamed Conrail Shared Assets (CSAO). The creation of CSAO was a condition of the merger approval process before the federal railroad regulatory agency, the Surface Transportation Board (STB). That restructuring into a terminal railroad company occurred effectively during the summer of 1999.

This terminal Conrail is a ‘neutral’ terminal or switching road, that operates as a cost center. It performs car switching and yard classification work for its two owners, Norfolk Southern and CSX. It does not bill shippers or participate in the waybill. Strictly speaking, it serves as the railway local operating agent for its two owners.

Where?

Conrail Shared Assets’ train operation primarily covers just under 500 track miles in the northern New Jersey region that is part of the New York City urban area, plus another approximately 370 track miles in the Philadelphia metropolitan region to the south.

CSAO’s local benefits?

In the years that followed the breakup of the original Conrail, the new terminal operation worked to increase the level of two-railroad service competition offered to railroad shippers. The original Conrail had served more than 80% of the highly urbanized East Coast market under its original 1974 Congressional charter. Neither CSX nor Norfolk Southern in those years had direct service contact with those shippers. In some ways, this was a form of “open access” local freight service.

The simple translation is that freight customers in these terminal areas have a choice of using either NS or CSX main line routings or prices between the many NS- and CSX-served remote origin or destination markets.

Another benefit is that when a single entity like CSAO performs the terminal switching service, the unit costs within a congested geographic area like northern New Jersey or Philadelphia are lower than if each Class 1 railroad company performed its own train movements.

Beyond freight car placement and pick-up service, CSAO also helps Amtrak and New Jersey Transit operate some of those passenger trains over CSAO-owned and -maintained tracks.

How is it working for rail freight and passenger customers?

A limited circulation report suggests that by about 2016, the provided service metrics were pretty good. CSAO switching of freight cars at customer locations was in excess of 94% of customer expectation. That’s remarkably high compliance.

Train departure service provided by CSAO was typically in the 90% to 92% range according to one report.

Freight car yard dwell time across the CSAO network was less than 20 hours. In contrast, yard dwell times at many Class 1 systems yards was often in the 24- to more than 30-hour range according to a survey of STB metric reports.

The results have been impressive at a practical level.

Between the first full base year of 2000 and 2014, Conrail Shared Asset managers have produced the following productivity gains.

Conrail Shared Assets Terminal Benefits (2000-2014)

- Number of shippers served has increased

- Route miles decreased by about 3%

- Locomotives required down by about one-third

- Only about 90 locomotives required

- Employees required for the service is down by approximately one-third

- Derailments incidents are down by about two-thirds

- Railroad employee injuries reduced by more than one-third

Conclusions

Consolidation of complex railway terminal operations under a unified operating command structure clearly works and delivers both cost improvements as well as service and safety benefits.

That’s important, since strategically the next big hurdle in improving overall railway freight efficiency in the PSR era is likely to be within these complex yards and industrial areas.

At least two of the Class 1 railroads have separately admitted that yard operating improvements are the next front for continued productivity gains. Therefore, reorganizing the improvements made under the Conrail terminal changes should provide lessons for rail management and regulators in the next decade.

PSR cost reduction results are not unique to the current business model offered by six of the current seven Class 1 North American railroads. The only significant difference is that the cash flow savings from a terminal operation flow directly to the owning railroad companies (in this case CSX and NS) rather than to shippers as lower rates or to investors as dividends.

Acknowledgements

- In memory of the documentation work of both Roy Opitz and Gardner Rogers during their Conrail years.

- Productivity gains during the original Conrail operating period occurred under the stewardship of Ed Jordan, Stanley Crane, Jim Hagen and David LeVan.

- Part of the management improvement concepts embedded into the Conrail culture were introduced by Ram Charan. Ram believed in a balance in the business of serving customers, the need for financial improvement and an investment in developing Conrail’s human talent. (I had the privilege of periodically reporting on projects to each of these leaders during my 21-year Conrail career.)

- The Conrail Shared Assets PSR-like productivity improvements occurred during the leadership of Ron Batory (now head of the Federal Railroad Administration).

Justin

I remember before precision railroad. We called it employed.

Speedyk

Before the ludicrous brand name was applied it was called railroading. Years of hiring inexperienced and unqualified managers, nepotism in promotion, and “saving” money by letting infrastructure corrode needed an escape plan for senior management. Thus, doubling down on wrecking railroad operations was called PSR and sold like the snake oil it is.

Hunter painted those railroads red with their own paint like High Plains Drifter.

Having worked for all major railroads and at various levels I have no empathy for their current plight, think the big ones should be broken up into little pieces again, including feckless short line holders like G&W. Not one railroad merger ever benefited the shippers or the employees, all were for shareholders and top management and all have proven to be short-term gains with long-term problems.

Gary Williamson

You fail to mention conrail went bankrupt so those type of improvements didn’t accomplish much. Other than drive up the cost for csx and ns to buy them. I could also say more negative things about PSR than positive. I really don’t believe the data on accident being down.

Carl

”

conrail went bankrupt so those type of improvements didn’t accomplish much.

”

Turning a unsustainable organization into one that isn’t just sustainable but thriving is an awesome accomplishment.

Christopher Parker

Jim, you sure that the number of shippers on Conrail increased? I recall reading precisely the opposite, I think in Railway Age – that number of shippers had dropped by half while the total number of shipments increased.