The views expressed here are solely those of the author and do not necessarily represent the views of FreightWaves or its affiliates.

When Uber launched in 2010, it didn’t take a logistics genius to wonder how the technology and business processes the company brought to market for people was going to reshape the trucking industry. Fast-forward to 2020 and Uber for X is a movement that has already come and gone.

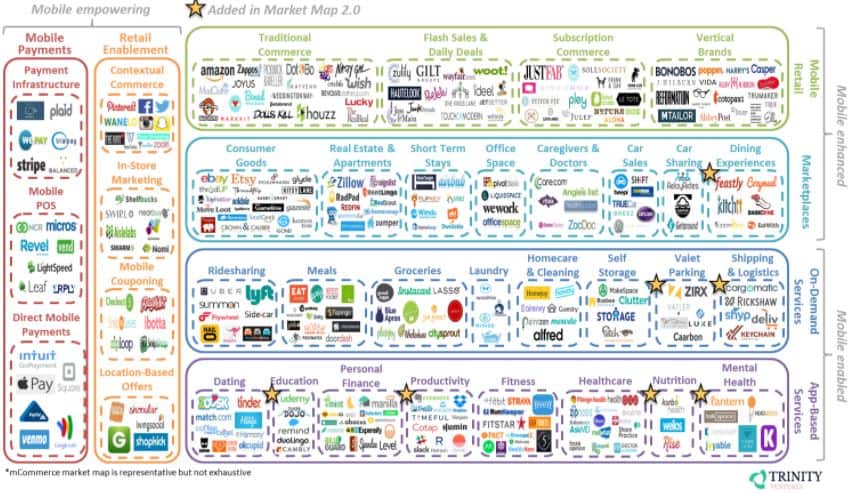

While it may seem that Uber Freight and Convoy have cornered the digital freight brokerage market, many incumbents and startups alike are still fighting for a piece of the digital brokerage pie. In reality, we are in inning one of a very long game. Years before Uber made its actual entrance into the trucking space with the purchase of Otto, Cargomatic launched in Los Angeles and set off a prodigious chain of events that kicked off the boon of venture capital flooding the supply chain space, changing the industry forever.

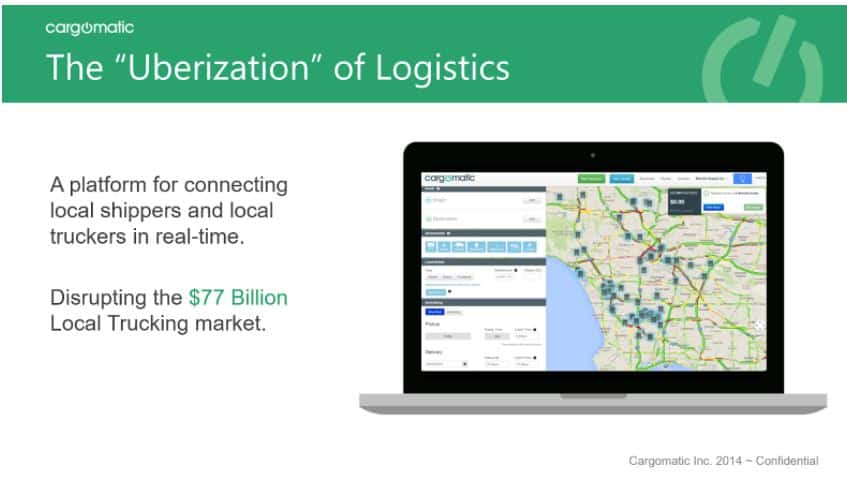

In the middle of 2012, Brett Parker, a veteran supply chain executive, and Jonathan Kessler, a software engineer with startup chops, were introduced over dinner by a mutual friend, Roger Berman. The two began talking about ways to bring technology into transportation and hatched a plan to make an Uber-like app for truckers to find loads with instant quoting, booking, tracking and payments. Digital freight brokerage had already been pioneered in the less-than-truckload (LTL) space when FreightQuote, GlobalTranz and Worldwide Express brought “Expedia for LTL transportation” to market more than a decade before.

When Kessler and Parker founded Cargomatic, there wasn’t anyone outwardly working on automating truckload dispatch through a mobile app. By April of that year, Kessler, working with Martin Hendleman, a self-taught programmer, had developed a prototype app and website to begin testing Uber-Esque dispatch for small trucking companies in Los Angeles. The product launched in the wild in October 2012 and shippers absolutely loved it. In those days, many truck drivers didn’t have smartphones and often the ones who did, didn’t own their own trucks.

“The driver’s side was tricky that first year. We ended up purchasing a lot of phones for drivers to help get the app into the market so we could get some feedback. It was expensive and time-consuming but we had no choice. Shippers wanted the service and we did whatever it took to get our product out there into the marketplace,” said Parker.

With impressive growth numbers and a stable product, Kessler and Parker raised a small round of angel investment in April of 2013, a few short months after going to market. “We were fortunate that we had revenue out of the gate and could demonstrate a product-market fit. We didn’t have the luxury of buying market share or running unpaid beta tests. We didn’t have proper funding and we were all working for free,” he said.

With some seed capital from friends and an aggressive sales team, Cargomatic blanketed Los Angeles, quickly growing to more than 100 loads per day in just a couple of months. That growth was rewarded with a $1.3 million seed round in September 2013, followed by a $2.6 million second seed shortly after.

The fact that Cargomatic was able to attract investment from Silicon Valley venture capital firms as a truck brokerage was unheard of in 2013. At that time, pitching VCs about trucking was met with questions like, “Why won’t FedEx or UPS just do this?” “What kind of trucks are we talking about?” “Is the market big enough?” Kessler and Parker used to spend the first 10 slides of their pitch educating VCs on what a truck looks like, the size of the U.S. global transportation market, delving deeply into the various modes and players, giving very clear and specific reasons why incumbents wouldn’t be interested in pursuing a local digital LTL and truckload brokerage.

With this capital, Cargomatic quickly built a team of scrappy engineers and salespeople, moving out of Kessler’s apartment and into an office in Venice Beach. “The thrill of joining a company like Cargomatic at the time was palpable from the start. Pre-Series A, Venice Beach, ‘Uber for X,’ it checked all the boxes at the time for a startup in Silicon Beach. It also felt like we were doing something that could truly revolutionize trucking,” said Paul Montha, an early business development hire at Cargomatic.

Today Cargomatic continues to double each year and has spurred on a handful of companies with similar business models which themselves have garnered massive checks from the investment community. This is a testament to the fact that our industry is in its infancy of innovation and investment. Cargomatic, Flexport and other logistics firms that raised venture capital in those years did the heavy lifting of educating the venture capital community on the nuances of logistics and supply chain, familiarizing the investors of today with what’s happening in supply chain and logistics technology. Now, VCs are buying up tech startup stock as quickly as they can and there’s little doubt that Cargomatic played a key role in bringing VC interest to trucking and logistics. Cargomatic walked so digital brokers around the world could run!

Click for more FreightWaves commentaries by Charley Dehoney.

lindanhewal

Thanks for sharing

Kyle R

Memory lane!

Chris G

What would the industry do without this article?