It is nearly Thanksgiving 2019. There are reports that the heavily used railroad intermodal corridor serving the adjacent Port of Los Angeles and Port of Long Beach is seeing maritime container volume drops year-over-year. The suggestion is that the drop will lower railroad freight train movements along the 20-mile long special project route of port traffic container trains.

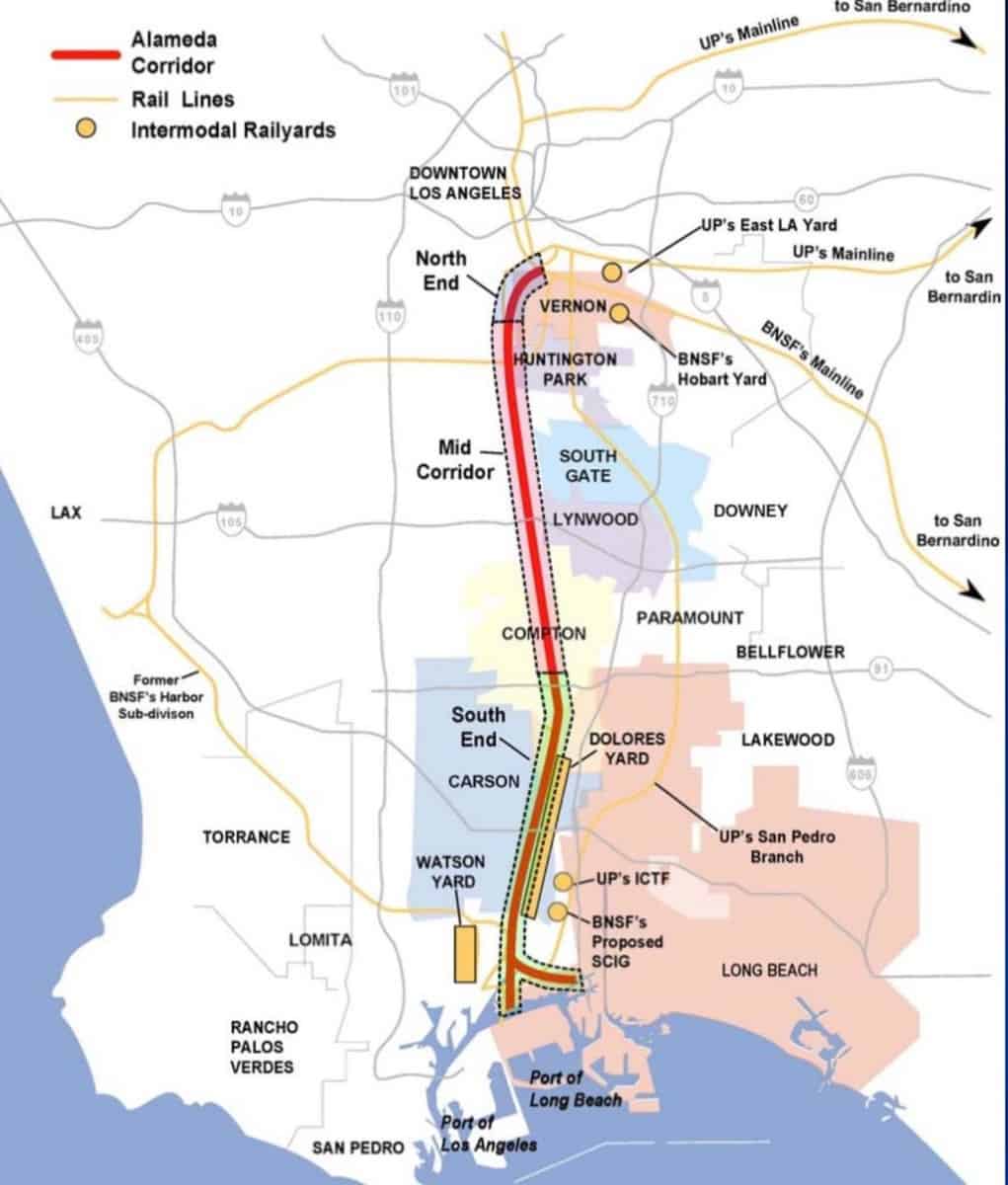

Technically, the railroad project is called the Alameda Corridor Transportation Authority (ACTA).

One outlook is that perhaps “if current trends continue, ACTA will experience significant cash flow deficits beginning in 2024… growing in size out towards 2038.”

ACTA is not a railroad company-owned asset. Instead, think of it as special tollway authority with the capacity for numerous trains per day. That authority is financed by a series of privately financed public debt measures.

Physical facts about the Alameda Corridor:

- Depressed rail line (tracks lower than street-level) connecting central Los Angeles with the region’s ocean port complex to the south.

- The depressed rail tracks eliminated road/rail congestion delays at about 200 locations along a 20-mile corridor.

- The original capital expenditure investment totaled about $2.4 billion.

- Union Pacific and BNSF are the major users of ACTA, with their trains paying a toll:

- Initially, a $15 toll for a loaded twenty-foot equivalent container (TEU) and $4 for an empty TEU.

- Separate toll of $8 per railcar for other commodities.

- Adjusted up over the years to now higher tolls.

Again, ACTA is administered as a state-chartered authority. Has that rail project worked? Absolutely.

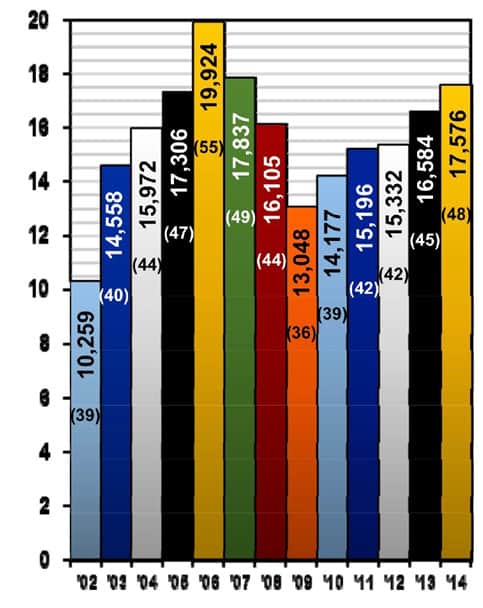

Consider in Figure 1 the dense freight train operations that used the corridor in the 13-year period 2002 to 2014.

Total annual Alameda Corridor trains per year

(plus calculated daily average)

Data from ACTA published reports

That is a lot of trains – more than 17,000 in 2014.

No other special service intermodal route in the world sees this kind of volume.

In 2006, the corridor marked its highest number of trains per year, followed by three years of decline during the Great Recession.

Yes, traffic has slumped before.

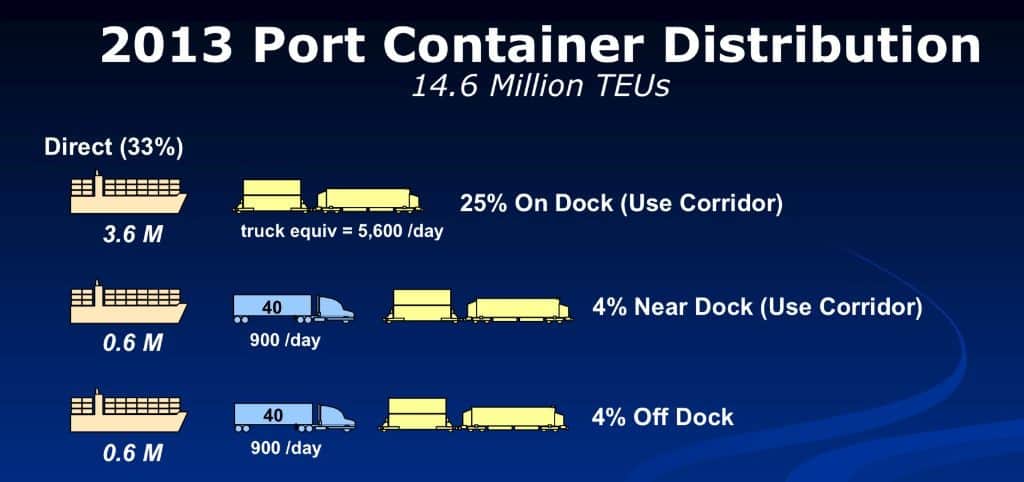

How much of the port complex traffic moves inland by rail? Not as much as you might think. Trucking is still the primary freight mode. Rail’s intermodal market share was calculated back in 2007 at about 20%.

It varies by year. Figure 2 shows 2013 rail intermodal share at about 33%.

Many proponents of the corridor project expected a much larger rail share. Perhaps up to 25% to 50% of the total. That didn’t happen.

Trucks continue to dominate because of the basic high load on/load off lift costs for rail when the movement is a short haul between the port and the southern or central California distribution processing and holding centers. “Trucks rule on short distances” until those terminal rail costs are somehow lowered.

Debt coverage fundamentals

- Who might be on the hook?

- Is there a back-up plan?

- What about traffic recovery?

- Is a financial crisis as some allege a likely outcome?

Few predicted this outlook uncertainty three decades ago when the special rail line project was conceived, designed, engineered and then built.

Intermodal rail 25 to 30 years ago was growing strongly.

Linked to global trade, the port complex’s container trade was often growing at nearly 7% annually.

Rail-related port and container traffic growth was stimulated by the 1983-84 APL Lines introduction of the double-stacked container train.

The issue in the 1990s was how could public policy support that environmental mode shift?

The new all-grade separated railway line was the public solution. Local special purpose financing was adopted. No big share of federal funds or federal grants were required.

What could go wrong? More and more ships with containers were coming.

Realistically, all projects face risks. A deeper examination does reveal increasing risks not in the original strategic assumptions. History teaches us that at least three competitive forces can change project outlooks. They are:

- Geographic re-sourcing.

- Unexpected innovation moves by a party.

- Geo-political change.

Many global projects miss these signals during the buildup excitement and construction. The board and management of ACTA have paid attention to the occasional traffic volume shifts. This 2019 report is not their first debt service review.

Now there is a challenge predicted by experts from the international consultancy Mercator. It released a report with risk calculations for the combined San Pedro Bay port complex in the face of complex competitive challenges from other ports and routes.

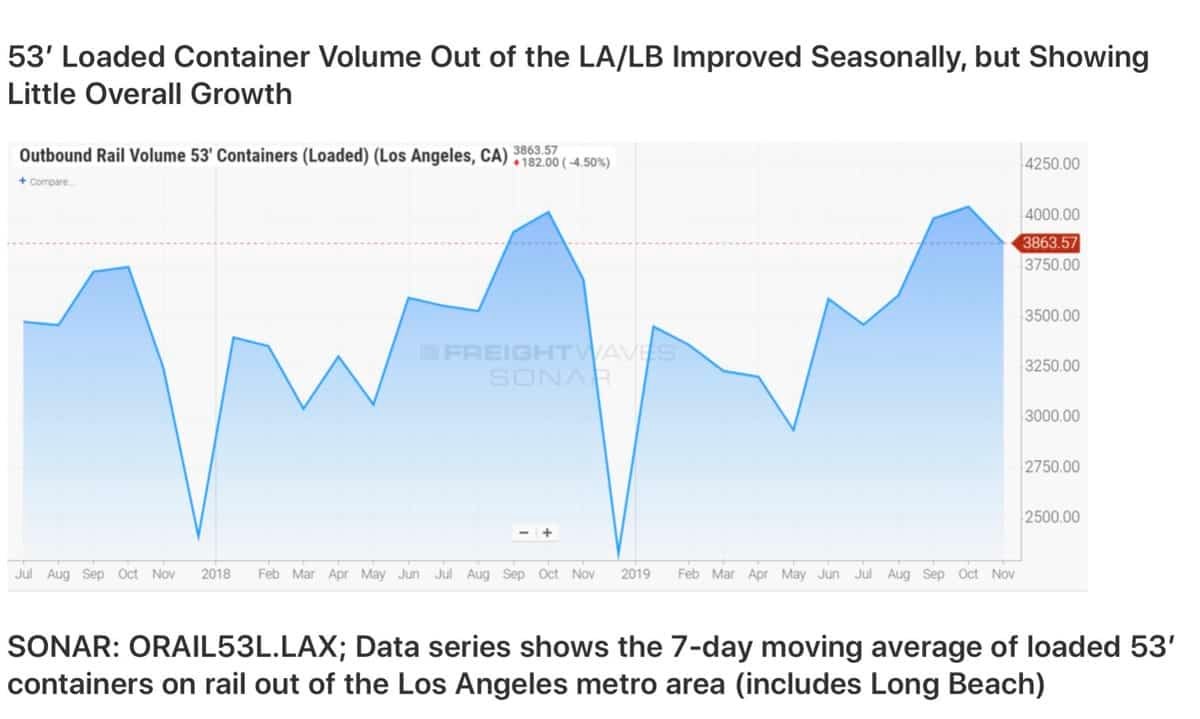

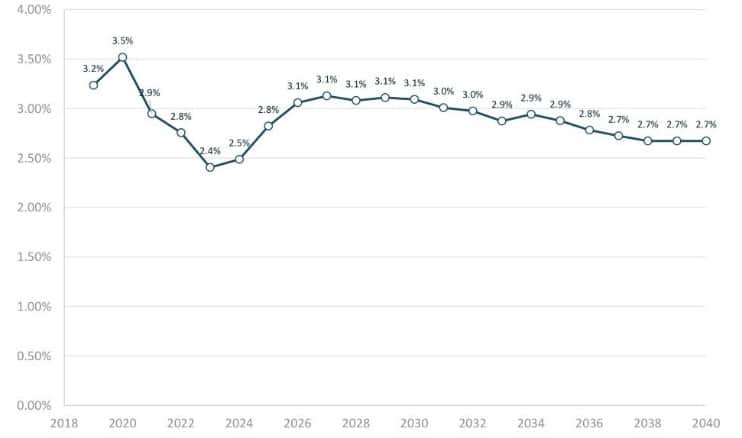

Figure 3 stands out to this economist.

This wasn’t the growth pattern back in the 1990-2006 era.

If this is the correct long-term 20-year outlook, it does send a message of lower railroad intermodal growth instead of the previous much higher pace (often in the 4% to 7% range).

Note – none of the North American railroads have issued a similar long-term low intermodal growth outlook. Not yet.

Early railroad market view conclusions

Some might ask if this port/rail access is like a Ponzi scheme. A Ponzi scheme is technically a fraudulent investing scam.

The pattern of due diligence review by the Authority isn’t consistent with withholding due diligence data. The Great Recession of the 2008-09 period was one of those re-examination periods. Now comes the freight recession “wave” of 2019.

Will Pacific Rim-Southern California port container volume rise again in the coming 2020-2025 period? Or in the 2040 timeframe?

There is too much uncertainty.

Mercator’s report sees a significant slowing. Its solution seems to suggest another port side investment project. Would that promoted expansion address the geo-political trade uncertainty and produce significant rail volume? No one knows. Volume growth and new share gain remain a calculated business risk.

Re-sourcing of overseas manufacturing for the U.S. market is taking place. Some of that re-sourcing is moving manufacturing production bound for the American market out of China towards southern Asia and west towards the India subcontinent.

That westward shifting of manufacturing will result in a trade route shift that favors shorter distance and transit times via the Suez Canal and U.S. Atlantic coastal ports.

We see evidence of this re-sourcing and competitive route shifts already in the U.S. commercial 2018-19 data published both in FreightWaves SONAR graphs and in the trade war report by Lori Ann LaRocca.

Will the Alameda rail corridor fail? Failure is not likely. The potential of new refinancing terms and re-pricing are, however, likely.

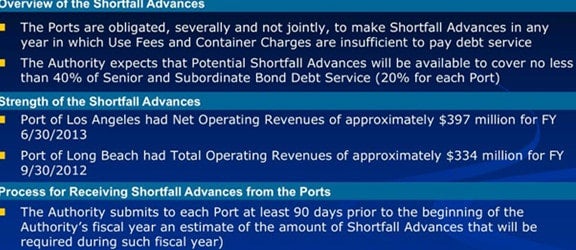

Figure 4 identifies the first responsibility for debt coverage short falls. Note that the major railroad companies in the first instance are not liable.

Clearly there is a plan for which parties might be “on the hook” for the coverage shortfall.

And if traffic stagnates into 2020 and perhaps beyond – regardless of the reasons – the Authority has the ability to increase the toll charges per train unit (car or containers) that use its toll-railway tracks.

Of course, an increase in the per railway unit charge could exacerbate the California ports’ Suez re-route competition problem. Higher West Coast port and inland rail costs would favor shifts towards the Port of New York/New Jersey and the Port of Savannah (among others).

One part of the mystery is how the Los Angeles and Long Beach ports serving intermodal railroads BNSF and Union Pacific will adjust their contract and spot rates over time as they respond to new source and global route competition. Will they first preserve unit margins or re-price for both volume/share gains? No one knows.

In the interim, the two ports are the first recourse for investors.

How do you see this issue evolving?

Recommended references based on my recent research include:

- Alameda Corridor Transportation Authority reports and PowerPoint documents available on internet.

- Mercator – “Economic Impacts of San Pedro Bay Port’s Share Losses – On the Alameda Corridor Transportation Authority” (prepared for Pacific Maritime Association).

- Independent reviews of the financial issues and possible market and strategy reactions by:

a. Ari Ashe, and Journal of Commerce staff

b. Transport analysis by Bill Freeto, DePaul University

c. Intermodal/port published notes – Jean-Paul Rodrigue, Hofstra University. - Lori Ann LaRocca – TRADE WAR: “Containers Don’t Lie – Navigating the Bluster” – Marine Money, Inc., Nov. 2019