On October 29, Bloomberg published an article by Dina Bass, “The ‘Uber for Trucking’ Tries to Navigate Some Uber-Scale Problems.” That was followed by Craig Fuller’s article, Is winter coming for the super-hot FreightTech space?, which ran in FreightWaves on November 3. It would be worth it to read both articles if you have any interest in how the competitive landscape for freight trucking marketplaces, or truckload matching apps, is evolving.

That got me thinking about freight brokers and freight forwarders again, on the heels of Is disruption finally underway in the freight brokerage industry?, which I wrote on May 10, 2019, and Why digital freight brokers might fail to disrupt the freight brokerage industry, which I wrote on September 11, 2019.

It also got me thinking again about the challenges that digital freight forwarders (DFFs), digital freight brokers (DFBs), and digital freight marketplaces (DFMs) must overcome in order to succeed at their stated aim of disrupting traditional freight brokers and forwarders. In the rest of this commentary I will use the term digital attackers to refer to this group of startups.

In a bit more depth than before, I am going to examine why it could be wrong to assume that traditional freight brokers and forwarders present easy targets for their venture-backed digital attackers, and how early-stage investors considering new investments might think about the challenges such startups must overcome.

Low switching costs are the Achilles’ heel of every digital attacker

In my September 2014 blog post, Revisiting What I Know About Network Effects & Startups, I adopted this definition of network effects: “A network effect occurs when the value of a good or service increases for both new and existing users as more customers use that good or service.” Network effects have played a role in the growth and profitability of some of the world’s most profitable companies, but network effects alone are insufficient to build a large and profitable business.

Digital attackers have been attractive investments to venture capitalists because they promise to digitize freight brokerage and freight forwarding, while simultaneously unleashing network effects.

It is not difficult to understand why these startups have raised enormous sums of money from investors when you combine that promise with the sometimes stated, but ultimately incorrect, opinion that the entire $800 billion or so United States’ freight market is up for grabs by these digital attackers.

The story by Dina Bass highlighted, with a very clear example, why the digital attackers are failing to benefit fully from whatever network effects their platforms might unleash: “Travis Washington, a trucker based outside Atlanta, says he once called to arrange a job with J.B. Hunt Transport Services Inc. and was told to hang up and book through the company’s app. The broker gave him an extra $10 for doing so. But he still uses Convoy’s app daily, including a service called Convoy Go. It lets drivers bring only their tractors and hook up to a trailer pre-filled with cargo at pickup. It can also save on fuel and other costs associated with a trailer. But Washington says Convoy’s prices for the return trip are typically too low, and so he loads the Convoy trailer with freight booked through a traditional broker. It’s not a great outcome for Convoy, but the company doesn’t discourage the practice, as long as the trailer is returned within a few days.”

In other words, digital attackers suffer from the phenomenon of relatively low switching costs.

In my October 2014 article, Revisiting What I Know About Switching Costs & Startups, I defined switching costs as “ . . . the expense in cash, time, convenience, risk and process disruption that a customer of one product or service must incur if they change from one product from an incumbent Producer A to another product from Producer B. Switching costs can be explicit or implicit, and confer the benefit of customer lock-in to incumbent suppliers if the customer perceives the cost of switching to outweigh the benefits that would be obtained by making the switch.”

To be more specific, the example of Travis’ use of Convoy’s app, J.B. Hunt Transport Services, and a traditional broker, is an example of the phenomenon known as multi-homing.

Multi-homing occurs when the cost of switching between directly competing products is so low that customers routinely do so – think Twitter vs. Facebook, or Snapchat vs. Instagram. In this example, the cost to Travis of multi-homing – time, is exceeded by the benefit – a load that pays him more. Low switching costs make it rational for Travis and others like him to behave as he did in this example. For shippers, multi-homing makes sense because it increases the likelihood that they will find a carrier willing to charge them less for a load by comparing offers from different sources.

Travis’ example is concerning because it appears that Convoy is subsidizing the cost of the trailer on the return leg. Multi-homing makes it difficult for platform businesses with strong network effects to extract value from their users or customers. This is a problem that the digital attackers need to solve if they are to succeed at displacing the competition and becoming profitable. It is also the reason why many such marketplace apps remain wildly unprofitable irrespective of the gross revenues that they generate.

The authors of Freight Matching Apps by Marketshare, an October 2019 research report published by FreightWaves Freight Intel Research provide some insight into what’s happening, from the perspective of carriers in the spot-market. In conducting the research for this report FreightWaves Freight Intel sent out 80,000 emails and received 219 responses. The focus of the survey is carriers operating one to three trucks. It is important to note that data from the American Trucking Associations suggests that as of May 2019, fleets of six trucks or fewer represented 91.3% of all trucks in the trucking market. Fleets of 20 trucks or fewer represent 97.4% of the market.

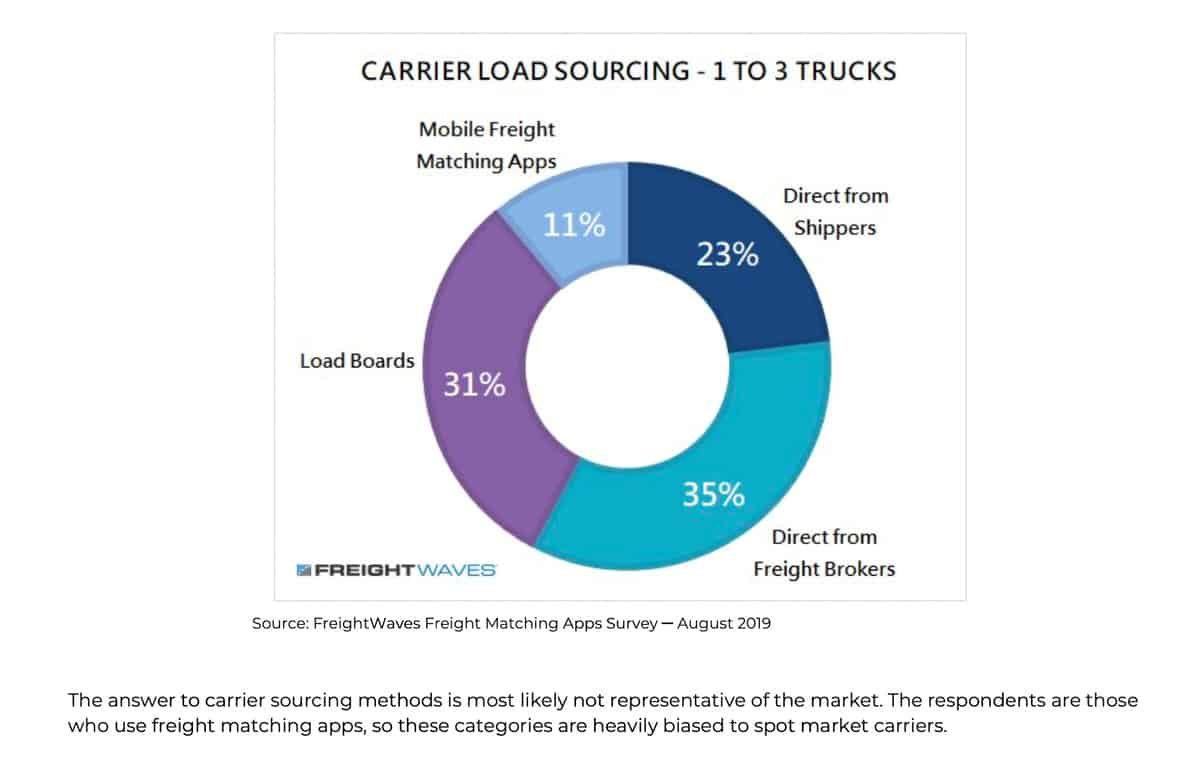

I found the chart below to be the most illustrative of the problems that digital attackers face. Asked how they source freight: “Carriers that use freight matching apps said they only source 11% of their freight from digital freight matching apps. The most popular method for sourcing freight for carriers running one to three trucks remains directly from freight brokers, shippers and load boards.”

That finding is important because small carriers and relatively small shippers are most reliant on the spot market, which is the primary focus of most digital attackers. My interpretation of this is that digital attackers are failing to change behavior in a meaningful way.

This finding also matches what I am hearing from startup founders who are building new innovations to serve the freight brokerage and freight forwarding market. As a result, many of these founders are adopting different business models than their predecessors.

Digital attackers must seek sustainable differentiation

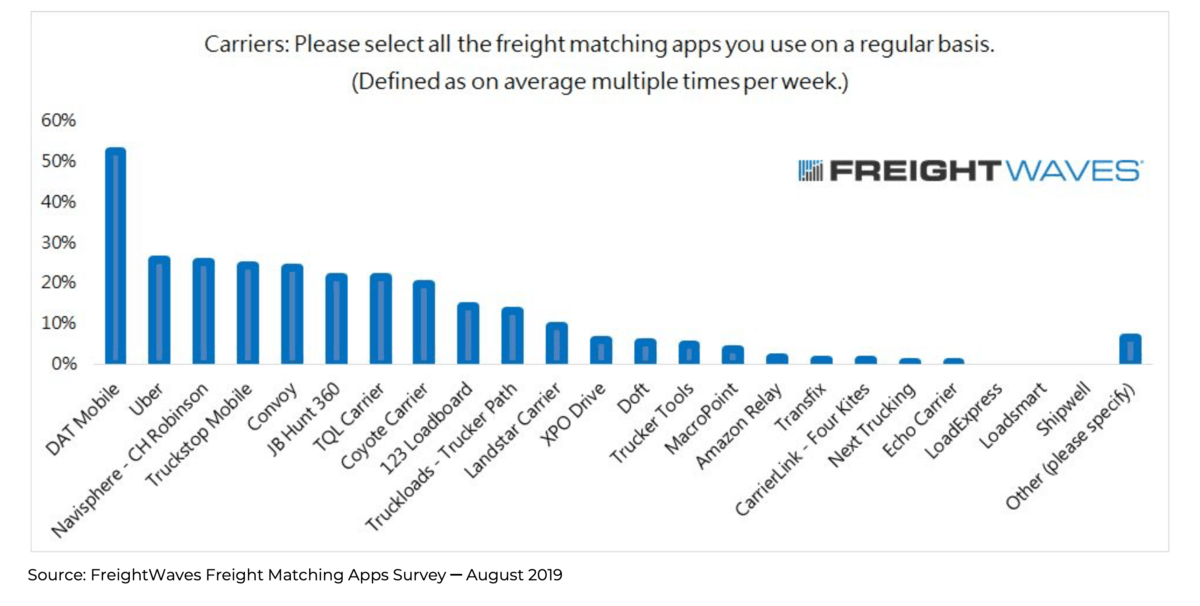

The chart below, also taken from Freight Matching Apps by Marketshare, gives a glimpse of the crowded nature of the market. Note that the chart does not include niche, vertically focused players concentrating on matching freight between shippers and carriers in a specific industry or only in specific regions.

My interpretation of the chart above is that digital attackers are not yet offering sufficient differentiation to shippers and carriers, because if they were offering sufficient differentiation the incumbents wouldn’t feature as prominently as they do at the top of this ranking.

In the 2016 article, Industry Study: Freight Trucking (#Startups), my co-author and I relied on data from the American Transportation Research Institute to conclude that “Freight trucking is a challenging business that is characterized by net margins of 7% or less, with most carriers earning margins of about 5%.”

The low profit margins in trucking encourage multi-homing.

That is also why I believe that the critical problem digital attackers should be solving is not the freight matching problem. The critical problem digital attackers should solve is the profitable loads problem.

Why? Because increasing a carrier’s net margins from 7% to 8% with everything else held constant is more desirable to that carrier than increasing that carrier’s net margins from 7% to 8% with an accompanying increase in the volume of matched freight that carrier must service.

The profitable loads problem is a mathematical problem that is very difficult to solve. Moreover, once a mathematical solution has been developed, the challenge of implementing it in software that can be used in real-time by carriers and shippers is not a trivial undertaking. Whichever one of the digital attackers solves the profitable loads problem will be clearly differentiated from its competitors in the market.

The important problem is not matching more loads at scale. The difficult and important problem is matching more profitable loads, at scale.

Venture capital and software alone are insufficient barriers to entry

The authors of What are Digital Freight Brokers Worth?, a September 2019 research report published by FreightWaves Freight Intel Research made an observation with which I agree. They said, “We see traditional freight brokers and DFBs slowly transitioning over time to more closely resemble each other (traditional brokers will increasingly employ technology while DFBs will increasingly become more human labor-intensive).” This will happen because some, if not all, traditional freight brokers have the financial resources to invest in the software tools that give digital attackers their edge.

The digital attackers that will succeed in disrupting the freight forwarding and freight brokerage business with freight brokerage software must develop solutions to other long-standing problems in the industry that now lend themselves to being solved with software, or they must allow other software products to be built by others who can solve those problems, with the digital attacker’s platform serving as a foundation. In other words, the digital attacker that wins must evolve into an innovation platform.

What is an innovation platform?

In The Business of Platforms: Strategy in the Age of Digital Competition, Innovation, and Power, Michael Cusumano, Annabelle Gawer and David Yoffie define an innovation platform as one that offers“technological building blocks that third-party innovators use to develop new complementary products or services. The building blocks usually include tools and connectors that facilitate the creation of complements such as software applications for computers and smartphones. At least one side of an innovation platform always consists of complementors, and at least one other side always consists of end users.”

Tying it all together

In theory, digital attackers and their VC backers expect that building transaction platforms will disrupt the traditional freight brokerage and freight forwarding business. The reality is more complex.

Multi-homing, low switching costs, low barriers to entry and a lack of sustainable differentiation makes the objective of disrupting traditional freight brokerage and freight forwarding more difficult than it at first appears.

Rapid growth is certainly possible, but such growth is likely to be unprofitable in the near- and long-term unless digital attackers can solve other long-standing problems in the industry in ways that are difficult for traditional incumbents to imitate, and that enable them to deliver and extract more value from carriers and shippers.

The digital attacker that will win is the one that successfully makes the transition from a product- or service- focused business model to becoming an innovation platform for freight. To put it another way, the digital attackers that will win must find a way to create a demand-side innovation AND a supply-side innovation if they are to accomplish the goal of disrupting the traditional incumbents.

Author’s disclosure: I am not currently an investor in any startups mentioned in this article. However, I am assessing numerous startups that may compete with some of them for potential early-stage investments.

ElShaw

I think the DFB who wins this thing will do it quickly while having 2-3 employees. If you need more employees to handle human interaction on loads, then you haven’t created a finished DFB. The winner will start conservative, running 20, 50, 100 loads a day without getting involved (this.isnt including “out of the ordinary” issues – say 2 out of every 100 loads… I.E. Accident, a breakdown that takes multiple days to fix, incorrect PO loaded on trailer, trailer was loaded overweight on an axel, human error, etc)

Perhaps hire 1 employee for every 200 loads to maintain the DFB for these issues.

The drivers are going to make more money,.the customers will save a little money, drivers will finally have access to the compensation they deserve for doing all the work, instead of a third party determining what is fair.

Design it ti reward the shippers and carriers that have always done the right thing. Which is the majority of them.. – (I.E. The one that doesn’t ask for extra money just because the shipment was 20 lbs heavier than the rate con showed, a shippers who won’t leave a driver hanging if he had 100 miles dead head and is 10 minutes past his apt., They don’t show up a day late, seal in hand, with pallets that mysteriously double stacked while in transit.)

Noble1

Analysts: Uber Freight goes ‘well beyond’ brokerage competitors

Quote:

“Morgan Stanley’s analysis paints a picture in which Uber Freight emerges as the clear stronghold in digital freight matching. ”

“Large brokers still hold some advantages over Uber Freight, as they have established relationships with tens of thousands of carriers. But Morgan Stanley analysts say Uber Freight’s rapid growth, especially as it enters the flatbed market, could even pose disruption to established players, namely Landstar. ”

From my perspective UBER is still in its infancy and we haven’t seen anything yet .

In my humble opinion ……..

Michael Evans

Lots of information in this article! When the average American thinks of trucking and freight brokers, they probably have no idea how advanced the industry has become. But, as with all other things, there will always be changes, including in the trucking industry. With the advancements, there will likely be advanced problems, or kinks. But the trucking industry will survive!!

Tim Higham

Great article, indeed!

Remember, freight “matching” (simply finding the next load) is only one VERY small part of running a trucking company, whether you have 1 truck or 20. Freight apps just don’t cut it and never will. Nobody can run a trucking company from a phone app. It’s IMPOSSIBLE.

Additionally, 99% of the time, the driver in a small fleet relies on his or her dispatcher to find the next load, negotiate a fair rate, get setup with the broker, manage the pickup and delivery appointments, monitor the transit, provide fuel advances to the driver, gather the POD paperwork, manage any claims or issues along the way, pay the driver each Friday, manage truck maintenance needs, get the driver their NEXT load, bill the customer, receive AR payments, and repeat and repeat and repeat hundreds of times per year (or even thousands of times a year with just a few trucks in a fleet).

Trucking companies – no matter the size – are increasingly using sophisticated TMS software to manage this entire complex process (I can attest to over 24,000 asset carriers to using TMS software myself). PHONE APPS DON’T CUT IT AND NEVER WILL.

Yes, an “app” may help to find an occasional load, but to run a REAL and PROFITABLE trucking business you need the best (and inexpensive) TMS software that you can find that plugs you IN to all the freight sources and load boards in real-time – AND you need TMS software that will manage every aspect of your drivers, trucks, trailers, customers, pick / drop locations, AND your loads.

Tim Higham

CEO

AscendTMS (www.TheFreeTMS.com)

Andrew

This is a fantastic write-up of these business. Really appreciated the level of detail here. You are so right about the minimal impact of switching services off of these “digital brokers.” In many cases it’s even a net POSITIVE outcome for the carrier to switch services to a traditional broker or customer to run back. As long as that’s the case, these digital people are going to have some tough sledding. Well done sir!