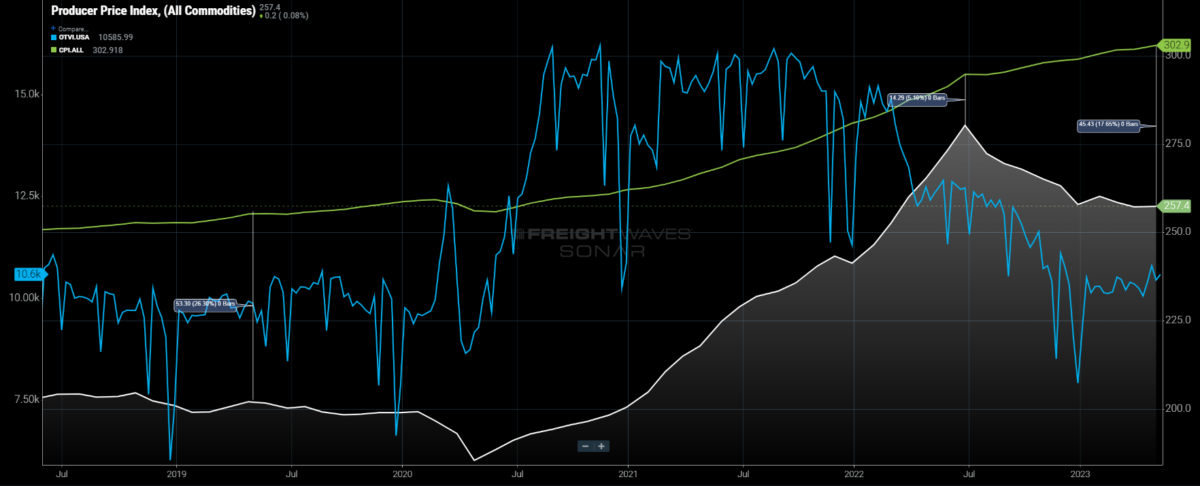

Chart of the Week: Producer Price Index – all commodities, Consumer Price Index – all, Outbound Tender Volume Index – USA SONAR: PPI.ALLCOM, CPI.ALL, OTVI.USA

The Producer Price Index (PPI), which measures the input costs for goods, has fallen 8% since last summer. The Consumer Price Index (CPI), which measures what consumers pay for goods and services, has kept increasing. Companies are still trying to get their margins back to pre-pandemic levels with price increases on finished goods. This will continue to put freight demand at risk in the second half of the year.

It should be noted that this is not the total PPI figure, but the commodities specific index that measures raw inputs. It is not meant to be a 1 to 1 comparison with the CPI as that would be nearly impossible with aggregated data.

The PPI does have a transportation cost component to it, so it is not surprising that after truckload freight demand — measured by the Outbound Tender Volume Index (OTVI) — collapsed in March of 2022 the PPI started to decline a few months later. This is representative of the beginning of supply chains becoming less congested and the flow of goods flowing more freely.

One reason for the still rising CPI figures — what the Fed uses as a measure for inflation — is a lagging response by companies to pass along the increasing input costs in the early phases of the pandemic.

The PPI increased 20% throughout 2021, while the CPI only rose 6.7%. It is typical for companies to hold off on price increases and try to absorb as much of the cost as possible on the front end so as to not shock their customers into looking for replacements. This is why inflation is such a lagging indicator.

Goods demand has been eroding since 2021, something companies had trouble recognizing due to their difficulties sourcing materials. They were never able to count on receiving enough inventory.

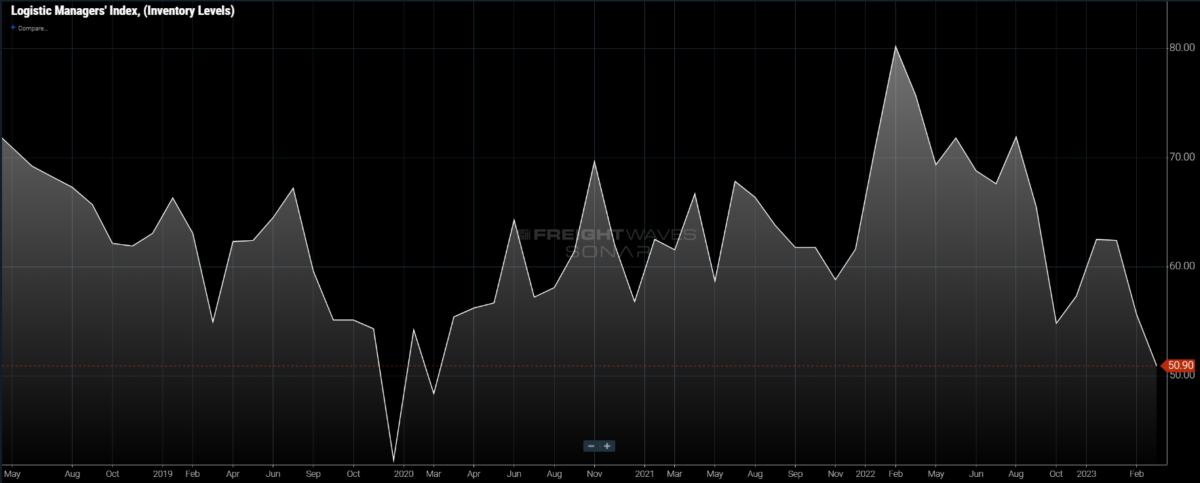

Inventory levels are getting closer to being in line with company targets as indicated by the recent Logistics Managers’ Index (LMI) report that shows a reading of the lowest level of expansion since March of 2020. As inventories normalize, discounts become less likely and price increases on base goods continue. This puts future demand in the hands of the consumers, who are being put under continuous pressure to spend less.

How much can consumers take?

Consumers received windfalls of cash during the pandemic in the form of stimulus packages and extended unemployment benefits. They also had much more free time, which led to the consumer spending bubble.

The problem now is that the bubble has burst and consumers have yet to feel the full effects of continuous Fed rate increases and declining purchasing power. The jobs market is also showing cracks with jobless claims on a consistent rise to start the year.

Wage growth has not been able to keep up with inflation at many levels. The service sector, which had a boom in 2022 after lockdowns ended in the U.S., is now starting to see the effects of diminishing consumption.

The reality is that companies are now driving most of the inflation as they recover margins, not the consumer.

It’s not all doom and gloom

There is optimism left, however. Zac Rogers, a contributor to the LMI, talked on this past week’s Freightonomics about how upstream participants in supply chains are more optimistic about demand later in the year as they expect the Fed to take a pause on rate hikes. This will open the door for a more stable investment environment. He states it is less about the rate and more about the expectation.

Downstream participants are not as optimistic, but they also tend to feel things on a lag compared to upstream. Unfortunately for many transportation providers, this also may mean the most overserved sectors that grew on the backs of consumption will not feel the economic recovery till later.

About the Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real time. Each week a Market Expert will post a chart, along with commentary, live on the front page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry in real time.

The FreightWaves data science and product teams are releasing new datasets each week and enhancing the client experience.

To request a SONAR demo, click here.