Despite what many perceived as a solid performance against a very favorable backdrop – C.H. Robinson posted record gross revenues, net revenues and operating income in the fourth quarter of 2018 – it took Wall Street investors all day to figure out how they felt about it.

Shares of C.H. Robinson (NASDAQ: CHRW) closed at $86.61 on Tuesday when trading ended, after which the third-party logistics provider released its results. On Wednesday, the stock opened at $87.51, then fell sharply to $85.62 by 10:00 a.m., bounced back up to $86.91, dropped all the way to $85.18 at 1:30 p.m., and finally rallied to finish the day at $86.73, a 0.14 percent improvement over the previous day’s close. At one point during Wednesday’s choppy trading, CHRW was trading down 2.6 percent from where it opened.

Part of the confusion stemmed from CHRW’s somewhat mixed result as the company beat Wall Street’s consensus expectations on earnings-per-share but missed on gross revenue. Management’s candor on the earnings call Wednesday morning regarding tougher first quarter comps may have also quelled some momentum to the upside.

C.H. Robinson CEO John Wiehoff opened the earnings call with a statement about the flexibility of CHRW’s model and how it can react to changing freight markets.

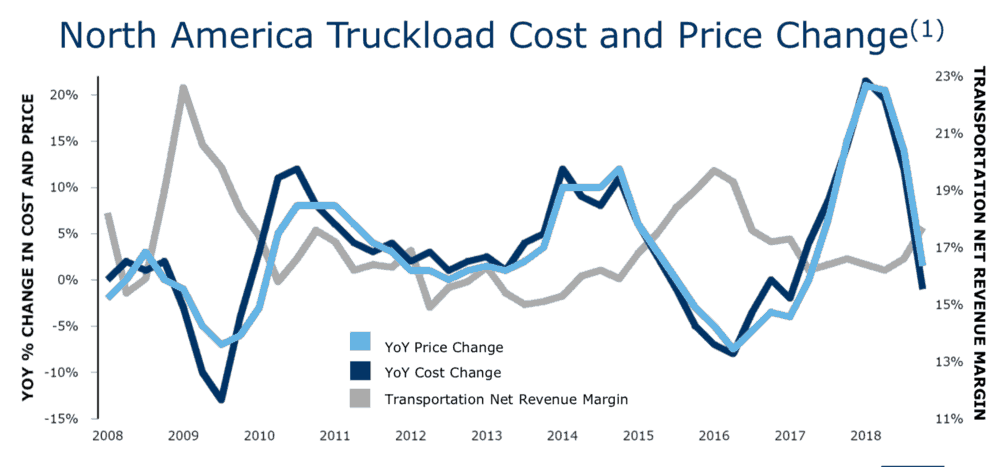

“The strength of our business model is the ability to rebalance our portfolio between contractual and spot market freight as market conditions change,” Wiehoff said. “In periods of market dislocation, we experience higher levels of repricing activity across our portfolio. Then as routing guides perform more effectively and freight costs decelerate, we tend to see our volumes shift more heavily towards contractual business accompanied by net revenue growth and margin expansion. This outcome is clearly reflected in our fourth quarter results.”

Transportation equities analysts agreed and several characterized C.H.’s business model as ‘defensive’ in a freight market expected to cool this year from a volatile 2018.

“Net revenue deceleration into 1Q clipped share upside from a standout 4Q result,” Susquehanna analyst Bascome Majors wrote in a note released after the call. “But we see a clear path to our above consensus forecasts for 2019-20, and with shares trading below historic support levels and the model defensive in a downturn, CHRW remains our top logistics pick.”

Ken Hoexter at Merrill Lynch said the bank would “remain neutral on valuation, but solid defensive name.”

“Although the company isn’t immune to cyclical downturns, its variable-cost model helps shield profitability during periods of lackluster freight demand, as evidenced by a long history of above-average operating profitability,” wrote Morningstar’s (NASDAQ: MORN) Matthew Young in a January 16 outlook. Still, Young thinks that as contract rates – “sell rates” – converge downward toward weak spot prices, “Robinson’s net revenue growth will moderate meaningfully in 2019.”

Cowen (NASDAQ: COWN) also thought that C.H. Robinson is a good trade in a softening freight climate.

“As spot rates continue to fall, CHRW’s ability to shift to contractual business (now 65 percent of total business) could cause margin expansion in 1Q19,” Cowen analyst Jason Seidl wrote on Wednesday.

Finally, Stifel (NYSE: SF) thought that C.H. had a particular advantage in late cycle downturns.

“We believe CHRW is a later-cycle beneficiary that offers stability and a degree of downside protection given its diversified, non-asset-based, intermediary business model. As the market matures, gross margins and volumes should continue to expand at NAST,” wrote Stifel analyst Bruce Chan in a Wednesday pre-call note.

During the question-and-answer period after C.H.’s presentation on Wednesday’s call, analysts were curious about management’s forecast for margins, the spread between how much CHRW sells capacity to shippers for and the price at which it can buy capacity from carriers (in C.H.’s terms, “price” versus “cost”). The analysts seemed to accept that rapidly deteriorating spot rates would stunt contract rate growth or even pull it down, but they wanted to know what that meant for CHRW’s position in the market.

“After a very strong 2018 year-over-year comparisons clearly get more challenging as we move through 2019. Can you speak to the levers that you intend to pull to help drive NAST (North American surface transportation) net revenue growth in 2019 given evidence of a balanced freight market?” asked “several analysts.”

“A balanced freight market,” with a smaller spread between contract and spot rates, would tend to compress CHRW margins, but in answering the question, Wiehoff subtly changed the emphasis from net margins to net dollars per load.

“As we’ve stated in the past, we tend to look at net revenue dollars on a per load or per shipment basis as a more important internal metric than absolutely net revenue margin,” Wiehoff explained. “So we know for the first half of 2018 our net revenue dollars per load were pretty close to our historical average and those really expanded throughout the second half of the year as cost started to moderate.”

Wiehoff went on to say that controlling and driving further efficiency would protect net revenue dollars per load. There are at least two ways to read that statement. Wiehoff could have been referring to a generally elevated pricing environment that will maintain absolute net dollars even if margins contract – although truckload rates are softening, carriers still have to cover the industry-average 12 percent wage increases of 2018, so there is a high floor.

C.H.’s CEO might have also been hinting at a productivity play, i.e., the company can grow net revenues even with flat margins if it maintains absolute net revenue dollars per load and every broker covers more loads per day.

Some of the comments made by Chief Operating Officer Robert Biesterfeld around CHRW’s technology later in the call suggest that he expects to lower the company’s cost to cover a load and increase the number of loads per broker.

“Automating transactions and direct load matching are certainly part of the reason why operating margin has expanded and why we believe the opportunity to continue to expand operating margin, but it’s really only part of the story,” Biesterfeld said in response to a question from Citi’s (NYSE: C) Chris Wetherbee.

“We’re also rolling out the tools that help us to accept the right freights based upon predictions of outcomes, more effectively manage exceptions, and we’re leveraging tech in new ways across all of our reporting segments that remove the unnecessary steps out of our operational processes,” Biesterfeld continued.

In a somewhat bearish (“Underweight”) reaction to CHRW’s results in an early morning Wednesday note, Morgan Stanley (NYSE: MS) analyst Ravi Shanker acknowledged that C.H. Robinson was improving the efficiency of its operation on cost and throughput per broker.

“Total net revenue was +13% y/y while personnel expenses were +9% y/y. This is the second quarter in a row in which the spread between net revenue growth and personnel expense growth was positive, and the biggest spread since 3Q15 (average headcount in the quarter was +1.4% y/y),” Shanker wrote.