Biesterfeld: C.H. Robinson has maintained consistent margins through multiple disruption cycles

C.H. Robinson (NASDAQ: CHRW) is not afraid of Amazon’s entrance into freight brokerage and welcomes the competition, incoming chief executive officer Bob Biesterfeld told Wall Street analysts on the company’s earnings call this morning.

After prepared remarks by Biesterfeld, John Wiehoff, Robinson’s outgoing CEO, and Scott Hagen, the company’s controller and interim chief financial officer, the executives answered questions from equities analysts on both secular and cyclical issues.

The first question fielded by Robert Houghton, vice president of investor relations, was asked by “several analysts.”

“Regarding the recent announcement by Amazon to enter the truck brokerage space, how does this impact your business in the short-term, and longer-term, how might the company react to a competitor willing to do business for no profit?”

Biesterfeld’s response was poised and measured. Robinson had known that Amazon was in or would be entering the space for some time.

“I would look at this as another step in what has been a rapid change in the competitive landscape over the last years,” Biesterfeld said. He went on to narrate the successive waves of technological disruption that have transformed the third-party logistics space since C.H. Robinson has been publicly traded. In the 1990s, Biesterfeld said, the bear case was that internet load boards would disintermediate brokers. In the 2000s, new tech-enabled entrants – Biesterfeld left those companies unnamed, but we understood him to refer to Echo and Coyote – were supposed to seize market share and compress broker margins. In the 2010s, a nearly unlimited supply of private equity capital fueled aggressive roll-up strategies and created a new class of leading brokerages.

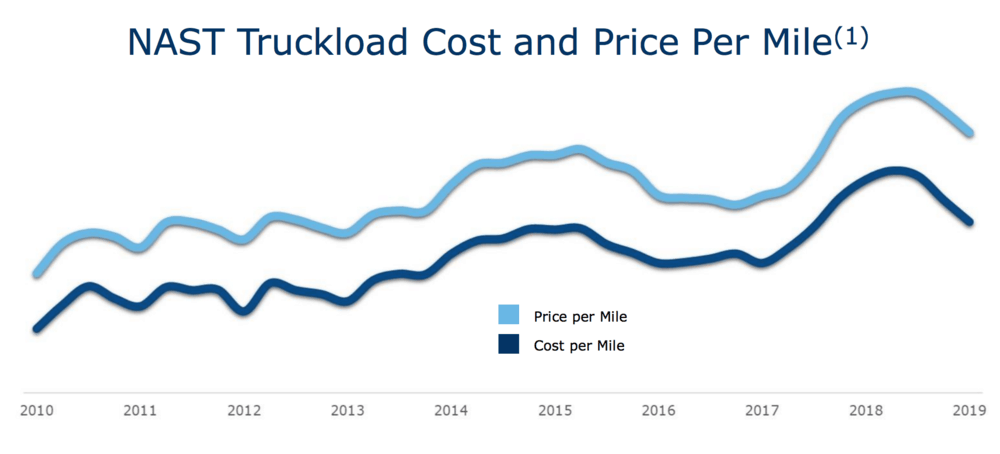

Throughout it all, Biesterfeld said, C.H. Robinson adapted, invested in technology, continued growing its revenue and maintained very consistent margins. The graph below, from CHRW’s earnings presentation, shows the stability of Robinson’s price-cost spread over the past 20 years:

Biesterfeld emphasized that Robinson spent about $1 billion on technology over the past 10 years and would spend another $1 billion on technology in the next four to five years.

Next, Ravi Shanker from Morgan Stanley and Cowen’s Jason Seidl asked Wiehoff to characterize the competitive environment and wanted to know if Robinson was running into tech-focused brokers that are more aggressive on price.

Wiehoff said that the competitive landscape for freight brokerage has been fragmented, highly competitive, with a high degree of churn – new entrants into the space and players leaving the industry – for decades. Robinson has watched new players come in with a variety of strategies, including leveraging pre-existing relationships and starting price wars to gain market share, but said that the recent development has been that tech startups are trying to scale faster and change the customer experience through the use of digital portals.

“We do see a change in the competitive landscape in terms of startup capital,” Wiehoff said, but reminded the analysts that the fundamentals of the industry were largely the same.

Jack Atkins at Stephens and Todd Fowler at KeyBanc asked about C.H. Robinson’s digital transformation.

Biesterfeld said that the biggest change in adoption has come in the small carrier community, which now sees the use of technology as a win instead of a burden. He added that about 75 percent of C.H. Robinson’s load tenders are automated, and about half of all of the shipments moving through its system are automated end-to-end. Those automated shipments make Robinson more efficient and profitable because they generate data that can be used to improved pricing and matching algorithms.

Later in the call, Robinson executives addressed questions about global trade and domestic freight cycles. Matt Young from Morningstar asked if CHRW expected margins to normalize. In the first quarter of 2019, Robinson’s transportation net revenue margins across all segments came in at 18.6 percent, the widest first quarter margin since 2010 except 2016’s 19.7 percent.

Biesterfeld said that he expected margins to moderate because “cost is always a leading indicator to price, and to take it a step further, the transactional market typically leads the contractual market.” Biesterfeld said that both price and cost should fall back down to trend line growth, which has averaged about 4 percent a year over the past decade.

Fowler also asked about C.H. Robinson’s attitude toward acquisitions in the current environment, which has seen rich multiples driven by private equity firms competing with strategics. Fowler was particularly interested in final-mile service providers.

“We really like our current approach to M&A,” Biesterfeld said. “We like founder-led businesses that are really healthy, that are a cultural fit, profitable and complement nicely our foundational services. Valuations are extremely high in the final-mile space, but we’re certainly active in looking.”

After the call, shares of C.H. Robinson opened at $78.19, about 2 percent lower than the previous close, but quickly regained ground and were trading slightly up by mid-afternoon.