For container lines, it just keeps getting better and better. Demand is hitting new highs with every passing quarter. For besieged cargo shippers struggling with overwhelmed supply chains, it just keeps getting worse and worse. Their question is: When will the COVID-induced demand surge finally peak, allowing shipping services to return to normal?

The answer from Maersk, the world’s largest container line operator, is: Definitely not in the first quarter of this year, maybe in the second quarter — but then again, we’ve never lived through a pandemic before, so maybe even later.

Record quarter, again

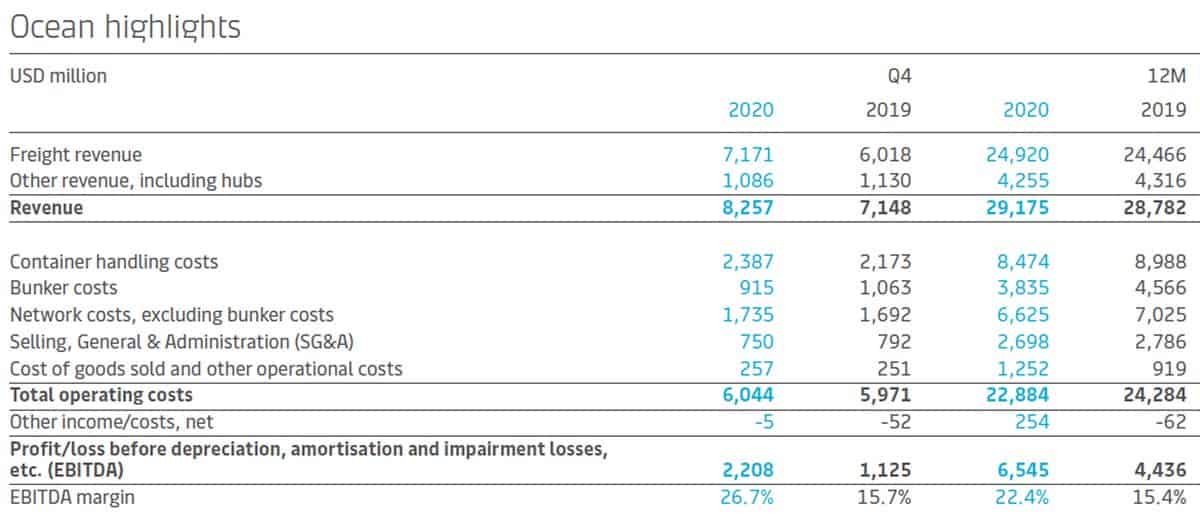

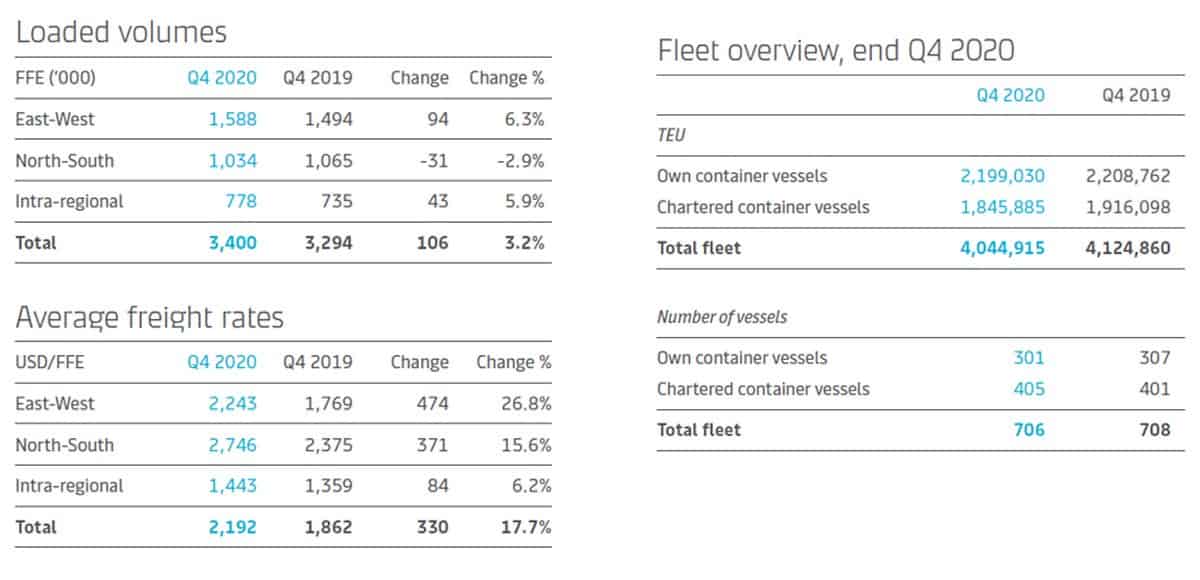

On Wednesday, Maersk reported ocean revenues of $8.26 billion for Q4 2020, up 15.5% compared to Q4 2019. Revenue growth was driven by a 3.2% increase in volume, but primarily, by a 17.7% spike in freight rates.

Ocean division earnings before interest, tax, depreciation and amortization (EBITDA) nearly doubled, coming in at $2.2 billion in Q4 2020, up 96% year-on-year. For the full year, ocean EBITDA rose 48%, to $6.5 billion. Company-wide EBITDA rose 44%, to $8.2 billion.

Maersk CEO Soren Skou said on the conference call with analysts, “In Q4, we delivered the best-ever quarterly earnings results in ocean. And in logistics. And in terminals. The tailwinds experienced in the fourth quarter have continued in the first quarter and we expect the first quarter of 2021 to have a result that is above our fourth-quarter results.

“We have everything deployed that we can deploy,” Skou said of current market conditions. “We are chartering more capacity right now to deal with some of the bottlenecks.”

He continued, “We are full. Spot rates are high. We expect to remain full past Chinese New Year, which is quite extraordinary. This year, the Chinese government and many companies in China are incentivizing employees to stay at work as opposed to traveling home. So, manufacturing in China is doing really well.”

Unusually wide guidance range

Maersk introduced initial guidance for 2021 EBITDA of $8.5 billion-$10.5 billion, which would mark year-on-year growth of 4-28%. The huge range from the low to high end — $2 billion — is due to an unusually high degree of uncertainty.

Skou said that Maersk has already finalized 40% of its 2021 contract business, with the remaining 60% to be signed by June. “We are quite pleased with our progress,” he reported. “We continue to be happy. The signal we want to give is: It’s not like the contract market is weakening.”

With Maersk’s business split roughly 50-50 between contract and spot, and with contract rates expected to rise substantially year-on-year, spot rates would have to fall significantly starting in Q2 and remain weak through the second half for Maersk to end up at the low end of its 2021 EBITDA guidance range.

On the other end of the spectrum, the high end of the guidance represents a scenario where spot rates do not abate — i.e., the worst-case scenario for cargo shippers. “That would basically mean for us to do four times what we did in the fourth quarter [of 2020],” said Skou.

When will spot rates fall?

According to Maersk CFO Patrick Jany, the dynamics driving freight rates higher should “start easing in Q2 2021” and based “on the rates and volumes we have seen so far … we expect things to normalize” after the first quarter. The caveat, acknowledged Jany, is that “it’s really hard to predict demand patterns for 2021.”

Skou explained, “Whether [goods] demand stays strong once the world is reopening or consumers will spend all their money on services remains to be seen.

“Consumer demand has been very strong since August of last year as consumers have been spending some of the money they could not spend on travel, restaurants and events on products and we of course have benefited from that.

“We are also benefiting from inventory restocking. Many, many retail companies really scaled down their purchases of goods in the second quarter of last year and suddenly found out they had too few goods on their shelves and they lost sales. Retail restocking combined with strong demand from the consumer has been driving this massive growth in demand. The numbers in the U.S. are really extraordinary. ”

Skou concluded, “At some point retailers will have restocked. Then we are back to the basic demand of the consumer to drive our demand. And with that, who knows what happens when you get out of a pandemic? I don’t think any of us alive have been in this situation before.” Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON CONTAINERS: Importers face massive hike in ocean contract costs: see story here. Trans-Pacific trade crashes into max-capacity ceiling: see story here. COVID outbreak could cripple California container ports: see story here. Inside California’s colossal container-ship traffic jam: see story here.

Maersk Q4 2020 key performance indicators: