The Port of Los Angeles, the highest-volume container gateway in America, is diverging from the nationwide trend. U.S. container imports remain close to record highs, yet imports to LA are falling double digits.

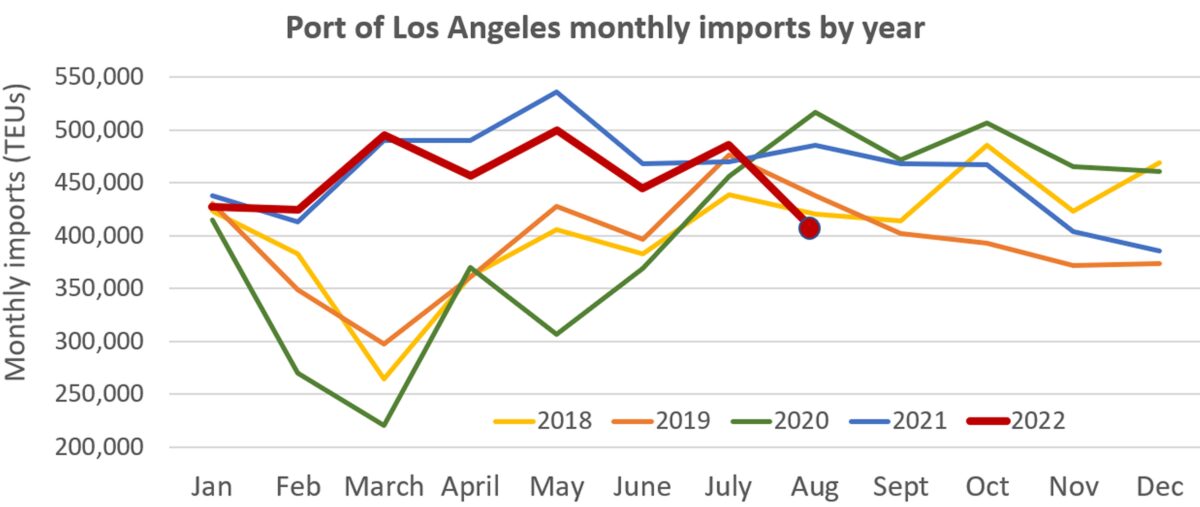

On Thursday, the Port of Los Angeles reported total throughput of 805,672 twenty-foot equivalent units in August, down 15.5% year on year (y/y). Imports came in at 404,313 TEUs, exports at 100,484 TEUs and empties at 300,875 TEUs.

Imports were down big, sinking 16.8% y/y and 16.7% compared to July.

It was the lowest import total in Los Angeles for any month since December, when volumes were suppressed by extreme landside congestion.

It was also the lowest import total in LA for the month of August since 2014, eight years ago, back when Barack Obama was president and Pharrell Williams’ “Happy” topped the charts.

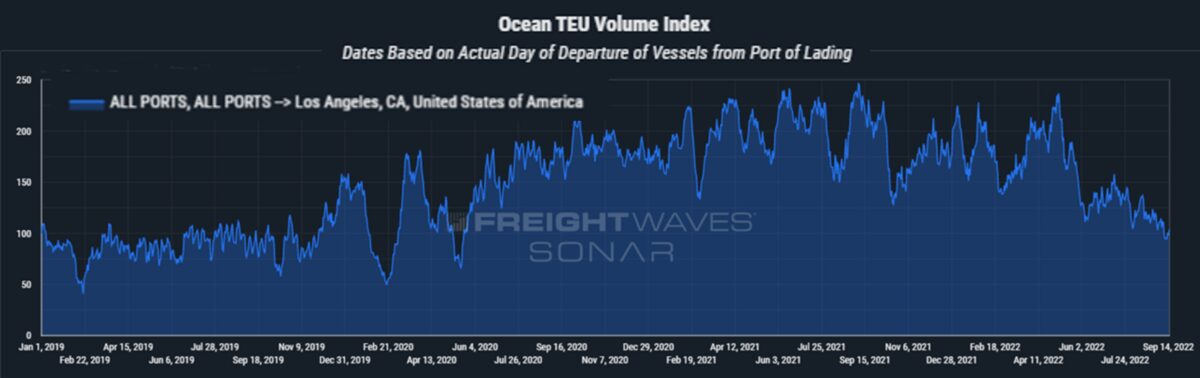

But last month’s import plunge in Los Angeles is not indicative of a countrywide trend. According to data from Descartes, U.S. imports in August were essentially flat compared to July. The nationwide import total was up 18% versus August 2019, pre-COVID. Los Angeles’ imports last month were down 8% versus August 2019.

Los Angeles’ performance stands in stark contrast to the blowout numbers just announced by the Port of Savannah in Georgia. Savannah handled 290,915 TEUs of loaded imports in August, by far the highest tally in the port’s history.

Savannah’s August imports were up 15.6% from July, 14.7% from the previous record month in May, 20% y/y — and 34% versus August 2019, pre-COVID.

Demand drivers of decline

During a news conference Thursday, Port of Los Angeles Executive Director Gene Seroka pointed to multiple reasons for the drop.

“Some of the cargo that usually arrives in August for our fall and winter seasons is already here,” Seroka said. “Cargo owners who expected longer lead times shipped earlier in order to guarantee delivery schedules. This just-in-case strategy versus the traditional just-in-time approach has been widespread in the market.”

Meanwhile, with 8.3% inflation, Seroka said “consumers are naturally getting a bit anxious, as are retailers. We’re starting to see canceled production orders out of Asia.”

Competitive drivers of decline

Another reason for weaker August numbers, as highlighted by the booming stats out of Savannah: Imports have shifted to the East and Gulf coasts at the expense of West Coast ports.

“Some shippers diverted cargos to East and Gulf Coast ports in order to avoid port congestion and as a possible hedge against West Coast labor contract negotiations,” Seroka said. “Consequently, those ports have substantial backlogs, while here in Los Angeles, we have very little congestion.”

Yet another driver of August’s drop: local competition from Long Beach, the port next door. A substantial volume of cargo shifted to Long Beach from Los Angeles. Long Beach imported 384,530 TEUs of cargo in August, up 2.2% from July.

Asked by American Shipper about the cause of the local shift, Seroka said, “There are some discussions on the ground between union leadership and the folks over at APMT [APM Terminals] about health and safety measures around the automated area.”

This led to a shift of around 40,000 TEUs from Los Angeles to Long Beach in August, he disclosed. (This equates to around half of LA’s sequential import drop in August versus July.) Seroka said that shift to Long Beach could be even higher this month: 60,000-80,000 TEUs.

He maintained that the shift will be temporary and the situation will “get back to normalcy between Los Angeles and Long Beach very soon.”

More LA volume weakness ahead

Seroka expects the volume pullback to continue in the months ahead.

“The bottom line is that we’re projecting lighter numbers in September and for the balance of the year,” he said. “But to keep things in perspective, even with this projected softer volume in the back half of the year, the Port of Los Angeles is headed toward the second busiest year in our history.”

Click for more articles by Greg Miller

Related articles:

- US imports keep chugging along, still up double digits vs. pre-COVID

- Only 8 ships waiting off Southern California — but 41 off Savannah

- Despite billions in canceled orders, container imports stay near peak

- Trans-Pacific rates still sinking. Trans-Atlantic rates still peaking

- Turning point? Port of LA boss sees imports ‘easing’ lower in August