Niche ocean carrier Zim has been one of the great success stories of the container shipping boom. It expanded its fleet faster than larger rivals off a smaller base, focused only on the highest-paying lanes — like the trans-Pacific — and kept spot exposure high at 50%. As earnings skyrocketed, it became the largest U.S.-listed shipping company by market cap.

Freight rates for the second quarter of 2022 disclosed by Zim (NYSE: ZIM) on Wednesday show that it’s still outperforming larger carriers on rates. Yet the numbers reveal a rising risk: Zim is more exposed to weakening spot rates than liner giants like Maersk and Hapag-Lloyd. And those spot rates are continuing to fall.

Zim reported net income of $1.3 billion for Q2 2022, up 50% from the year before but down 22% from net income of $1.7 billion Q1 2022. Adjusted earnings per share of $11.07 fell short of the consensus forecast for $13.37. Zim’s stock price decline 6% Wednesday despite a dividend boost.

Adjusted earnings before interest, taxes, depreciation and amortization of $2.1 billion came in 15% below analyst consensus and down 17% from the first quarter.

Hapag-Lloyd raised its full-year guidance on July 28. Maersk followed suit on Aug. 2. On Wednesday, Zim kept its guidance unchanged, for full-year EBITDA of $7.8 billion-$8.2 billion.

The good news: This is up 18-24% from Zim’s record year of 2021. The bad news: It implies Zim’s second-half EBITDA will decline 32-36% versus the first half.

Spot rate exposure

In contrast to Zim, Maersk expects its second-half EBITDA to fall 9% versus the first half. Hapag-Lloyd anticipates a drop of 3-21%.

Ocean carrier earnings are highly leveraged to average freight rates. Maersk’s spot exposure is down to 29%, while Hapag-Lloyd boasts a much more diversified service footprint than Zim.

Despite spot rates falling double digits between the first and second quarters, Maersk’s average rate (including both spot and contract) actually increased 9.4% to $2,492 per twenty-foot equivalent unit in Q2 2022. Hapag-Lloyd’s average rate increased 5.8%, to $2,935 per TEU.

Not so with Zim. Its average Q2 2022 rate was $3,596 per TEU, much higher than Maersk’s or Hapag-Lloyd’s, but unlike those carriers, Zim’s second-quarter average decreased 6.5% from the first quarter.

Zim had previously stated that rates on its annual trans-Pacific contracts that began in Q2 had more than doubled year on year. The fact that its average rate still fell compared to Q1, even with the higher contract rates included, underscores Zim’s exposure to trans-Pacific spot rates.

Spot rates continue to decline

Indexes measuring Asia-U.S. spot rates have shown a continued decline throughout this year.

The Freightos Baltic Daily Index (FBX) assessment for the China-West Coast route is down 57% year to date. The FBX China-East Coast assessment is down 44%.

The FBX incorporates the effect of premium surcharges in its calculations. This has resulted in a steeper decline than shown by other indexes that don’t include premiums in their assessments.

Zim CFO Xavier Destriau said during the conference call the surcharges “had been a significant feature toward the end of 2021 and during the first quarter of 2022, [but] these have clearly faded over the [second] quarter. And we are not assuming we will generate significant additional surcharges going forward.”

On spot rate trends, Zim CEO Eli Glickman said, “Over the past several weeks, we’ve seen a decline in freight rates, particularly in the trans-Pacific. We recognize that the trades may have peaked, however, rates remain elevated and therefore very profitable.”

Destriau predicted that spot rates will continue to gradually decrease, with third-quarter averages below the second quarter, and fourth-quarter averages below the third.

Asked why trans-Pacific spot rates are falling despite high U.S. port congestion — particularly on the East and Gulf coasts — Destriau replied, “Demand is still strong, but it’s not as strong as it used to be. Let’s be clear: There are signs of weakening. That may be … why rates are starting to normalize.”

Zim’s fleet capacity and throughput

Zim’s focus on spot upside in targeted trade lanes was one reason its earnings rose so fast during the COVID era. Another reason, particularly in the earlier stages of the pandemic demand surge, was its decision to rapidly grow its throughput by adding more ships to its fleet.

Its fleet has risen from 96 vessels at the time of its January 2021 initial public offering to 149 currently. Almost all of the additions are from the charter market, with Zim paying premium rates for multiyear leases. By agreeing to high-priced charters, it increased its upside exposure to the record-high freight market — at the expense of downside commitments to pay high charter rates in years ahead when freight rates will almost certainly be lower.

By paying steep charter prices to add more ships, Zim was able to grow its fleet, and thus its quarterly throughput, faster than larger liners that kept their fleet size steady off much larger bases.

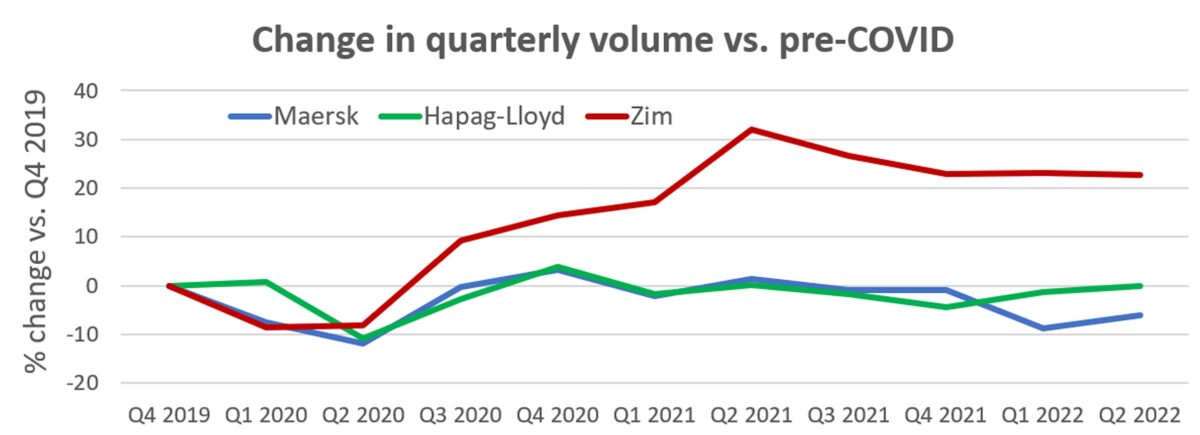

Zim’s Q2 2022 throughput was up 23% since Q4 2019, the last quarter before the pandemic. In contrast, Hapag-Lloyd’s quarterly throughput was down 1% over the same timeframe, and Maersk’s was 8% lower.

Zim’s quarterly throughput peaked a year ago. It handled 856,00 TEUs in Q2 2022, down 7% from Q2 2021. The charter market has been largely sold out, providing less opportunities to grow the fleet with leased tonnage, while port congestion continues to limit throughput.

In other words, an earlier driver of Zim’s earnings boom — fleet growth — had already stalled and now another driver — rates — is headed down.

Zim’s future charter exposure

Asked about the company’s ability to unwind charter exposure should there be a recession, Destriau pointed out that Zim has 28 charters come up for renewal in 2023 and 34 in 2024. Meanwhile, it has 46 long-term-chartered newbuildings due for delivery in 2023-24.

Destriau maintained that this mix gives Zim flexibility to manage its fleet size based on market conditions.

If freight rates are strong enough, it will renew expiring charters and add new service strings as newbuilds are delivered. “But if the global economy enters a prolonged recession and demand significantly drops, then obviously, we would not renew those charters.”

Click for more articles by Greg Miller

Related articles:

- Five years on Wall Street: Shipping’s exits, arrivals, whales and minnows

- Hapag-Lloyd CEO: US consumer still ‘holding up,’ demand not collapsing

- No precipitous plunge in container shipping rates, just ‘orderly’ decline

- Maersk: Shipping profits stay ‘super strong’ as supply chain pain persists

- Record container ship traffic jam as backlog continues to build

- Container shipping boom continues: Hapag-Lloyd hikes outlook (again)

- Container shipping spot rates still falling: What will be the new normal?

- Asia-US container shipping rates are flashing two bearish signals