If you want to make money in container shipping, better to lease out large ships to the liner companies than to be a liner company operating those vessels, paying the fuel bills and catering to cargo customers.

Container-ship lessor Costamare (NYSE: CMRE) is a case in point. On the quarterly analyst call, Gregory Zikos, Costamare’s chief financial officer, reported that “larger vessels have enjoyed a rising charter market and today there’s a limited supply. Charter rates for larger vessels have been rising faster than those of smaller vessels.”

Costamare cited data from Clarksons showing that one-year time-charter rates have reached $30,000 a day for container ships with capacity to carry 8,500 twenty-foot-equivalent units (TEU).

According to Zikos, there is now more interest in three- to five-year charters beyond the standard one-year term. “The gap [in pricing] between a one-year and three- to five-year charter is not as wide as it has been in the past,” he said, pointing out that “some years ago, there was no three- to five-year market for larger vessels at all, and now we are seeing these deals.”

When liner companies agree to multi-year charters at pricing that’s at less of a discount to one-year rates than before, it implies that they’re more concerned about future rate inflation and are more inclined to lock in capacity now to protect themselves.

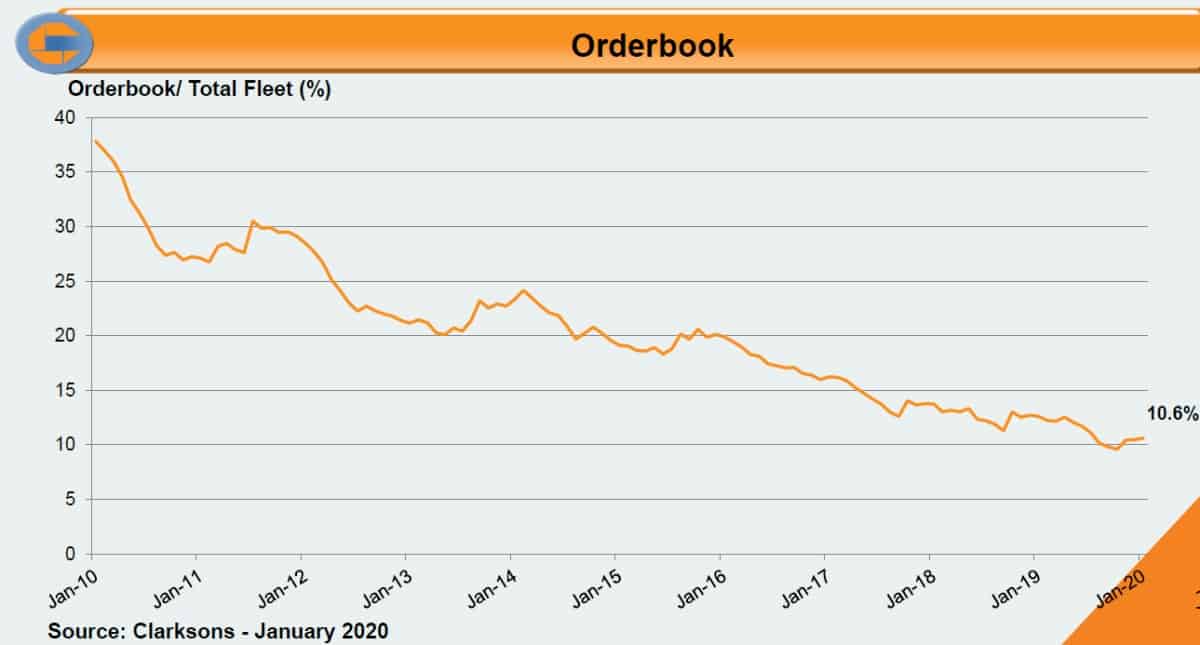

One big reason for that inflation concern is the orderbook. “There are very few deliveries scheduled for 2022 onwards,” noted Zikos. According to Clarksons data cited by Costamare, orders now stand at just 10.6% of the total fleet – historically low and down sharply from a 37% orders-to-fleet ratio a decade ago.

Orders for container-ship newbuildings are being stymied by concerns over future carbon-emissions regulations and uncertainty over what ship design and fuel type will meet those rules.

As newbuilding deliveries dwindle, container lines will have to pay more to charter-in tonnage from ship lessors like Costamare, assuming global demand for transoceanic container shipments doesn’t slump due to a “black swan” event such as the coronavirus or a global financial collapse.

More cost pressures

Lease pricing is a substantial cost, as some liners charter-in around half their fleets. Another major cost center for liners is fuel. Due to the IMO 2020 rule, vessels without exhaust-gas scrubbers have switched from cheaper 3.5% sulfur heavy fuel oil (HFO) to more expensive 0.5% sulfur fuel known as very low-sulfur fuel oil (VLSFO).

An 8,000-TEU non-scrubber-fitted container ship consuming 100 tons of fuel per day was spending $42,800 per day burning HFO a year ago and is spending $62,800 per day burning VLSFO currently, a cost increase of $20,000 a day or 47% (based on global marine-fuel price estimates of Ship & Bunker). The two-year price increase is 75%.

Higher costs for both ship rentals and fuel come at a time when freight income remains lackluster, meaning that liners are generally not able to pass along costs to customers. The historical curve of the Drewry Composite Index (SONAR: WCI.GLOBCOMP), which provides a weekly measure of the global spot cost to ship a forty-foot equivalent unit, reveals that pricing is now back to levels seen in mid-2011, eight-and-a-half years ago.

Scrubber installations

Given that freight rates are unlikely to surge, liners will likely sign more long-term charters to protect against ship-lease inflation and install more scrubbers to reduce fuel costs.

Clarksons estimates that 56% of container ships in the 15,000-TEU-plus segment are scheduled to have scrubbers installed – it is the single most scrubber-focused segment in all of shipping (excluding passenger vessels). Clarksons estimates that 47% of container vessels in the 12,000- to 14,999-TEU category are set for scrubber installations.

Zikos is in an ideal position to gauge liner sentiment toward additional installations beyond previously agreed contracts. His company installs such units at the request of charterers. It already has five scrubber-fitted ships on charter to Maersk, five on charter to MSC and five newbuildings with 10-year charters to Yang Ming scheduled for installations.

“We are in discussions with liners regarding the installation of scrubbers as part of a package together with a charter agreement,” said Zikos on the analyst call, confirming, “There is a lot of interest from the liner companies regarding new scrubber installations today.” He maintained that it’s still possible to get a scrubber ordered and installed by the end of 2020.

A further cost headache for the liner companies is that scrubber installations save on long-term fuel costs but increase leasing costs in the near term. When vessels are removed from service for a scrubber installation, that capacity needs to be replaced to maintain service routes. Costamare cited estimates that 4.6% of the container fleet is currently out of service for scrubber refits.

The more ships are off hire and in the shipyards, the more liners have to pay to replace them (because the supply-demand balance moves in favor of the ship lessors). This dynamic has been cited as one of the reasons why charter rates were particularly high in 2019 for larger vessels, which are more prone to have scrubbers installed than smaller container ships.

Quarterly results

Costamare reported net income of $35.9 million in the fourth quarter of 2019, up 82% from the fourth quarter of 2018. Adjusted earnings in the most recent period came in at $0.32 per share, topping the consensus forecast for $0.28 per share.

Charter income rose 17% in the fourth quarter versus the year before and higher gains appear likely this year. The company has 18 ships with capacity of 6,600 TEU or more coming off hire in the next 12 months. Given the strong demand for these ship sizes, Costamare should be able to recharter these vessels at higher rates. More FreightWaves/American Shipper articles by Greg Miller