At FreightWaves we’ve been scouring economic data for any sign that the Trump administration’s recent tariffs imposed on Canadian, European, and Chinese goods are actually harming the economy. So far, so good: U.S. industrial production, retail sales, and demand for transportation are all still at robust levels. There are signals in one mode, though, suggesting that freight carriers should prepare themselves for a significant trade slowdown this fall.

All of the major container line alliances are reducing capacity on their transpacific services from Asia to the North America over the next few months. The OCEAN Alliance, made up of China COSCO, Evergreen, CMA CGM, and OOCL (just acquired by COSCO), ended one transpacific service with a weekly capacity of just over 10,000 TEUs that called on Long Beach and Seattle. OOCL replaced 6,900 TEU vessels on another transpacific service that called on Seattle with 5,800 TEU ships, representing a capacity cut of 16%.

“The move, which comes following mounting problems faced by the Sino/US trade war, and consequential trade reshuffles that have built up due to the international conflict, is now spreading to concern lines such as OOCL, mainly due to the structural connections the company now has with COSCO,” wrote Paul Richardson, a container trade analyst.

THE Alliance, which includes Hapag-Lloyd, Ocean Network Express, and YangMing, announced that it would end its PS8 transpacific service, which had a 6,590 TEU weekly capacity and called on Tacoma and Long Beach. THE Alliance also cut its PS4 service, calling on Los Angeles and Long Beach, from 8,330 TEUs to 6,580 TEUs weekly.

Meanwhile, the 2M alliance, Maersk and MSC, signed an agreement with Israeli line ZIM to consolidate and reduce their Asia-East Coast services. Seven loops are being combined into five loops, beginning in September; four operated by 2M and one by ZIM. Maritime industry observers were surprised to see the staunchly independent, alliance-adverse ZIM combine services with 2M—it’s being interpreted as a move to manage the risk of a China-USA trade war.

In a statement, Eli Glickman, President and CEO of ZIM, said: “We are pleased to enter into this strategic operational cooperation with the 2M Alliance. The agreement will significantly improve our services on this important trade, where we remain a major player as part of our strategy. It is a vote of confidence by the two largest players in the industry, acknowledging ZIM’s capabilities, reliability and strength. Furthermore, it will enable ZIM to achieve operational efficiencies and ensure our ability to maintain a leading position on the trade.

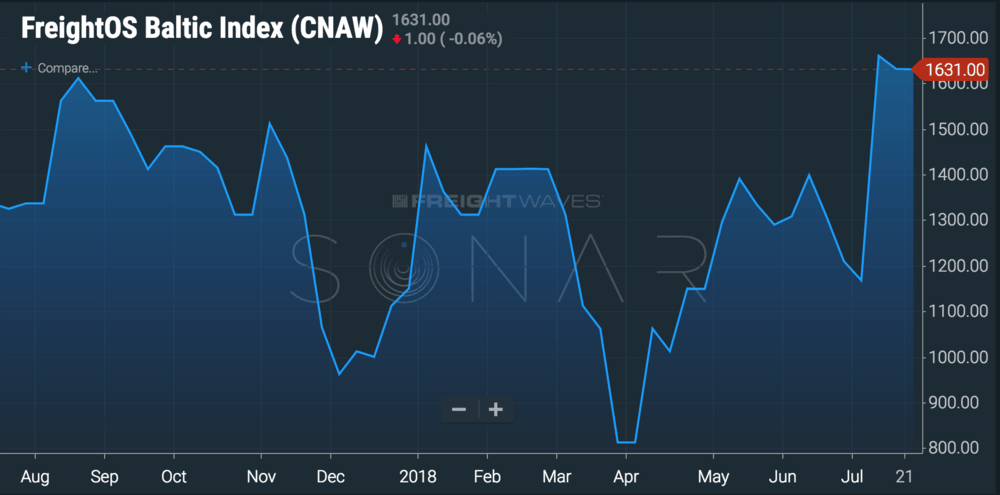

Container spot prices from China to the West Coast (SONAR code: FBX.CNAW) have remained elevated for the third straight week as shippers rush to lock up capacity before more tariffs and capacity cuts are announced. Last week a container from China to the West Coast cost $1,631.

We’ve compiled a list of which American ports are most exposed to a slowdown in China trade, based on data from the Descartes Datamyne port report. Fully 56% of Los Angeles’ imported TEUs originate in China, but for Long Beach, the proportion is 64%. On the East Coast, Savannah is the most heavily exposed, with 45% of its inbound TEUs coming from China. The trucking and intermodal freight market coming out of Seattle may get even more bleak after the container lines’ changes to their services because 61% of its port volume comes from China.

A significant reduction in the China-US container trade poses downside risk to Union Pacific (NYSE: UNP), Berkshire Hathaway-owned BNSF (NYSE: BRK.A), and JB Hunt (NASDAQ: JBHT) intermodal volumes. According to Susquehanna’s most recent rail report, intermodal accounted for 44.2% of Union Pacific’s carloadings in Week 28 and 51.2% of BNSF’s. Intermodal is clearly a large source of revenue for the railroads (the railroad with the least exposure, Canadian Pacific, still pulls intermodal for 37.3% of its carloadings), and if the railroads are forced to replace that freight with another source, we anticipate price reductions intended to compete directly with trucking.

Ultimately, these anticipatory moves by the container lines have not affected American freight markets yet—if anything, record June container volumes on the West Coast have kept truckers busy. But the lines’ capacity cuts are the first signal—albeit an upstream signal—that the tariffs and protectionist rhetoric tossed back and forth between Presidents Trump and Xi will have serious economic consequences.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.