Container lines have now cancelled 212 sailings over the next three months in response to the coronavirus pandemic, according to Copenhagen-based Sea-Intelligence. The tally has more than quadrupled from 45 “blank” (cancelled) sailings just one week ago.

According to Sea-Intelligence CEO Alan Murphy, the liners’ drastic moves to slash services began as a reaction to shippers cancelling bookings due to social distancing and quarantines, but have morphed into a rate-protection strategy.

“It is clear that the primary purpose of the capacity reductions [is] to prevent a catastrophic drop in rate levels,” Murphy affirmed on Monday. “The cost savings are also important, as they too are measured in the billions, but they pale in comparison to the impact declining rate levels will have.”

Murphy warned that the virus-driven financial impact on carriers “could be profound,” but the magnitude depends on carrier pricing discipline.

In his best-case scenario, in which volume decline 10% and rates hold relatively firm, carriers would lose an aggregate of $800 million. Under his worst-case scenario, in which both volumes and rates decline to the same degree they did in 2009, carriers would collectively lose $23 billion this year.

Carrier survival strategy

Lars Jensen, CEO of SeaIntelligence Consulting (a different company than Sea-Intelligence), said in an online post, “The potential loss [in the worst-case scenario] is of such a staggering magnitude that it is clear that carriers are highly likely to blank far more sailings [if] we begin to see rates slide too far.”

Asked whether such losses are threats to the solvency of any of the liner companies, he replied, “The worst case of $23 billion would be potentially life-threatening for everyone [but] it is not the size of the losses that is the main problem right now; rather, cash flow is the key aspect.

“Carriers’ survivability in the coming months hinges on the depth of their current liquid reserves, their ability to attract additional liquid reserves [and the extent they are] able to postpone larger payments and potentially refinance debts.”

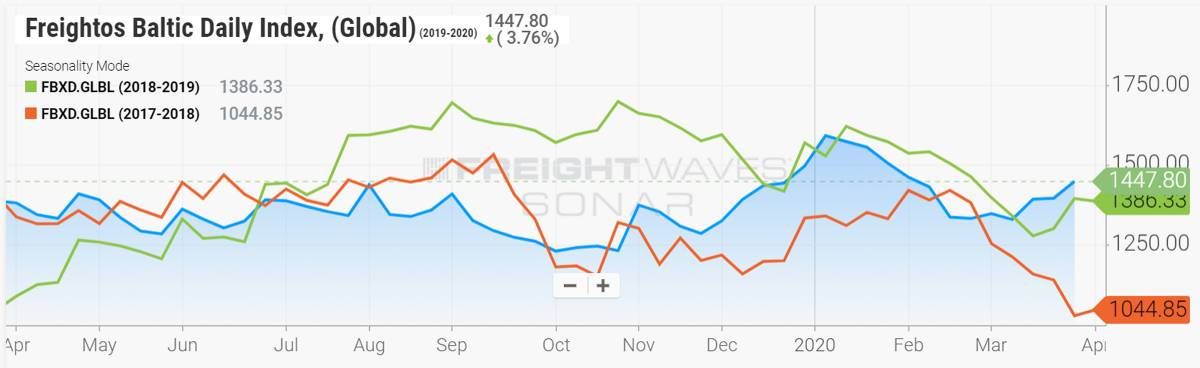

The good news for liners is that so far, they have been able to keep rates from falling. The Maersk rate estimator is essentially flat week-on-week and month-on-month. The Freightos Baltic Global Daily Index (SONAR: FBXD.GLBL), which amalgamates pricing per forty-foot equivalent unit on all lanes, is actually up versus the prior two years.

According to Larsen, “They have indeed held a good price discipline thus far, which is why, for now, we should as a baseline expect them to hold the line through aggressive capacity cuts.”

Fallout for cargo shippers

Escalating cancellations of sailings is a major negative for U.S. cargo shippers. Bookings made on ships with cancelled sailings will be delayed. Furthermore, widespread blank sailings have a knock-on effect that reduces the service reliability of sailings that haven’t been cancelled.

According to Nerijus Poskus, global head of ocean freight at Flexport, “Blank sailings could make procuring space and equipment more challenging, depending on regional demand. Shippers will have to find more options if they are importing.

“While shocking, the move [by container lines] is expected,” he said, pointing to the surge in booking cancellations by consignees.

Poskus also noted that this could affect the timing of annual contracts between carriers and shippers.

“All of this is happening in the middle of the Trans-Pacific contract season, for agreements that usually run from May 1 through April 30 of the following year,” he said. “Shippers are not sure if they should be locking in contracts now, later, or relying on a volatile spot market.” Click for more FreightWaves/American Shipper articles by Greg Miller