The spotlight is squarely on the avalanche of containerized imports at America’s largest gateway ports: Los Angeles and Long Beach. But it’s not just California. Volumes are also surging at Gulf Coast and East Coast ports.

And it’s not just the U.S. “Chinese ports are completely filled with export cargo as carriers cannot cope with high cargo demand,” reported Alphaliner. In Europe, “vessels are regularly arriving one to two weeks after their reserved berthing window.”

Analysts attribute this unexpected spike to consumers using money to buy goods that they can’t spend on services due to COVID restrictions. Counterintuitively, the coronavirus pandemic has — at least temporarily — has precipitated a box-port boom.

The problem for an increasing number of ports is that this is too much of a good thing. On Wednesday, MarineTraffic AIS (vessel positioning) data showed over 20 container ships waiting in San Pedro Bay offshore of Los Angeles and Long Beach. That’s the same number of ships at anchorage as last week.

Steepest upswing in 10 years

Former Trailer Bridge CEO John McCown compiles and analyzes container imports to the top 10 U.S. ports in The McCown Report. He uses both official port data and customs data. The numbers for November are “extraordinary,” he said.

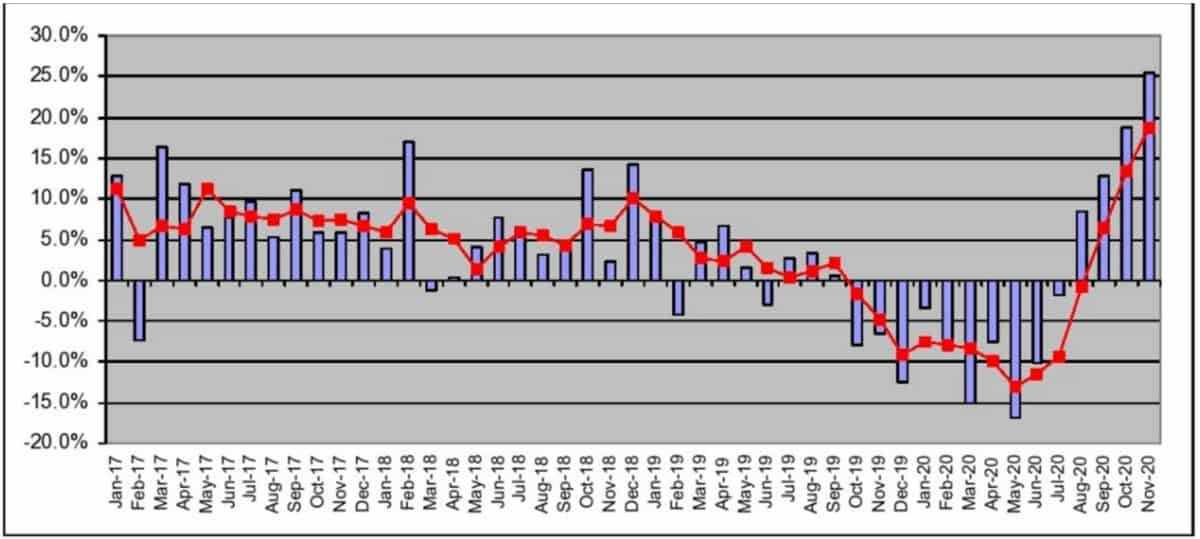

Total inbound loaded twenty-foot equivalent units (TEUs) for the top 10 ports surged 25.5% year-on-year in November. That topped the 18.7% rise in October and the 12.9% gain in September.

Over the past three months, U.S. port imports are up 18.7% year-on-year. “The three-month trend line figure is the highest it has been in at least 10 years,” said McCown.

That three-month trend had sunk to -13.1% in June. Then it turned around, breaking even by August and shooting upward into positive territory ever since.

McCown’s stats mirror data on the seven-day trailing average of U.S. maritime import customs filings on FreightWaves’ SONAR platform (SONAR: CSTM.USA). This dataset shows November’s outperformance holding firm this month, with filings up 24% year-on-year as of Tuesday.

Boom spreading to East, Gulf coasts

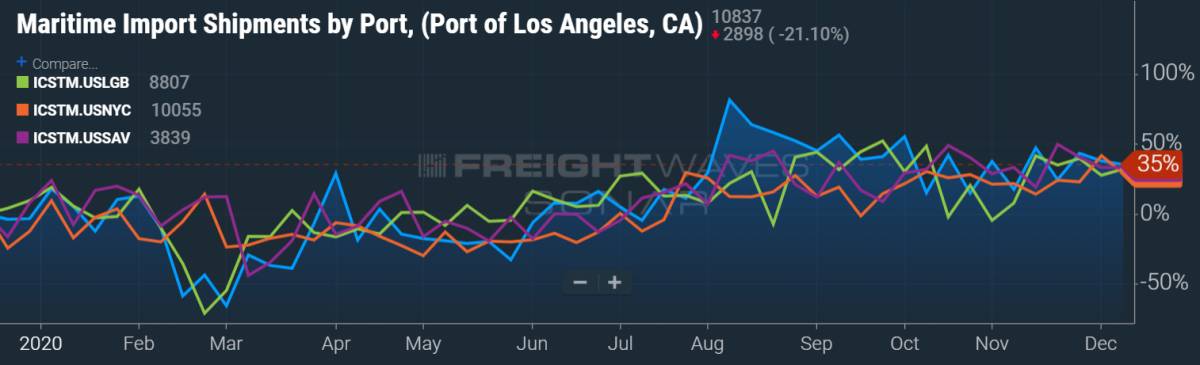

On the West Coast, both Los Angeles and Long Beach reported big numbers for November. Imports to Los Angeles rose 25% year-on-year, with Long Beach up 30.5%.

But importers are also moving outsized volumes to the ports on the other coasts.

On Wednesday, the Port of Houston reported a record November. “Our fourth quarter is shaping up to be the best in our history,” commented Port of Houston Executive Director Roger Guenther. According to McCown, Houston’s loaded import container volumes in November increased 20.7% year-on-year.

On the East Coast, McCown puts the year-on-year gains for last month at 29.5% in New York/New Jersey and 34.9% in Savannah, Georgia. Of America’s top 10 ports, Savannah rose the most last month, even more so than Los Angeles or Long Beach.

McCown calculated that East and Gulf Coast ports in the top 10 were up 18.6% over the past three months versus the same period in 2019. That’s essentially the same as West Coast ports, which were up 19%.

This pattern is confirmed by SONAR data on maritime import customs filings at Los Angeles, Long Beach, New York/New Jersey and Savannah. The trend lines in December for all four ports are converging.

Different decisions by different consignees

Which volumes are going to the West Coast versus the East and Gulf coasts? It depends upon the cargo shipper.

SONAR collects data on imported TEUs by top consignees. As of Wednesday, 86% of imported TEUs with Amazon (NYSE: AMZN) listed as consignee went to the West Coast over the past 30 days. Of the total, 79% went to Los Angeles/Long Beach.

In stark contrast, only 21% of TEUs with Walmart (NYSE: WMT) listed as consignee went to West Coast ports. The main gateways for Walmart were Savannah, Houston and Norfolk, Virginia. Together, these three ports accounted for 71% of Walmart consignee TEUs over the past month.

Neopanamax canal transits rise

As previously reported by American Shipper, the Panama Canal has experienced congestion since mid-October. Congestion has been fueled by high exports of U.S. liquefied natural gas (LNG) and liquefied petroleum gas (LPG) to Asia coinciding with heavy container volumes from Asia to the U.S.

Delays have struck ships without reservations, i.e., LPG and LNG carriers, not container ships with reservations.

Liners serving the Asia-U.S. trade via the Panama Canal generally use larger vessels transiting the newer Neopanamax locks. In October and November, during the period of reported congestion, Panama Canal Authority (ACP) statistics show a total of 262 container-ship transits via the Neopanamax locks (in both directions).

This is a 10% increase from container-ship transits through the Neopanamax locks during the same two months last year — confirming that despite canal congestion, container cargo bound for the U.S. has not only kept flowing, but grown. Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON CONTAINERS: Liner capacity control and the future of container shipping: see story here. Q&A: Flexport on 2021, container crunch and liner pricing coup: see story here. The mystery of the frozen trans-Pacific spot rates: see story here. COVID lockdown sequel threatens container shipping demand: see story here. Containers are the ‘new gold’ amid ‘black swan’ box squeeze: see story here. Container rates are on fire. How can you invest in that? see story here.