Listed container-ship owners and operators won’t report final Q1 results for another month, but three early disclosures give a taste of what’s to come. The signals are flashing bright green.

Taiwan-listed Evergreen just posted record-breaking monthly operating revenues for March, while Oslo, Norway-listed MPC Containers revised its outlook upward and Hong Kong-listed COSCO Shipping announced preliminary results that shattered analyst expectations.

The first quarter is shaping up to be much better than Q4 2020. For most container-shipping companies, it could be the best quarter in their history — at least, until the second quarter.

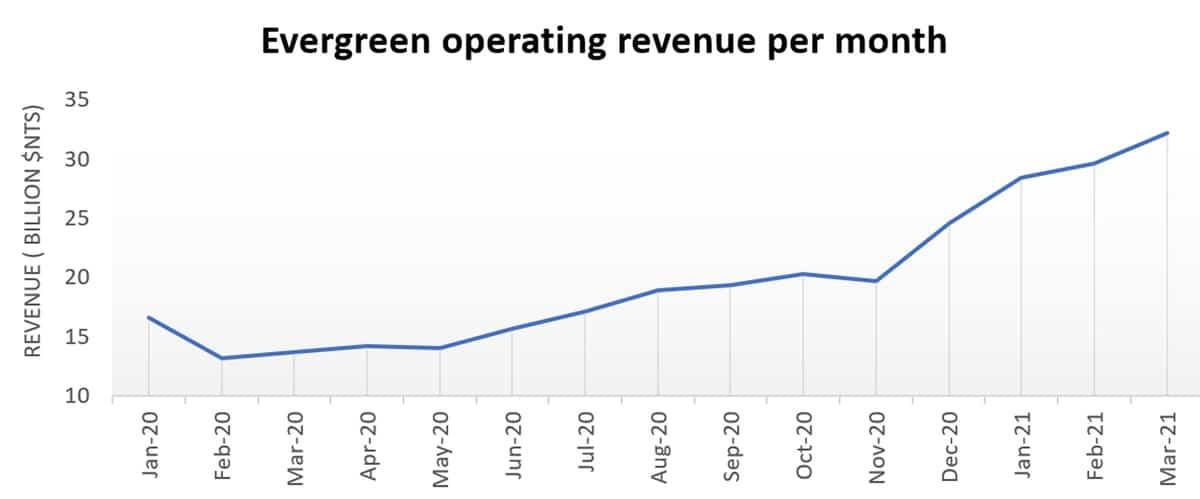

Evergreen’s Q1 revenues jump

As the world fixated on the plight of the Ever Given in the Suez Canal, the liner company that operates the ship, Evergreen Marine Corp, was wrapping up the best quarter, revenue-wise, in its history.

Evergreen reported 32.17 billion New Taiwan dollars (NT$) in operating revenue for the month of March, up 135% year-on-year and up 40% versus Q4 2020. Revenues for the first quarter totaled NT$90.24 billion, the equivalent of $3.17 billion and just over double Q1 2020 revenues.

Fearnleys Securities noted Monday that Evergreen is “a close peer to ZIM [NYSE: ZIM] due to high trans-Pacific exposure.” Pointing to Evergreen’s Q1 revenue jump, it said “similar arithmetic” should apply to ZIM.

Consequently, Fearnleys believes ZIM’s Q1 2021 revenues will be $1.8 billion-$2 billion, with minimum earnings before interest, taxes, depreciation and amortization (EBITDA) of $800 million. “In short, ZIM generates 50%-plus of FY 2021 guidance in one quarter.” Furthermore, Fearnleys believes ZIM’s Q2 results “will match if not exceed Q1.”

MPC: Estimated EBITDA up eightfold

MPC Containers (OSLO: MPCC) leases out a fleet of 60 smaller box vessels, most with capacities in the range of 1,300-2,800 twenty-foot equivalent units (TEUs).

Back on Feb. 27, it forecast FY 2021 revenues of $200 million-$240 million and EBITDA of $90 million-$120 million. On Monday, it upped its guidance to revenues of $230 million-$260 million and EBITDA of $120 million-$140 million.

The midpoint of the ranges increased by 11% and 24%, respectively. The new revenue midpoint is 43% above FY 2020 revenue. The new EBITDA midpoint is eight times FY 2020’s EBITDA.

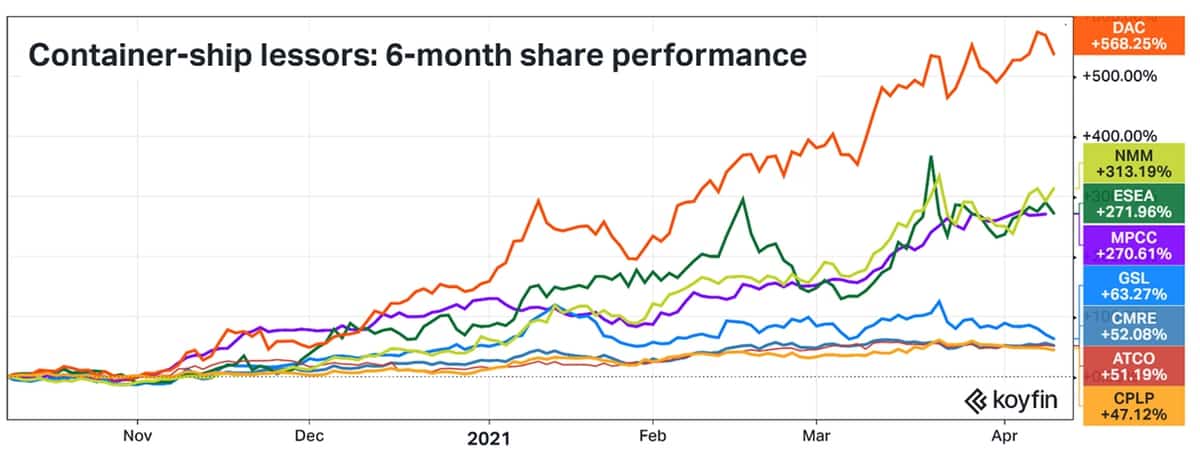

Over the past six months, MPC’s stock has risen 271%. In the U.S. market, listed container-ship lessors include Atlas Corp (NYSE: ATCO), Danaos (NYSE: DAC), Costamare (NYSE: CMRE), Capital Product Partners (NASDAQ: CPLP), Global Ship Lease (NYSE: GSL), Navios Partners (NYSE: NMM) and Euroseas (NASDAQ: ESEA). They’re all up double or triple digits.

Clarksons Platou Securities analyst Frode Mørkedal pointed out Monday that ship-leasing companies are securing longer charters, giving them more protection than liner operators from future downside.

“We believe tonnage providers … offer the best risk/reward bet in the container-ship value chain right now. There are too few ships available because of strong volume growth and port bottlenecks, with more than 4% of the container-ship fleet idle in port queues,” said Mørkedal, who noted that charter durations have risen to a 10-year high.

COSCO blows away estimates

The MPC and Evergreen disclosures followed an earnings “blowout” announcement by China’s COSCO last week.

In a securities disclosure on the Hong Kong Stock Exchange, it pre-announced net income for Q1 2021 of 15.45 billion yuan (RMB), the equivalent of $2.36 billion. That’s 53 times the profit COSCO reported in Q1 2020.

Jefferies analyst Andrew Lee commented that COSCO’s Q1 estimate “already exceeds both our and consensus 2021 full-year estimate of RMB10.8 billion and RMB13.1 billion.”

To put the enormity of the number in context, COSCO’s Q1 profit estimate is 56% higher than what the company earned in the entire year of 2020.

Commenting on the COSCO revelation, Jefferies analyst David Kerstens said, “This bodes well for the Q1 2021 outlook for the European container liners Maersk and Hapag-Lloyd.”

Kerstens added, “The normalization of the container market is taking longer than expected, due to bottlenecks and capacity constraints, exacerbated by the recent blockage of the Suez Canal, while container demand is supported by the greatest restocking cycle on record in the U.S.”

Click for more articles by Greg Miller

Related articles:

Could container shipping spot rates stay red-hot until 2022?

Demand boom on collision course with ocean transport ceiling

ZIM: US importers buckle, sign contracts early, pay 50% more

Could America’s historic import crunch get even worse?

Ocean carriers hold all the cards in contract talks with shippers

Deutsche Bank on import bonanza: ‘You ain’t seen nothing yet’