You need your ocean cargo ASAP. You know which container ship it’s on. What’s the chance that your ship arrives at the port on schedule? For the answer, flip a coin. Heads: The ship will dock on time. Tails: It’ll be late — possibly very late.

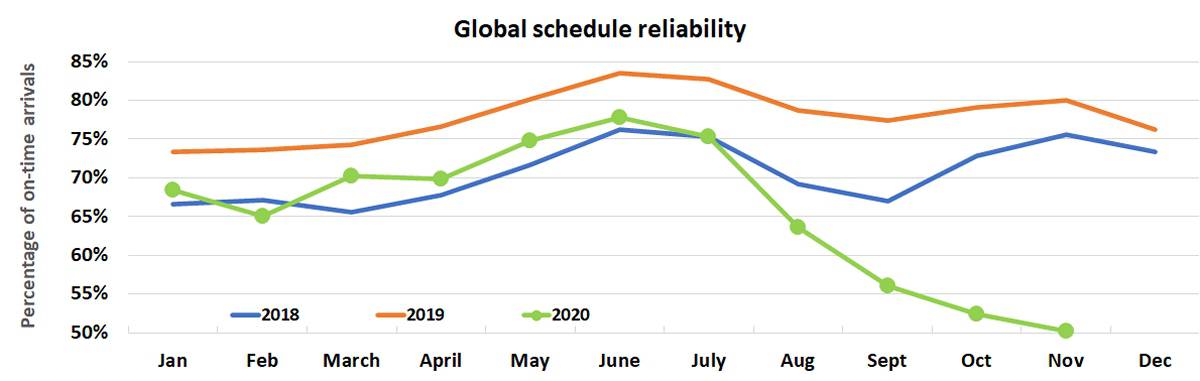

On Thursday, Copenhagen-based Sea-Intelligence released its Global Liner Performance Report for November. It found that average global carrier schedule reliability across 34 trade lines fell to just 50.1% last month.

It is the worst global score recorded since Sea-Intelligence introduced its reliability measure in 2011. The second- and third-worst scores were recorded in September and October.

The year-on-year decline has been precipitous. In November 2018 and 2019, carrier services were far more reliable, averaging 75.5% and 80% reliability, respectively.

The November data was particularly ominous for U.S. importers. Asia-U.S. reliability was far below the global average. Trade-lane stats are analyzed on a two-month rolling basis. For October-November, on-time arrivals were down to 28.6% in the Asia-West Coast trade and 26.4% in the Asia-East Coast trade.

In other words, for U.S. importers, it’s not a coin toss. The chance of avoiding ocean delays is less than one in three.

This could get worse before it gets better. American Shipper asked Sea-Intelligence CEO Alan Murphy whether reliability could hit new lows by January, amid the pre-Chinese New Year rush.

“It’s not impossible,” Murphy warned. “Especially given what we’re seeing with [container] equipment shortages.”

Not just more delays, but longer delays

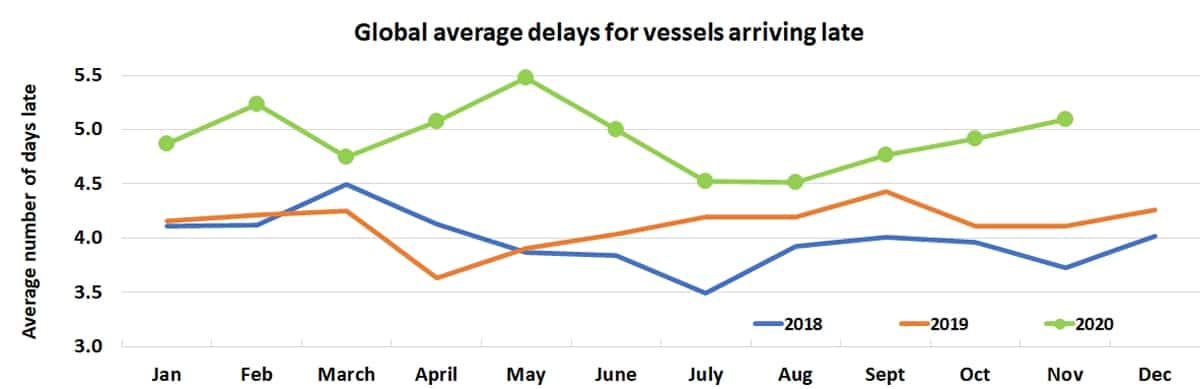

The news for shippers gets even worse. It’s not just that delays are becoming more frequent. It’s that delays are getting longer.

Sea-Intelligence calculated that the average delay for late vessels had risen to 5.1 days in November. That’s an 11% increase from average delays of 4.51 days in August.

The all-time monthly global high in this Sea-Intelligence data set came in January 2015 — 5.5 days — amid labor unrest at U.S. ports.

Even so, 2020 stands out. In each month since April, 2020 average delays set records for that particular month.

And while November’s number is still below 2020’s peak of 5.48 days in May, the situation in May was different.

In Q2 2020, carriers “blanked” (canceled) an unprecedented number of sailings. The lower number of vessels in service was easier for carriers to manage, so schedule reliability improved. While delays were longer in May, schedule reliability had rebounded to 74.8% that month.

In contrast, November suffered a worst-case combo of much higher unreliability plus extended delays.

Ranking the carriers: from best to worst

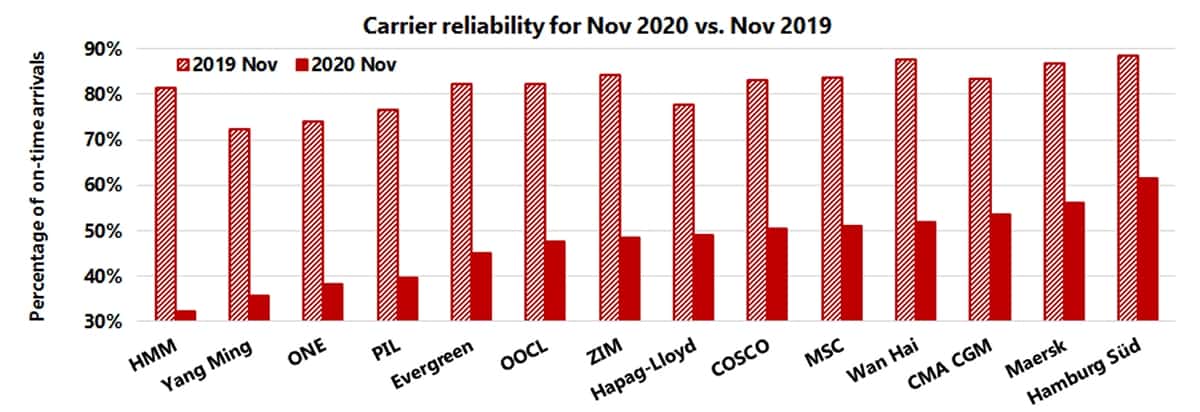

Sea-Intelligence also analyzes schedule reliability by carrier.

Hamburg Sud ranked first in November, with schedule reliability of 61.5%. Rounding out the top five were Maersk Line (56.2%), CMA CGM (53.7%), Wan Hai (51.9%) and MSC (50.9%).

On the other end of the spectrum, the worst performer was HMM, with just 32.2% reliability. That’s about half of Hamburg Sud’s score.

Rounding out the bottom five were Yang Ming (35.6% reliability), ONE (38.1%), PIL (39.7%) and Evergreen (45.1%).

Reliability slump could last until Q2

“With news of widespread port congestion, and with carriers not letting off capacity-wise until at least Chinese New Year, shipping might not see improving schedule reliability until Q2 2021,” warned Murphy.

As he explained to American Shipper, “reliability was quite good” during the heavy blanking period in Q2 2020. “My assumption is that this was because you had fewer ships [in service], so it was easier to manage. It’s as simple as that.”

If so, the antithesis should also true, which is what the market is experiencing now. “From July onwards, the carriers put in more and more vessels and extra loaders [ships not part of a regular service]. Since they started doing that, reliability has gone to hell. As long as you’re piling in tons of extra capacity, it’s going to be a challenge.”

The ports factor

Beyond carrier capacity, the recovery of container-service reliability also hinges on ports.

SeaIntelligence Consulting Lars Jensen wrote in an online post, “The reality is that many ports suffer from catastrophic indigestion due to the sudden boom in demand owing to the pandemic effect. Such port congestion leads to massive waiting times for simply getting a slot at a berth. It would not be reasonable to purely blame the carriers for this dramatic drop in performance,” said Jensen. Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON CONTAINERS: Liner capacity control and the future of container shipping: see story here. Q&A: Flexport on 2021, container crunch and liner pricing coup: see story here. The mystery of the frozen trans-Pacific spot rates: see story here. COVID lockdown sequel threatens container shipping demand: see story here. Containers are the ‘new gold’ amid ‘black swan’ box squeeze: see story here.

Y Tanaka

“shipping might not see improving schedule reliability until Q2 2020,” — Do you mean Q2 2021?

Greg Miller, Senior Editor

Thanks for pointing out that mistake. I’ve corrected it now.

Stephen Webster

Low container rates in the past forced some companies to reduce capacity or leave the industry.