Container volumes failed to keep pace with overall gains as ocean shipping reversed a previous-year decline in the face of headwinds that threaten its fragile recovery.

Global maritime trade increased 2.4% to 12.3 billion tons in 2023, according to the Review of Maritime Transport 2024 released Tuesday by United Nations Trade and Development (UNCTAD), which forecast growth of 2% in 2024 and average gains of 2.4% a year through 2029.

But the report warns that soaring freight costs and operational challenges mostly from geopolitical conflicts weigh on shipping’s long-term recovery.

Container trade that edged up 0.3% in 2023 is expected to strengthen to 3.5% in 2024, if the supply chain remains stable.

Demand for iron ore, coal and grains remains strong.

“A record of almost 250,000 port calls by container ships in the second half of 2023 were driven by growing trade and longer routes, causing some congestion, especially in Asia, which handles 63% of global container trade,” UNCTAD said.

Disruptions to key routes through the Suez and Panama canals and resulting longer voyages pushed ton-miles up by 4.2%.

Rerouting, port congestion and rising operational costs saw freight rates surge in 2024. The report cited the Shanghai Containerized Freight Index (SCFI) that by midyear had more than doubled from late 2023 on longer shipping distances, increased fuel consumption and higher insurance premiums.

UNCTAD projects global consumer prices could increase 0.6% by 2025 if freight rates remain elevated.

While high-volume shipping mostly moves under charter and contract for primary trans-Pacific and Europe-bound cargo, spot rates outside those routes also surged.

From January to July 2024, the average rate on the SCFI Shanghai–South America route more than doubled to $9,026 per twenty-foot equivalent unit, the highest level since September 2022, the report stated. The Shanghai–South Africa route saw its average rate almost triple to $5,426 per TEU (highest since July 2022), while the Shanghai–West Africa average rate jumped 137% to $5,563 per TEU (the highest since August 2022).

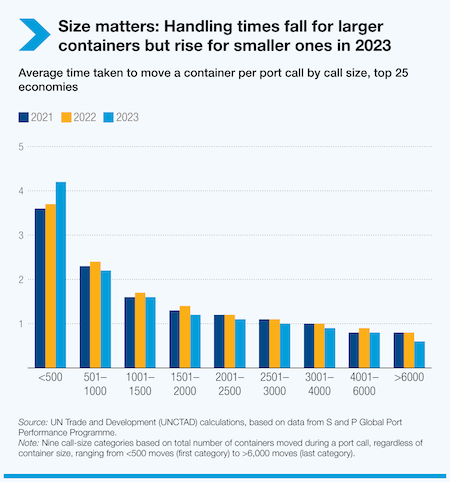

Major ports saw container ship wait times as much as double in 2023 on record port calls, rerouted vessels and rising shipping volumes.

The report found that digital technology such as blockchain, AI and automation helped adopting ports, particularly in Asia, reduce waiting times, improve cargo tracking and speed transshipment.

The global shipping fleet grew by 3.4% in 2023, ahead of trade growth but still below historical averages. Total cargo capacity reached 2.4 billion tons, primarily by container ships and liquefied natural gas carriers. Bulk carriers and oil tankers account for the largest number of vessels.

China, Japan and South Korea dominated the shipbuilding market in 2023 with 95% of global output. China for the first time delivered more than half of the world’s newbuild capacity.

Find more articles by Stuart Chirls here.

Related coverage:

Roaring volume has Port of Los Angeles eyeing $1 trillion in imports