Uncertainty. It’s a word logistics managers have said so many times that if they had a dollar for every time they said it or wrote it in a sentence, they would have more money in their bank accounts than the ocean carriers. Ironically, this once nemesis for shippers has become its savior and an enemy of the carriers.

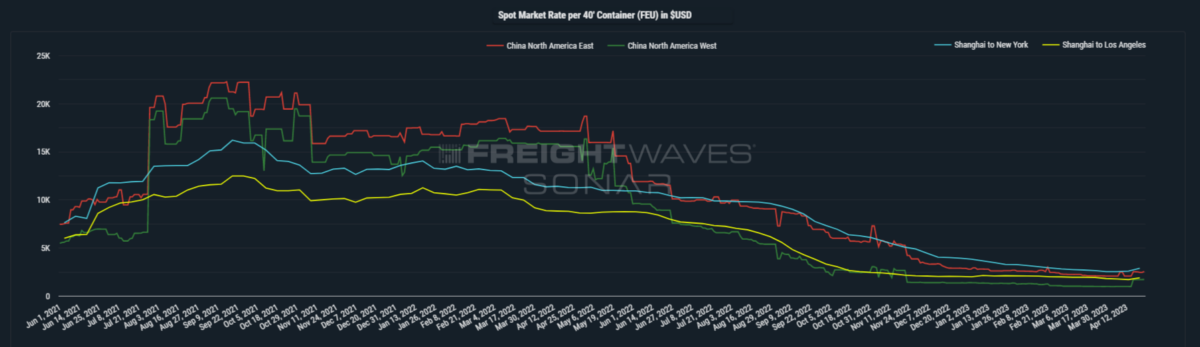

The murkiness of consumer spending along with bloated warehouses continue to impact ocean orders, which, of course, have slammed ocean freight rates. The cut in vessel capacity by the ocean carriers has not put a floor in freight rates, so the urgency to lock in a contract has not been as dire for shippers.

With no drastic changes in inventories or consumer spending on the horizon this contract season, the mix of contracts and spot rates is different. We all know beneficial cargo owners (BCOs) normally diversify with a mix of contracts and spot rates, but this contract season, the low rates have BCOs turning more to non-vessel operating common carriers (NVOCCs) to help them maximize the use of spot rates.

Paul Brashier, vice president of ITS Logistics, told American Shipper that low spot rates are just one piece to this unconventional ocean contract period.

“While the volume of containers being booked in the spot market is clearly a reflection of the rock-bottom rates being obtained by shippers in the spot market right now, there are two recent behaviors by BCOs influencing this market,” Brashier explained. “Many shippers took drayage services to request for proposal (RFP) as early as November of 2022. This signaled that a significant number of BCOs were not planning to contract with ocean liners per usual in March-April of this year and then hold their drayage RFPs in April-May.”

Brashier said as more BCOs look to control their own trucking, NVOCCs and ocean liners have experienced significant decreases in door-to-door freight availability to truckers as more shippers book to the ramp and container yard shipments.

Just look at the American Trucking Association’s Truck Tonnage Index. It fell to its lowest level since August 2021 in March. In February, the For-Hire Truck Tonnage Index dropped as well. The pipes of the logistics chain are just like containers. They don’t lie.

The flow of trade is a harbinger of things to come. What things are telling us now is because of the lack of freight demand, prices will continue to be soft.

Alan Baer, CEO of OL USA, said volume levels in the trans-Pacific eastbound market continue to remain foggy, which will only add to a more untraditional contract season.

“Spot rates continue to move erratically, creating a nervous buyer beware tension between committing to fixed pricing and sticking with the existing spot rate formula,” Baer said. “Savings generated from May through August may be enough to offset the higher peak rates if and when volume accelerates.”

Predicting the return of the consumer and drawdown of inventories has been proven futile so far. Until all those involved understand the flow of trade and the many pipes, which include warehouses and manufacturing orders, expect more false predictions to be made. Until then, nothing is normal in logistics and the power shift in the game of supply and demand has shifted back to the shipper.

The Magic 8 ball once used by shippers and logistics managers when they asked their supply/demand questions is now in the hands of the ocean carriers. You saw how well it worked out for shippers during COVID. As for how it will work for ocean carriers and the stemming of falling freight rates, that story is still being written.

Janice Mink

I don’t know why anyone is surprised by these changes. It is clear that national and international monetary policy and politics are suppressing demand as one would expect. That the carriers have no clear strategy is the surprise.