Editor’s note: This story was updated at 12 p.m. on Sept. 1 to reflect updated information.

On Friday, FreightWaves reported that factoring company OTR Solutions made the decision to place digital freight brokerage Convoy on a “do not approve” list based on concerns about Convoy’s balance and credit.

Now, Convoy and OTR Solutions have issued a joint statement saying that the situation has been resolved.

“Earlier today, an article appeared in the press referring to a misunderstanding between Convoy and OTR,” the companies wrote to FreightWaves. “That misunderstanding has been resolved and Convoy is up to date on all payments. Convoy has also been reinstated to the OTR buy list.”

The factoring company OTR Solutions had put Seattle-based digital freight brokerage Convoy on its “Do Not Buy” list, indicating that it would no longer pay carriers for Convoy loads.

Small carriers and owner-operators use factoring companies to get paid immediately for hauling shipments: The factor buys the invoice from the carrier and collects from the broker later. The factor has to assess the creditworthiness of the brokers whose payments it’s buying, and that’s where the trouble with Convoy came.

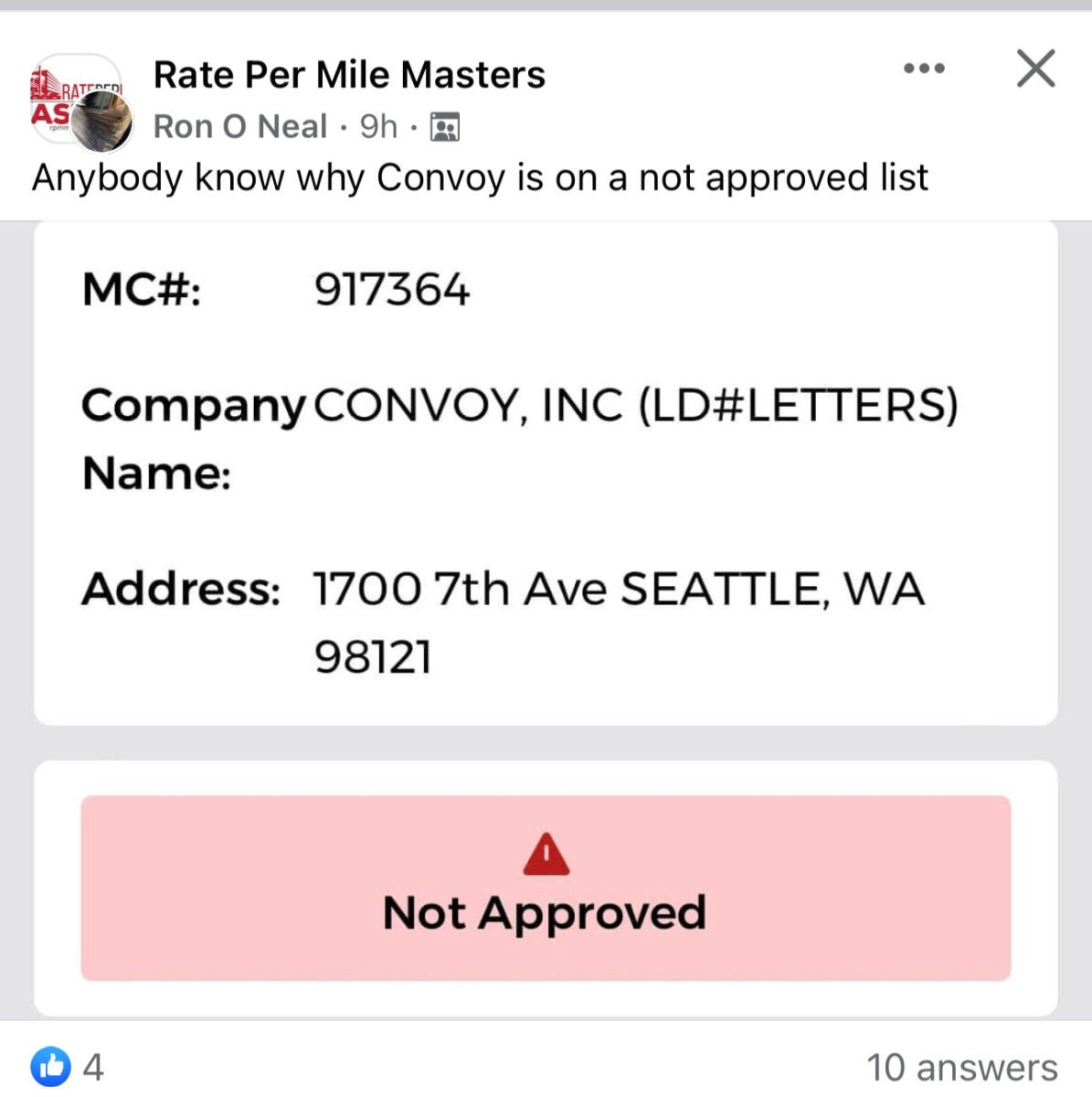

In a phone conversation with FreightWaves, an official at OTR Solutions confirmed that this screenshot posted to the carrier Facebook group Rate Per Mile Masters on Thursday night was authentic:

OTR asked Convoy to make an advanced payment for its current outstanding balance.

A week ago, FreightWaves reported that Convoy hired an investment banker to advise the company on strategic interest, including a possible sale of the business.

Gary Frederick

Don’t understand why guy’s even use this crap, just more people in your pocket. You can pull for any of the major brokers and get quick pay that’s cheaper then these so call money firms that tell you how you are gonna do business. If your paying 5% to crap fracturing why wouldn’t you get 2% from a carrier instead and get it in 48 hrs.? Some how alot of you guy’s rely on this maybe you shouldn’t have even got that truck if your willing to give money to factoring company’s, so called dispatch services, fly buy night fuel cards, or someone that’s taking money out of your bank faster then you can keep up with it. Man my head is spinning just writing this. I know it’s tough out here been doing it a long time but after you sit down and figure all the money you are giving away in percentages and fees that’s a pretty good amount of money a year. Just buying a truck doesn’t make you an owner operator,being a good business person does and alot of you guy’s thought that you were going to get rich and don’t really understand freight and how it works. So no love lost if they go belly up, there getting your money and your crying broke, that’s how the game works less truck’s more money for the rest of us.

Jason Ellingson

Amen Truck dude, and not just trucking industry. A correction on all levels is needed like what great grandpa used to talk about

Greg

Loves Freight Factoring has added CONVOY to their NO-BUY List:

Due to existing Credit Concerns, Convoy has been placed as a No Buy. We will process what Loads have already been accepted. Moving forward however, future Convoy Loads will not be approved until further notice.

Freight Dude

Who owns OTR Solutions? Do they have an axe to grind with Convoy?

They very likely are not the only factoring company supporting Convoy that are bigger and have not made this move

Al-Solo Nyonteh

As far as digital platform and customer service, I think Convoy is ranked with-in the top five companies. Hope they can stick around. Someone needs to set the standard. Trucker need to know how a good digital platform works and 24 hour/quick response customer service feels.

Jeff Ogren

Although digital freight booking represents a positive technological advancement, it is evident from the market that interpersonal connections remain significant. Truck drivers continue to prefer communicating and negotiating with individuals via phone, emphasizing the importance of building personal relationships. This is why I consider outsourcing as a balanced approach, bridging the gap between a technology-driven strategy and the higher expenses associated with domestic hiring. Furthermore, outsourcing to countries where key trucking languages are spoken, such as Spanish, Eastern European languages, or Punjab/Hindi, offers the opportunity to establish more robust and extensive relationships with carriers who may have been inaccessible previously

Jeff Ogren

Although digital freight booking represents a positive technological advancement, it is evident from the market that interpersonal connections remain significant. Truck drivers continue to prefer communicating and negotiating with individuals via phone, underscoring the value of cultivating personal relationships. This is why, at Zelh Logistics, we advocate for outsourcing as a well-balanced approach, bridging the gap between a technology-driven strategy and the higher expenses associated with domestic hiring. Furthermore, outsourcing to countries where key trucking languages are spoken, such as Spanish, Eastern European languages, or Punjab/Hindi, presents the opportunity to establish more robust and extensive relationships with carriers who may have been previously out of reach.

Truck Dude

Shame. They are a good company but never made a profit and now the entire market rate structure is against them so they just don’t have the dry powder to last. Many will fall before this is all over. Surge Trans was the first headline brokerage name. More to go I think. It’s econ 101 as balance is restored to the market no matter how painful.