Potential for higher rates in second half of year as restocking takes place

COVID-19, aka the coronavirus, is taking a bite out of Americans’ everyday lives. The disruption from shutting down retail locations, limiting large gatherings, and food and supply shortages brought on by Americans stocking up on goods will ultimately be short-lived – maybe a few weeks or months – and the economy will eventually bounce back, but the near-term impact on the freight markets will be significant.

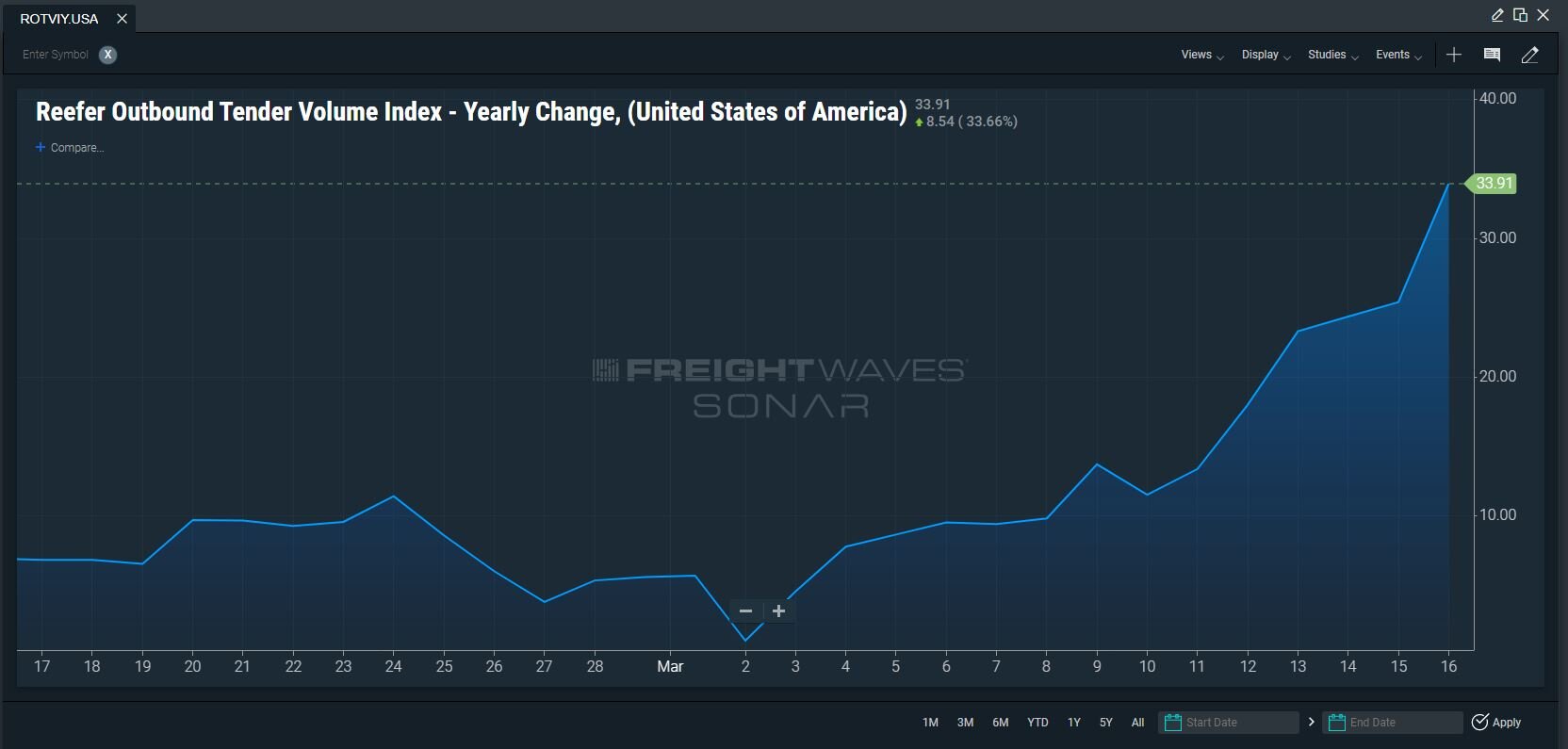

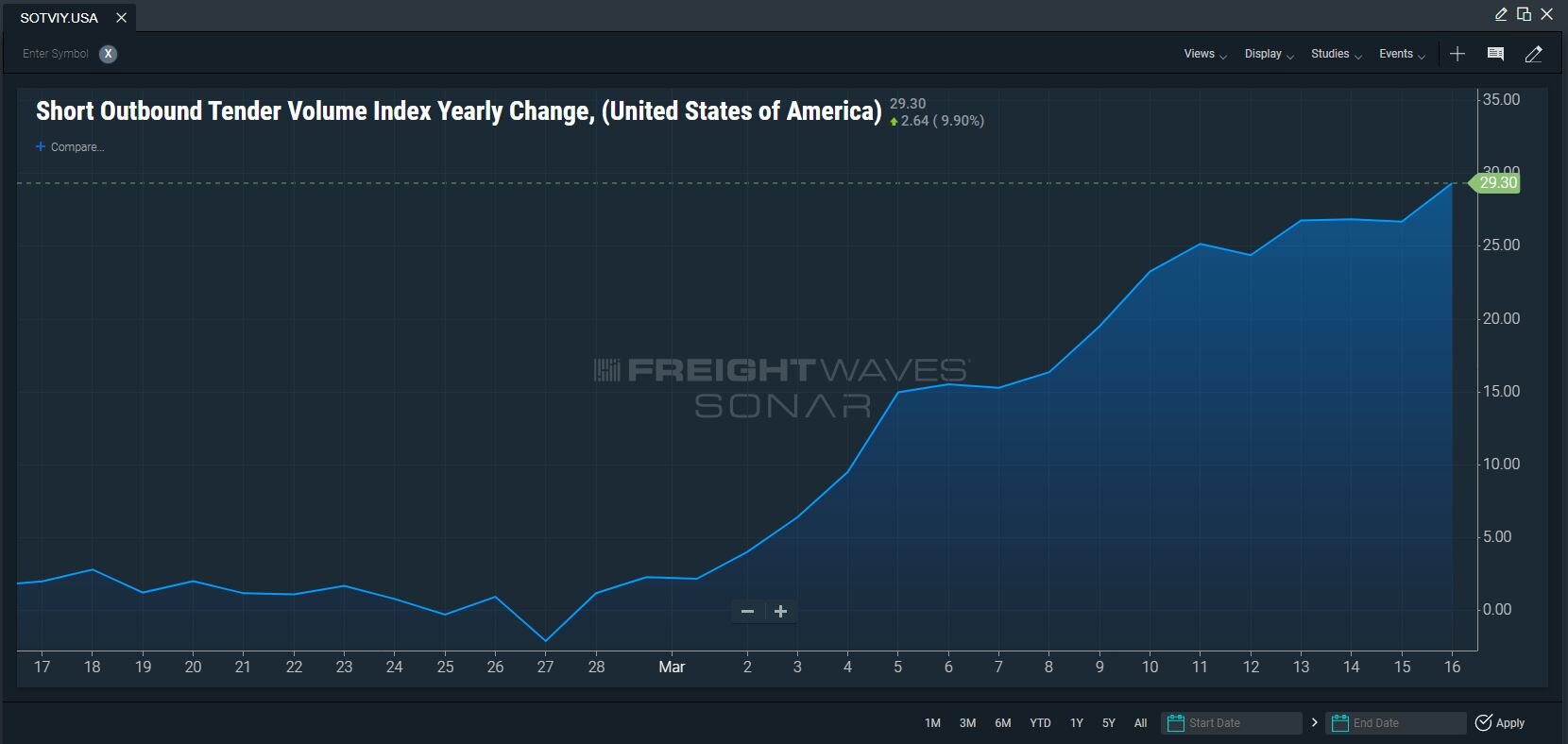

Right now, freight volumes and rates are rising quickly as retailers try to restock shelves with essentials. According to FreightWaves SONAR data, volume growth has been biased toward short-haul refrigerated freight: reefer volumes are up 25.37% year-over-year (ROTVIY.USA); and short-haul loads are up 26.6% year-over-year (SOTVIY.USA).

These volume increases are driving rates higher. FreightWaves’ Outbound Tender Rejection Index (OTRI) is at its highest level since the beginning of 2019. At 9.76%, the measure, which tracks carrier willingness to accept loads tendered to them by shippers under a previously agreed upon contract, indicates options for carriers.

Goldman Sachs, though, has warned that the overall economy is in for a rough ride. The firm revised its economic outlook to zero growth in the first quarter and a 5% decline in the second quarter. It did say that the economy should rebound in the third and fourth quarters, with growth of 3% and 4%, respectively.

“We expect U.S. economic activity to contract sharply in the remainder of March and throughout April as virus fears lead consumers and businesses to continue to cut back on spending such as travel, entertainment and restaurant meals,” Jan Hatzius, chief economist at Goldman Sachs, wrote in the report released on Sunday. “Emerging supply chain disruptions and the recent tightening in financial conditions will likely add to the growth hit.”

That view is impacting outlooks for the trucking industry. ACT Research, in its March installment of the ACT Freight Forecast, U.S. Rate and Volume Outlook, echoed Goldman Sachs’ view of the economy, noting that restocking efforts following the lifting of restrictions related to the virus will drive freight.

“Freight could be less affected than the overall economy in a service-side recession, the risk of which has risen,” Tim Denoyer, ACT Research’s vice president and senior analyst, said. “At this point, we expect a sharp but short decline in economic activity, but the situation continues to evolve quickly. With a likely inventory restock in the second half, among several tailwinds, there is a case for recovery in freight. And with capacity coming, we think the outlook for improving truckload rates is fairly resilient to COVID-19.”

There could also be a large influx in the second half of the year with imports from China, which is likely part of the Goldman Sachs assessment.

Investment firm Stifel hosted a conference call on March 12 with supply chain leaders from the footwear and logistics industries. They expect a bounce in the second half of the year after China ramps up production once again.

“The investment community may not appreciate the magnitude of the challenges and fallout for Asia-centric supply chains caused by COVID-19,” the Stifel note said. “For the footwear and apparel industry, production delays are at 3 to 12 weeks (impacting second and third quarter deliveries) and shortages of materials will cause delays to continue adding incremental transportation expenses.”

Bloomberg reported that China faced a deeper impact from the virus than was previously thought. The nation saw industrial output fall 13.5% in the first two months of the year, the publication reported, and retail sales plummeted 20.5%. In the U.S., the Commerce Department announced retail sales fell 0.5% in February following a 0.3% rise in January. Analysts expected a similar 0.3% rise in February, which does not account for the bulk of the coronavirus impact yet. Last week, retail sales fell over 9%, this despite a surge to buy water and other essentials. As more people hunker down in their homes for the next several weeks, retail sales are expected to continue falling.

The upside for truckload carriers is the long-range forecast.

“For transportation and logistics companies, disruption is likely to persist into July, and possibly even longer,” the Stifel note said. “Airfreight in particular is in heavy demand as manufacturers reposition inventory. Shippers and service providers alike should expect higher costs and further delays throughout the global logistics infrastructure.”

How quickly things return to normal depends on a number of factors, the Stifel call participants said. This includes:

-

How quickly can Chinese factories return to full production (it is currently estimated between 50% and 90% depending on location and products)?

-

How quickly can shortages of materials typically shipped in March and April be filled?

-

Can third-party manufacturers fill in gaps in production?

-

How will rising transportation costs and the fallout from lost sales impact delivery schedules?

Higher-priced goods could be restocked quicker as suppliers are able to justify air freight rates, which have also jumped in recent days as more airlines shut down global routes.

“As the initial disruption associated with Chinese production shutdowns clears, the future is even less certain: there are a wide range of outcomes depending upon how the U.S. demand picture develops,” Stifel said. “For now, shippers are well-advised to remain flexible and creative, and to seek out knowledgeable supply chain partners with scale and capacity relationships.”

For carriers, that likely means higher rates than initially forecast for this year, just as bid season starts to ramp up.