Covenant Transportation Group Inc. (NASDAQ: CVTI) reported fourth-quarter 2019 adjusted earnings per share (EPS) of 10 cents compared to 92 cents in the fourth quarter of 2018. The fourth quarter 2019 consensus estimate was 27 cents.

The result included a 2-cent-per-share loss associated with a customer bankruptcy at fleet leasing outfit Transport Enterprise Leasing (TEL) in which it holds a 49% interest.

“We are relatively pleased to return to profitability for the fourth quarter based on higher revenue per tractor and lower costs per mile sequentially versus the third quarter of 2019. However, by no means are we satisfied with the result,” said Covenant Transportation Chairman and CEO David R. Parker.

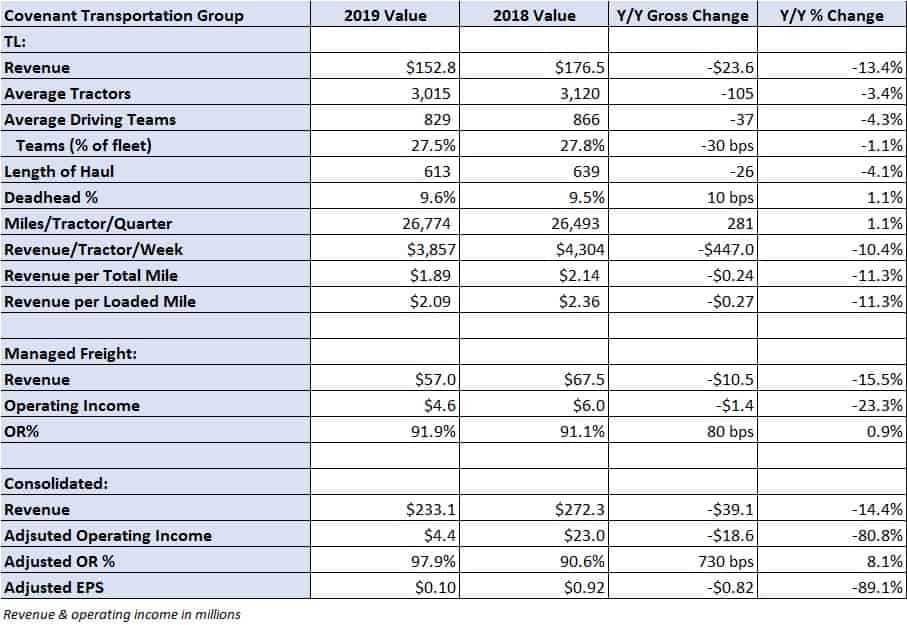

The Chattanooga, Tennessee-based truckload (TL) carrier reported a 14% year-over-year decline in consolidated revenue to $233 million. The company’s asset-based TL revenue declined 13% year-over-year excluding fuel surcharge revenue as the average tractor count was down 105 units in the period and average revenue per tractor per week dipped more than 10% to $3,857.

Average revenue per total mile declined 11% year-over-year to $1.89, but tractor utilization increased by 281 miles on average for the quarter, up 1% year-over-year.

The earnings press release stated that part of the decline in per-mile rates was due to the company’s move to allocate more equipment to its dedicated service. The release also cited excess truck capacity in the market as well as some customers reducing their peak season needs as reasons for the decline.

“For the fourth quarter and all of 2019, we battled a difficult operating environment, marked by excess industry capacity, lackluster freight volumes, intense competition from freight brokerage competitors, and higher operating costs,” Parker stated.

Covenant’s managed freight segment reported a 15.5% year-over-year decline in revenue to $57 million. The release stated that the bulk of the decline in revenue was again due to lower peak season capacity needs from its customers. The division reported operating income of $4.6 million in the quarter compared to $6 million in the year-ago period.

The company’s non-asset-based managed freight segment consists of its freight brokerage, transportation management services, warehousing and other offerings.

Outlook

Management expects the company’s operating cash flow and leverage ratio to improve year-over-year in 2020. The bulk of the improvements are expected to be realized in the second half of 2020 “as year-over-year comparisons in consolidated average freight revenue per total mile and margin performance in certain irregular route Truckload operations are expected to be negative for at least the next several months,” said Covenant Chief Financial Officer Richard B. Cribbs.

The release stated that the carrier is focused on swapping out solo-driven refrigerated business for more “profitable dedicated and dry-van opportunities.” This is expected to reduce capital costs like real estate and equipment as well as other operating expenses. Along those lines, management said the company recently won a new “significant” dedicated contract that commences in the second quarter of 2020.

Covenant reported that its leverage ratio (net lease-adjusted indebtedness divided by trailing four quarters’ earnings before interest, taxes, depreciation, amortization and rental expense) increased to 2.4x at the end of 2019 compared to 1.5x at the end of 2018. However, the company expects to further lower its capital requirements for both real estate and equipment as the tractor count has been guided to a range of flat to down 2% in 2020.

“From a balance sheet perspective, with net capital expenditures scheduled well below normal replacement cycle, along with positive operating cash flows, we expect to reduce net lease-adjusted indebtedness over the course of fiscal 2020,” Cribbs concluded.