Coyote Logistics recently released a white paper titled “The Coyote Curve: A Model for Mitigating Risk and Uncertainty in Modern Supply Chain Operations” explaining how the 3PL sees the dynamics of freight market cycles. Coyote created a complex model that involves three overlapping cycles, including seasonality, annual procurement, and market capacity—and we’ll discuss that in a moment—but the most compelling claims made in the white paper are indirect, only implied by their charts. To put it bluntly, Coyote appears to believe trucking spot rates are due for a rapid downturn.

This doesn’t necessarily mean that the United States is about to enter an economic downturn; one of the more intriguing aspects of Coyote’s model is that it doesn’t include macroeconomic data like GDP growth, industrial production, imports, or consumer spending. For what it’s worth, at FreightWaves we continue to have confidence in the overall economic situation despite some softness in housing activity. Check out Ibrahiim Bayaan’s work for our macro thesis.

Instead of looking at freight demand as it’s driven by external factors, Coyote modeled the internal dynamics of the trucking industry. The seasonality component of freight market cycles is relatively simple and should be familiar to our audience: freight is usually slowest in the first quarter, there’s usually a June surge and a fall surge. When unpredictable events like natural disasters occur, the impact on freight markets often depends on where they fall with respect to seasonal cycles (i.e., a major winter weather event in October or November, when capacity is tight, can be much more disruptive than one in February, a slow month for transportation).

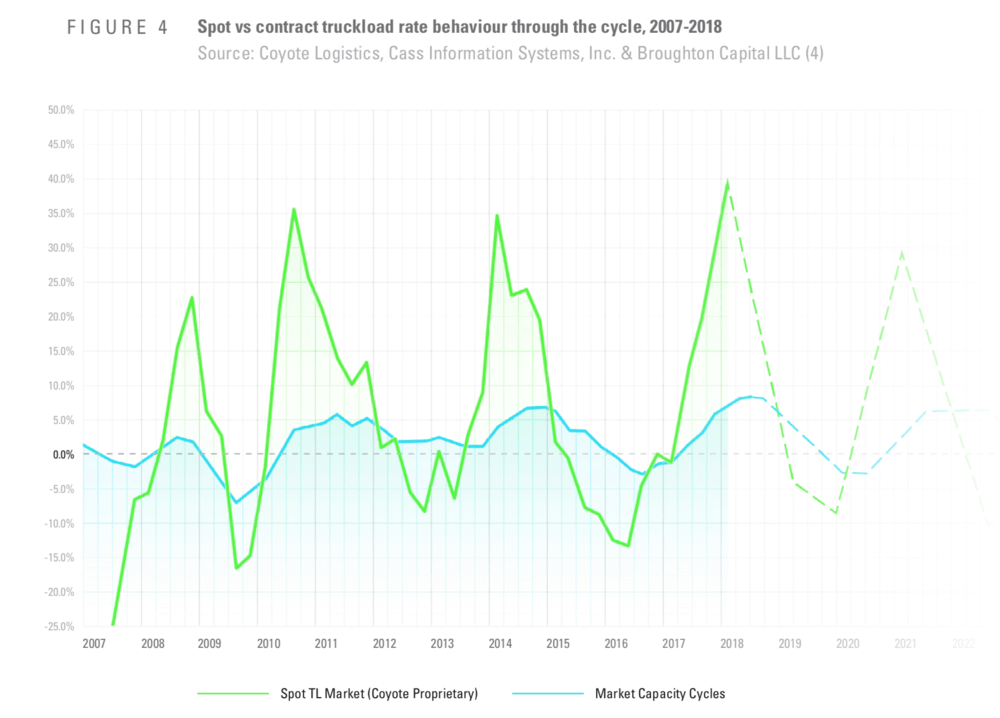

The white paper also looks at the spread between contract and spot truckload rates, which is largely driven by the timing of transportation procurement with regard to the trucking cycle. In the second half of 2017, spot rates rose far above contract rates, because shippers secured trucking capacity early in the year when the market was soft. In the middle of 2018, we’ve seen freight markets reach a fragile equilibrium with a lull in spot market action, because contract freight was re-priced at an exceptionally strong point in the cycle. Coyote illustrates this with charts, showing that the relative amount of pain felt by shippers in a given year depends on when in the cycle they negotiated their freight contracts.

Finally, Coyote modeled a third cycle—“the one cycle to rule them all: the market capacity cycle.” The market capacity cycle has to do with how carriers respond to favorable and unfavorable rate environments. Coyote points out that because trucking in the United States is so fragmented and little to no barrier to entry exists, capacity can be added to and pulled from the market quickly in response to market conditions.

Unfortunately, due to fragmentation and the predominance of small players, capacity is neither added or subtracted in a rational way; it’s more like a stampede, and it always lags truckload rate movements (see the above chart). During upswings, when spot price growth outpaces capacity growth, shippers feel the pain; during downturns, when the bottom falls out of the spot market and carriers are slow to take assets out of the market, carriers are left holding the bag. It’s a plausible theory, but again, we feel that leaving out the demand side of the equation, i.e., the macroeconomics affecting freight, is a bit of an oversight, because demand is even more volatile than supply.

None of this is really new—it’s just layering different supply and demand cycles on top of each other—but Coyote has presented the data in a compact, compelling format. The real kicker is the shape of the chart, and specifically the point at the cycle Coyote thinks we’re in now.

If Coyote’s right, trucking capacity has already nearly reached its ‘natural ceiling’, the point at which the glut of supply becomes imbalanced against freight demand and crashes prices. The problem is that it’s unclear what exactly is represented by the ‘market capacity cycle’ line. The chart cites Cass, which creates demand metrics—you can see the Cass Freight Shipment and Cass Freight Expenditure trends in SONAR. There’s a possibility that Coyote is somehow baking demand into its ‘capacity cycle’ line, but if that’s the case, it’s misnamed because it represents both demand (freight) and supply (capacity).

Again, we feel that in order to truly understand whether capacity has reached a level high enough to crash trucking rates, you have to take freight demand into account. That’s why factors like port activity (softer than expected), housing starts (stronger than expected), oil and gas E & P (unprecedentedly high), and industrial production (solid) must be considered.

John

Solution to many of the comments -stop working with brokers.

Really. Stop. Today.

Get out and make the sale and get your own customers.

While you are at it, stop blaming others for your issues. Because you bought a truck doesn’t make you a protected class.

Time to put your big boy pants on or accept you are in over your head.

LARRY Crutsinger

I do not know the answer, so please do not take this for the correct answer? Who owns Coyote Logistics? I was thinking it was UPS. I am almost sure I read this fact in a Trasport Topics article a few years ago. Is this correct? If this is a correct statement, it would explain to me the stance taken by this white paper.

Steve

The war trade with China could affect the industry? Or it is a cool off to supply and demand. Devastated areas from natural disasters can keep our economy moving due to demand of materials and transportation leaving China out of the equation.

sal piskorz

Coyote and most of the other brokers are the crooks in this industry. Due to DAT , CCJ Online and all the other online reporting of the market spot rates is what’s killing this industry. They are spewing a bunch of garbage all over the internet how the market rates are dropping due to more trucks than loads, this is why Coyote can come up with a report that the trucking industry cycle is about to rollover. That’s why Coyote will have a different rate for the same load every day because they look at these online reports made by some idiots that don’t know anything and that determines what Coyote’s rates will be for that day. Coyote and these other brokers should go out and buy $150k trucks, $28k dry vans and $50k reefers and try to haul these loads and make money then see what it feels like to make loan payments, driver pay, tolls, fuel, taxes and fees. Do they think you can haggle with the loan company, haggle at the toll booth or at the pump , haggle with the IRS,pay the driver less all because THE RATES DROPPED. You get my drift Coyote?

These brokers are only worth to be spit upon in public if we knew who these individuals were and whom they are working for. Brokers are a disgrace to the trucking industry.

john al

Shippers really need to get there head straight and start working with small carriers directly, brokers have made this logistics hell for small carriers by making over 50-100% margins on loads and yet shippers have no idea and are listening to broker’s BS day by day of capacity issue and market issue. I really hope there can me better way where shippers can work directly with carriers instead of going through these crook brokers who are destroying small carriers.

Keith

As long as the American People keep the Democrats out of power our economy will continue to flourish. But if the Democrats regain power watch taxes, regulations and unemployment go through the roof. I am not saying that everything Trump does is perfect or totally right, but at least he understands business whereas the Democrats only know how to redistribute wealth from those of us who bust our butts to make our economy great to those who are too lazy to get off their butts and contribute. We are experiencing a wonderful rejuvenation of our economy, our country and our workforce and as long as we have leaders that understand that redistribution of wealth is NOT the answer we will continue to prosper.

As for Coyote’s forecast, I too think they are missing the whole picture, they are looking at the micro-picture when they need to look at the macro-picture. Trucking is the heart of the economy because without it nothing moves anywhere, so no one can spend any money and jobs go away, houses are not built, people don’t eat. Right now trucking is the whipping post for so many taxes, fees, false inspection fines and tolls. Rhode Island has put the brunt of their tolls on trucks and now Indiana wants to put a 35% toll (tax) increase on trucks. All to pay for their mis-guided attempt at "Privatization" of their toll road. So now they want trucks to bail them out.

What most so called industry experts, politicians and consumers seem to forget is that if our cost continue to go up, rates are going to have to continue to go up and so will prices on consumers at the cash register. Do you really think that corporations pay taxes? No they don’t, the cost of taxes are included in the price to the consumer for their goods and/or services. Well the same goes for us, if our costs continue to go up so are our rates going to have to go up. Otherwise there will be no trucking companies to get your "Stuff" to the consumer.

So for the Coyote number crunchers; all your fancy charts, graphs and assumptions are pretty and maybe interesting, but they fail to include reality. Trucking costs continue to go up and rates are going to have to reflect those cost. Lastly, for all brokerage companies including Coyote, if you stop being so greedy and keeping so much of the total shipping costs and pay to the truck what is actually fair and reasonable to cover our costs and allow us to make a reasonable return on our investment; perhaps shipping rates might just drop and the end prices to the consumer might drop and everyone wins. As per the example cited below no broker is worth 27% of the total shipping costs.

Rates today are where they should have been for the past 10-15 years and they should not go down any further. Brother Truckers; Keep on Trucking and Keep America Great!!

tony

Coyote certainly hopes the spot market will crash. The best way for super brokers to make money is…if the carrier doesn’t. One interesting excerpt from the above article talked about "pain felt by shippers based on when they negotiated their freight contracts" No one talks about the pain endured by the carriers from the brokers. I don’t recall a time that I offered a bid amount to CH Robinson or Coyote that the little recent grad on the other end of the line came back with a counter offer. I had kids like this tell me that it is a light load and its only going a hundred miles – so it shouldn’t cost me that much. To which I respond…do you know what it costs to run a truck? (crickets chirping in the background)

Tim

When a customer offers central Texas freight to SE Mo for $2400, and a Broker out of Minnesota cuts it to $1750 to get all the loads, that’s what I call a down turn. Hope he can afford to set on the money for 60-90 days.

All the work we, the small owner operators have done to raise rates in a fair fashionable way goes down the drain, we are still here, but the cut rates live on forever, even after the cut rater’s go broke.

The last load I did for Coyote was the most screwed up load I have ever messed with in my 40 year tenure, they have no talent in their operations, just college graduates with degrees in areas that have nothing to do with transportation. Customers pay for what they get. Freight doesn’t move on paper, it moves on trucks.