The European Union’s ban on imports of Russian crude is now less than five weeks away. As the clock ticks down to the Dec. 5 deadline, crude tanker owners expect trade dislocations from the Russia-Ukraine war to intensify, propelling spot rates even higher.

“A key driver of the oil marketplace over the last six months is about to hit its last — but most impactful — phase,” said Brian Gallagher, head of investor relations at crude tanker owner Euronav (NYSE: EURN), on a quarterly call Thursday.

Kevin Mackay, CEO of Teekay Tankers (NYSE: TNK), said during his company’s call on Thursday: “The redrawing of global trade patterns [following Russia’s invasion of Ukraine] is the largest single factor behind current strength in rates. The forthcoming ban is set to significantly increase that impact.”

EU replacement of Russian crude

Tanker demand is measured in ton-miles: volume multiplied by distance. Demand for crude tankers has increased since the war began because the EU has partially replaced imports from Russia with volumes from more distant destinations. To comply with the Dec. 5 ban, that replacement process must rapidly accelerate in the coming weeks.

Mackay cited data from Kpler showing that EU imports of Russian crude dropped from 2.6 million barrels per day in January to 1.5 million barrels per day in September. “From Dec. 5, these volumes are set to fall to zero,” Mackay said. “Thus far, these volumes have been replaced almost barrel for barrel by imports from the U.S. Gulf, Latin America, West Africa and the Middle East.”

Due to much longer voyage distances, the ton-mile demand effect has been extreme.

The reduction in Russian short-haul crude flows to the EU between January and September reduced tanker demand by 11 billion ton-miles, according to Kpler data cited by Teekay. Replacement inflows from other sources during the same time frame increased tanker demand by 35 billion ton-miles — a net positive effect of 24 billion ton-miles.

Midsized tankers in the Aframax (750,000-barrel capacity) and Suezmax (1 million-barrel capacity) categories have enjoyed the most upside. More recently, very large crude carriers (VLCCs; 2 million-barrel capacity) have joined the party.

According to Gallagher, EU substitution of Russian crude with Atlantic Basin and Middle East crude “will in particular benefit VLCCS,” he said, adding that “this trend has been very pronounced since July.”

There are almost no U.S. ports that can handle VLCCs. Instead, crude is “lightered” using smaller ships such as Aframaxes, which do ship-to-ship transfers to load VLCCs in the U.S. Gulf.

“We are seeing growth in lightering exports in the U.S. Gulf onto VLCCs, some of which will go to Rotterdam,” said Mackay. “We’re seeing heavier volumes come out of the U.S. Gulf, which is why you see U.S. Gulf Aframax rates jumping to over $90,000 per day.”

Russian replacement of crude exports to EU

The other big dislocation caused by the war is the rerouting of Russian crude exports that used to go to the EU to more distant destinations, primarily India and China.

The Kpler data cited by Teekay shows that between January and September, this had a positive tanker-demand effect of 41 billion ton-miles. Together with the EU import effects, this brings the total net positive of war-driven crude dislocations to 65 billion ton-miles.

But what happens after Dec. 5?

Russian crude exports have been flowing freely so far. However, the combination of the EU ban’s impact on tanker insurance, the G-7 price cap and broader sanction fears could significantly reduce Russia’s crude exports. That would have a negative impact on tanker demand. It would reduce the “tons” in the ton-mile equation, partially offsetting “miles” upside from EU replacement imports.

Argus Media reported Wednesday that Chinese refiners “have so far bought only a handful of December-arriving cargoes from Russia.” It said that “China’s large state-owned firms were, until the start of the December trade cycle, key intermediaries between Russian producers and Chinese independent refiners, but appear not to be lifting December cargoes.”

Hugo De Stoop, CEO of Euronav, maintained that Russian crude will ultimately find buyers.

“We believe that if the [Russian] oil is cheaper than what you can fetch in other places, it will find a home. We have many precedents that demonstrate this,” said De Stoop on the conference call.

Operational limits on Russian exports

EU sanctions will ban EU reinsurance for Russian cargoes to non-EU buyers after Dec. 5 (until EU members approve an exception for those buying under their own price cap). U.K. Protection & Indemnity (P&I) clubs — which provide coverage for most of the world’s tankers — rely on EU reinsurance.

Nevertheless, De Stoop does not see a major new impact due to insurance.

“When I look at the P&I we are involved with, they have already done what many companies and banks have done. They have self-sanctioned or imposed a great deal of restrictions on business they do with Russia,” he said. “So, that is already the situation. What we’ve heard is that [U.K. P&I] will simply be replaced by less ‘international’ companies, namely insurance companies located in places like Dubai and China.

“I think that it’s more the physical operational restrictions that will dictate whether or not Russia will have to shut in some of its oil fields,” he said.

Russian ports, like U.S. ports, can’t handle VLCCs. In the winter, the country’s northern ports require use of ice-class crude tankers, mostly Aframaxes. The number of Aframaxes available to load Russian crude this winter will be limited as many Aframax owners will opt against carrying Russian cargoes due to the insurance issue and the G-7 price cap.

“There will be a two-tier market,” said De Stoop. “Because it’s going to be very difficult, even if you are based outside of Europe, to have ships that do one cargo out of Russia and the next one out of a place that is not under restrictions.”

From an economies-of-scale perspective, it doesn’t make sense to load an Aframax with Russian crude and sail it all the way to China or India. It makes even less sense given the limit on the number of ice-class Aframaxes available to serve Russia. “If you use those ships to do a long voyage, they won’t be available to go for the [shorter] distance which is icy,” De Stoop explained. (An Afraramax going all the way from Russia to China or India wouldn’t get back to Russia until the spring.)

He said Russia will have to use Aframaxes to lighter exports out of icy waters, do a ship-to-ship transfers to larger tankers, then bring the Aframaxes back to Russia to pick up the next loads. Russia will be forced to use lightering operations in the winter and compelled by economies of scale in other seasons. That will further tie up tanker capacity because ship-to-ship transfers are time-consuming.

“This is obviously a heavier operation than when you can just pick up the oil in a port and transport it to a destination without interruption,” said De Stoop.

Earnings roundup

The rate boost from the war, coupled with the post-pandemic oil-consumption recovery, has brought tanker companies back to profitability after almost two years of heavy losses. Owners of product tankers and small- to midsize crude tankers recovered first, and more recently, owners of larger tankers.

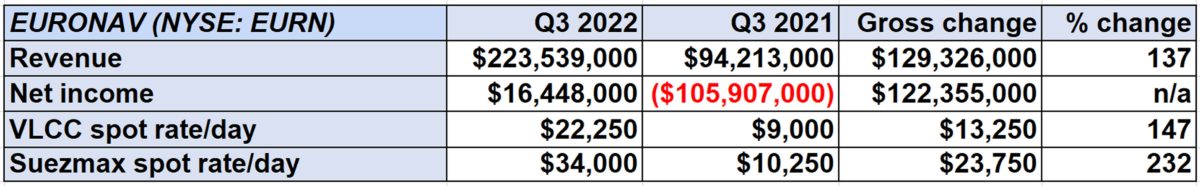

On Thursday, Euronav reported net income of $16.4 million for Q3 2022 versus a net loss of $105.9 million in Q3 2021. Earnings of 8 cents per share were in line with analyst consensus.

Euronav owns VLCCs and Suezmaxes. Its spot VLCC rates averaged $22,250 per day, more than double average rates in the same period last year. VLCC rates continue to rise. So far in Q4 2022, Euronav has 45% of its spot VLCC days booked at $47,500 per day.

Teekay Tankers — which owns Aframaxes, Suezmaxes and product tankers — reported net income of $68.1 million in Q3 2022 compared to a net loss of $52.1 million in Q3 2021. Adjusted earnings of $1.68 per share came in 2 cents shy of analysts’ consensus.

Teekay’s spot Aframaxes earned $35,917 per day in the latest quarter, more than five times spot rates in Q3 2021. So far in the fourth quarter, Teekay has 38% of its spot Aframax days booked at $36,600 per day.

Click for more articles by Greg Miller

Related articles:

- Sanctions could lift already booming product tankers to new heights

- Sanctions are about to slam Russia’s still-booming oil export trade

- Russian oil exports are still booming and EU is still reliant on Russia

- Russia oil sanctions: How conflict with EU rules threatens G-7 price cap

- G7’s grand plan to squeeze Russia oil windfall hinges on tanker shipping

- War effect on crude trade: Long-lasting and just beginning

- How new EU sanctions on Russia will shake up global energy trade