Stocks of container and dry bulk shipowners took a beating this summer. Tanker stocks continued their ascent, with many U.S.-listed tanker owners hitting fresh 52-week highs on Tuesday.

The consensus on tanker earnings: They’ve moved past their trough and are headed up from here. “The tanker sector can be characterized now as officially firing on all cylinders,” said Jefferies analyst Omar Nokta in a report this week.

The consensus on container shipping and dry bulk earnings: They’ve moved past their peak. Many of these shipowners still earn exceptional profits. Container-ship lessors have locked up enormous sums of charter revenue for years ahead. Even so, equities are following the negative trend in spot freight rates.

Container liner stocks

“On the cargo front, the news is grim, with [container] spot rates falling at an accelerated pace,” said Alphaliner on Tuesday.

Drewry’s Shanghai-Los Angeles spot-rate assessment fell 9% last week, to $5,562 per forty-foot equivalent unit. That’s down 55% from the all-time high in late November but still 3.3 times higher than pre-COVID levels. The decline in the current week, reported Thursday, was even steeper: Drewry’s Shanghai-Los Angeles assessment sank another 14%.

Among listed liner companies, shares of Zim (NYSE: ZIM) are now down 47% year to date (YTD), with Matson (NYSE: MATX) down 19%.

Liner companies are offsetting falling spot-market revenue with considerably improved annual-contract revenue. Even so, share prices are following spot rates down.

Recent Q2 2022 results showed that the average freight rates of some liner companies, such as Maersk, are more protected by contract coverage, whereas average rates of others, such as Zim, are more exposed to spot downside. Since Zim’s quarterly results announcement on Aug. 17, its adjusted closing price has fallen 31%.

Container-ship lessor stocks

Among the listed container-ship lessors, shares of Danaos (NYSE: DAC) are down 15% YTD and Global Ship Lease (NYSE: GSL) is down 22%.

On Aug. 30, GSL announced that it had chartered six 6,900-twenty-foot-equivalent-unit ships to Hapag-Lloyd for five to seven years starting in late 2023 to late 2024. Clarksons Securities analyst Frode Mørkedal noted that the forward fixing of these ships at $44,000 per day compared to their existing rates of $26,000 per day “reflects better fundamentals than perceived by the stock market.”

However, according to Alphaliner, the GSL deal was an outlier. “With the exception of one carrier, none of the main charterers are currently willing to embark on multi-year commitments.”

Alphaliner said that most liner companies see “choppy waters” for 2023 onward, which “will inevitably impact the charter market too, with expected lower demand for tonnage and rising pressure on charter rates.”

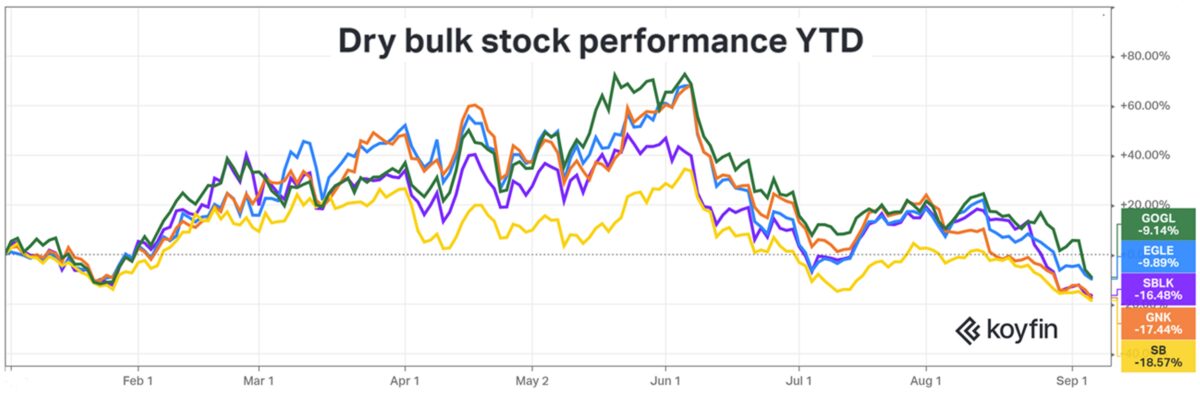

Dry bulk equities

Container shipping faces a potentially extended decline because a giant wave of new ships will hit the water in 2023-24. The container fleet orderbook is at 28% of on-the-water capacity, according to Clarksons. In contrast, the orderbook for dry cargo ships is low, at 7% of existing tonnage.

Dry bulk shares were strong performers this year until early June, when multiple equities were up around 70% YTD. They’ve fallen ever since.

Golden Ocean (NASDAQ: GOGL) is now down 9% YTD%. Eagle Bulk (NASDAQ: EGLE) 10%, Star Bulk (NASDAQ: SBLK) 16%, Genco Shipping & Trading (NYSE: GNK) 17% and Safe Bulkers (NYSE: SB) 19%. Dry bulk equities have fallen by double digits over the past two weeks.

Timing a dry bulk rebound

The current slump in dry bulk came as a surprise. The market could theoretically see a surprise recovery as well — depending on what happens in China.

“Dry bulk is a China game, for better or worse,” said Mørkedal. “The recent collapse in the dry bulk market is linked to China’s [COVID] policy [which] resulted in an economic slowdown and hence reduced raw material imports … [and] the unavoidable effect of removing port congestion. Over the summer, we estimate that 5% of the fleet returned to the market.

“Global iron ore trade was down 6% in August compared to the same month last year. Brazil’s iron ore shipments for August were the lowest in five years. [That] has been devastating for the Capesize market.” (A Capesize is a bulker with a capacity of around 180,000 deadweight tons.)

“Looking ahead, we believe there is more upside potential than downside risk,” said Mørkedal. “The bottom line is that if China resumes growth, we believe dry cargo will surprise once more.”

Daejin Lee, lead shipping analyst at S&P Global Market Intelligence, is much more bearish. He predicted dry bulk weakness until the second half of 2023, due to “slower than expected economic growth, with continued weakness in China’s real estate sector as well as the absence of high congestion.”

Tanker equities

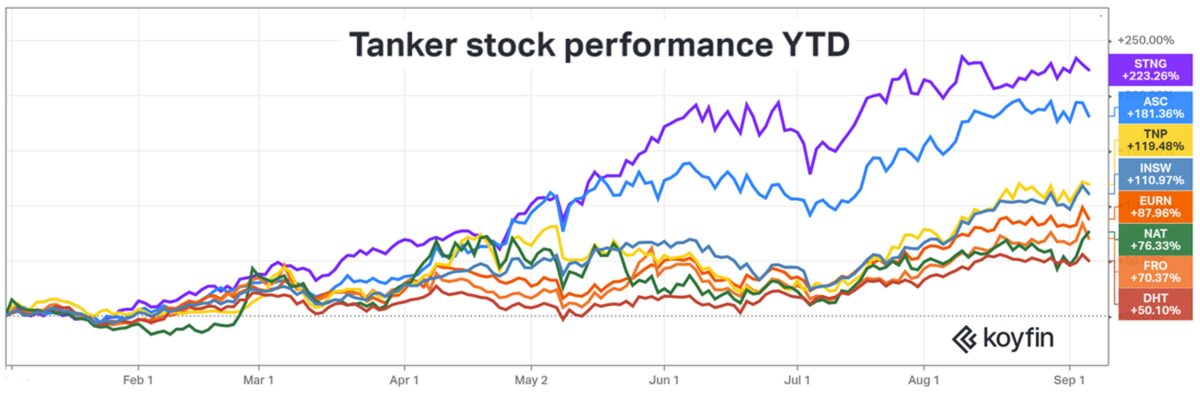

Tanker stocks have moved in the opposite direction of dry bulk and container names.

Fresh one-year highs were hit Tuesday by product-tanker owner Scorpio Tankers (NYSE: STNG), crude-tanker owners DHT (NYSE: DHT) and Euronav (NYSE: EURN), and mixed-fleet owners International Seaways (NYSE: INSW), Frontline (NYSE: FRO) and Tsakos Energy Navigation (NYSE: TNP).

Even though most tanker stocks pulled back on Wednesday by mid-single digits, YTD performance remains very strong.

Pure product-tanker owners have been much better performers than crude-tanker or mixed-fleet owners. Scorpio is now up 223% and Ardmore Shipping (NYSE: ASC) is up 181%. Big gainers on the crude-tanker and mixed-fleet side: Tsakos is up 119% YTD, INSW 110% and Euronav 88%.

Nokta of Jefferies upgraded his outlook for the tanker sector on Monday, predicting strong earnings this winter and throughout 2023 and 2024.

The tanker sector orderbook is historically low, at 5% of existing tonnage, effectively erasing supply side risks. The threats to tanker rates are on the demand side.

As in dry bulk, Chinese demand is very important to tankers. Deutsche Bank analysts Amit Mehrotra and Chris Robertson wrote in a research note: “We believe global demand for crude will continue to recover, but that there will continue to be near-term uncertainty with Chinese demand for crude so long as China pursues zero-COVID policies.”

Russian sanctions pose another threat to tanker demand. The G7 nations said Friday that they will move ahead with a plan to cap prices on Russian crude and products exports. The plan calls for barring U.K. and EU shipping insurance for Russian exports to buyers that don’t cap the price.

If Russia refuses to sell crude or products to nations observing the price cap, the insurance ban would severely restrict the ability for tanker owners to transport Russian cargoes to buyers in Asia or Latin America that don’t participate in the G7’s plan. This would effectively limit supply available to world markets (and tanker transport) — the very outcome the price-cap plan is designed to avoid.

Click for more articles by Greg Miller

Related articles:

- Tankers could profit if US restricts gasoline and diesel exports

- Will energy transition lead to boom or bust for crude tankers?

- Tanker shipping stocks pull away from the pack, hitting fresh highs

- War effect on crude trade: Long-lasting and just beginning

- The plunge in dry bulk shipping: Ominous signal on China’s economy?

- Container line Zim hit by exposure to falling spot rates

- How new EU sanctions on Russia will shake up global energy trade