The approach of Cummins Inc. to hydrogen-fueled internal combustion engines is very different from how and when it talks about most of its products. What gives?

Not a Cummins marketing exercise

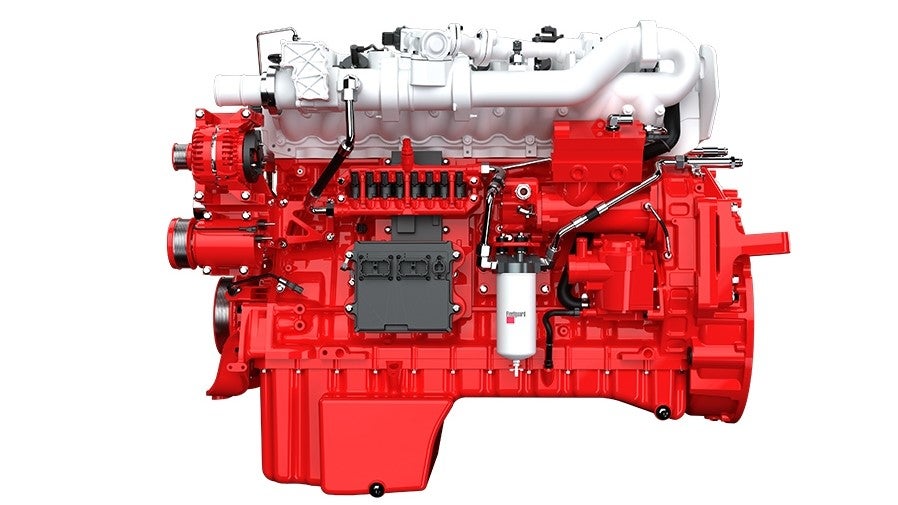

Cummins Inc. doesn’t typically talk about its products much before they are ready for launch. Customers for a new engine, whether branded as bright red-painted Cummins or a private label with Cummins’ technology imbued, take the lead there.

So how does the 103-year-old power and technology provider explain the early attention for its hydrogen-powered internal combustion engine due in 2027.

“I think it is a fundamental shift that we’ve made on this generation of engines that we probably would not have done before,” Srikanth Padmanabhan, the president of Cummins engine business, told me in September at the IAA Transportation event in Hanover, Germany.

“For the first time, we are building it from the ground up, which means we are trying to accommodate various fuels we could use. The second reason is that emission regulations are converging. The harmonizing of these standards allows you to build up in one region and transfer it to another. Before, we could never do it.”

‘A coincidence 20 years in the making’

Even if Cummins had wanted to sync up engines it sold around the world — saving significant engineering and financial resources — the timing of local emissions regulations would not cooperate. As world governments draw closer to zero-emissions mandates, that is getting easier.

“It is a coincidence 20 years in the making,” Padmanabhan said.

For example, the 15-liter ICE engine that debuted as a natural gas offering in China two years ago goes into production in Jamestown, New York, in 2024. Electronic data collection, part of China regulations, tells Cummins enough about the engine’s reliability, duty cycles and durability that the company is confident it will perform on hydrogen, propane or even gasoline.

“All of this put together is why I can talk about what we’re going to do in ’24 and ’27,” Padmanabhan said. “If this was an engine upgrade, our engineers would say until we get the entire spectrum of knowledge, don’t even talk about it.”

Customers do the talking for Cummins

In fact, Cummins’ customers are doing the talking.

Werner Enterprises, an early adopter of many technologies, ordered 500 of the hydrogen ICE engines. Transport Enterprise Leasing (TEL), signed a letter of intent in September to integrate the X15H engines into their fleets when the engines are ready.

“What Werner has done, what TEL has done, is put confidence in this for their sustainability journey because they have gone and told the world that by 2030 or 2035 they are going to be 35% lower [in greenhouse gas emissions] than where they are today,” Padmanabhan said.

Solving for zero emissions at Cummins

Cummins calls its efforts for carbon neutrality Destination 2050. It welcomes practically any technology that will help it achieve the goal.

Total cost of ownership parity for heavy-duty battery-electric and hydrogen fuel cell trucks with diesel is years, if not decades, away. So alternative fuel options that reduce pollution, engine controls that improve efficiency and hybrid options are all on the table.

“Interest in hydrogen is keen because of the opportunity to use a proven and durable ICE technology with an established supply chain and installed base of manufacturing,” Allen Schaeffer, executive director of the Diesel Technology Forum, wrote in a blog post earlier this week.

ICE engines fueled exclusively on hydrogen reduce greenhouse gas emissions to zero, while those that use a small amount of diesel with primarily hydrogen — known as dual fuel engines — reduce emissions by 60% to 90% depending on engine types and load factors, Schaeffer wrote.

Another example is Hyliion Holdings’ Hypertruck parallel hybrid. It operates for 75 miles on pure electricity before switching to a natural gas-powered generator. Cummins is helping Hyliion certify the Cummins 12-liter natural gas engine for the Hypertruck. The 15-liter is right behind.

“We’ll continue to collaborate,” said Brett Merritt, vice president of Cummins’ on-highway engine segment. “We’ll continue to look at what applications we could continue to work together on.”

$1 billion for electric truck charging in California

The California Public Utilities Commission (CPUC) is targeting $1 billion for electric vehicle charging with 70% of the money earmarked for fueling midsize and heavy-duty trucks that don’t have sufficient infrastructure to grow in numbers.

The CPUC is spreading out the costs of the five-year program among utility ratepayers across California. At about $140 million a year for trucking, it falls well short of what’s needed to offset the generous EV purchasing incentives the California Air Resources Board (CARB) doles out. But it helps.

Like the CARB funds, which target communities where pollution from diesel trucks is most obvious, the commission is pointing 65% of the taxpayer funds to those areas.

Aurora and Uber Freight extend partnership

Just in time for holiday shipping, Uber Freight and Aurora Innovation are expanding their autonomous freight-hauling partnership between Dallas-Fort Worth and El Paso. The customer is Veritiv, a provider of packaging materials. Think cardboard boxes, etc.

In the pilot, packaging products and goods are autonomously driven to Veritiv warehouse in western Texas and New Mexico. These packages are autonomously transported more than 600 miles between Aurora’s terminals.

The goal is seamless, on-time delivery, especially crucial during the holiday season.

“This autonomous vehicle pilot aligns with our strategy to assess new technologies to determine the best fit for our business and our customers,” said Mike Walkenhorst, Veritiv senior vice president of global operations and developing businesses.

Best of the rest …

Cowen Inc. raised its global forecast for electric vehicle penetration — passenger and commercial vehicles — to 21.4% in 2025. That’s more than 2.5 times its prior forecast of 9.6%. By 2030, the investment firm sees EVs accounting for 33.2% of all new vehicles, up from its earlier prediction of 25.7%. Cowen’s reasons include the continued success of Tesla, new RVs from legacy automakers and continued growth in China and Europe.

Daimler Truck North America (DTNA) began delivering its second-generation eCascadia Class 8 electric trucks to Penske Truck Leasing, one of its two major partners in testing its first-generation heavy- and medium-duty battery-powered models. Penske accepted two eCascadias on Monday at its headquarters in Reading, Pennsylvania.

Nikola Corp. has advanced to the second phase of a Department of Energy loan program that could help the startup receive as much as $1.3 billion in loan guarantees for its Phoenix Hydrogen Hub LLC. Nikola envisions the hub eventually generating up to 150 metric tons of green hydrogen per day though solar energy on 920 acres of land. But Nikola isn’t crowing yet. The hub and Nikola’s application face a DOE review and evaluation. The energy department will decide whether the loan guarantees will be granted. Meanwhile, Nikola is targeting 2024 to begin producing 30 metric tons of hydrogen a day at the hub.

Briefly noted …

Startup Class 4-7 electric delivery van maker Harbinger has hired former Tesla executive Gilbert Passin as chief production officer …

Following its recent boardroom drama that restored co-founder Mo Chen as executive chairman with 59% control of the autonomous trucking developer’s voting stock, TuSimple Holdings said it won’t be able to file its third quarter 10-Q form with the Securities and Exchange Commission on time. …

Trees the season as Kenworth again delivered the U.S. Capitol Christmas tree to Washington. Startup Hyliion used one of its pilot Hypertruck ERX models to do likewise to New York’s financial district.

That’s it for this week. Thanks for reading. Click here to get Truck Tech in your email on Fridays.

Alan