The nation’s largest flatbed carrier Daseke Inc. (NASDAQ: DSKE) had its recently lowered credit ratings confirmed by Moody’s Investors Service (Moody’s Corp. NYSE: MCO). The June 10 action by the firm confirms the company’s debt rating at B3 and changes the company’s ratings outlook, which was “under review,” to “stable.”

Daseke’s debt, default and liquidity ratings had been under review for “further downgrade” following a March 30 ratings downgrade.

According to the report, Moody’s took into consideration “the company’s position as a leading provider of open deck transportation and logistics services and the generally well-established operational track record of Daseke’s individual group companies.” Also, the report specifically referred to Daseke’s restructuring initiatives as a basis for the decision.

Restructuring on track

Daseke has concluded the first phase of its two-phase operational restructuring, which is aimed at consolidating separately operated flatbed companies that Daseke had acquired over the last decade and reducing tractors, trailers and headcount to better align with the company’s core freight offerings.

On the company’s first quarter conference call, management announced that the first phase of the restructuring had been completed, establishing a $30 million annual run rate improvement in operating income. The second phase is expected to conclude at year-end and provide another $15 million in operating income.

The carrier’s corporate overhaul accelerated when the founder and former chairman and CEO stepped down abruptly last summer. C-level changes have included a new CEO, CFO and COO, with all being appointed to their new roles this year.

In regard to the company’s restructuring actions, Moody’s stated, “the company has become better equipped to contend with the current weak conditions in the industrial and construction sectors in North America.”

The flatbed trucking segment remains depressed as the industrial economy lags. Further, COVID-19-related manufacturing shutdowns, specifically in the automotive sector, and depressed exploration, development and production activity in the oil and gas markets due to weaker demand and plunging prices have cratered the market.

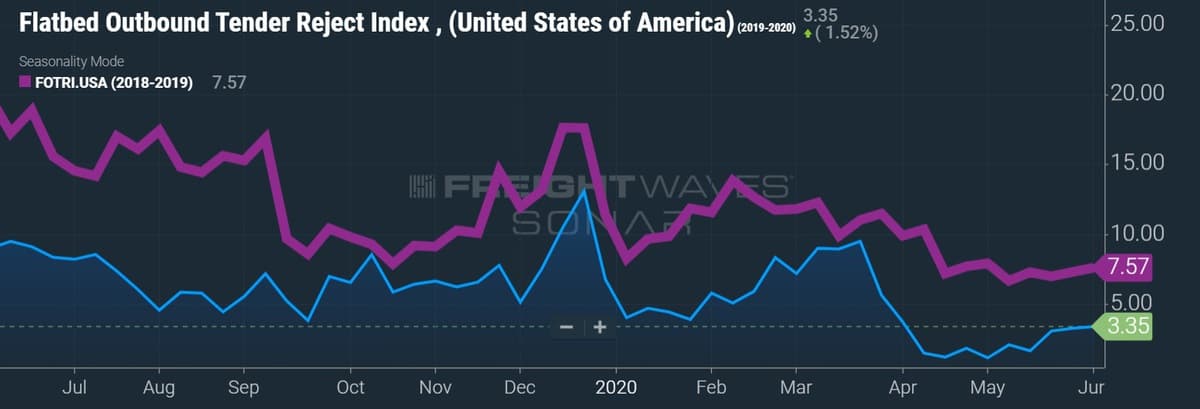

These headwinds are evident in FreightWaves’ Flatbed Outbound Tender Reject Index (SONAR: FOTRI), which measures a carriers’ willingness to accept loads tendered to them by shippers under contract terms. Currently, only 3% of loads are being rejected by carriers, less than half 2019’s lackluster levels, suggesting that there is excess capacity in the market given current demand levels.

Daseke is expected to have less than 2% exposure to the oil and gas sector after the completion of the planned divestiture of Aveda Transportation and Energy Services, an oil rig transportation company.

Margins and liquidity to be driver of future ratings

Moody’s expects Daseke’s “already thin” earnings before interest, taxes, depreciation and amortization (EBITDA) margin, which they measure at 2.4%, “will likely remain pressured in 2020, before improving in 2021.” The firm said a further decline in earnings could potentially increase the carrier’s debt/EBITDA to more than 5.5x, compared to the agency’s current calculation of 4.3x.

The agency warned that a downgrade could occur if it expects liquidity deterioration or if the company’s debt leverage ratio exceeds 6x, along with an interest coverage ratio (Moody’s uses funds from operations plus interest divided by interest as the metric) of less than 2x.

Moody’s listed Daseke’s liquidity as “adequate.”

In its first quarter filing, Daseke reported net debt-to-adjusted EBITDA at 3.2x, which is below its 4x leverage covenant. The company ended the quarter with liquidity of $107.5 million in cash and equivalents and $84.4 million available on its revolving credit facility. Total debt of $693.6 million, $586.1 million net of cash and equivalents, improved from the $608.4 million in net debt reported at the end of 2019.

Moody’s expects the company’s free cash flow “to be moderately negative in 2020, about $20 million, in part due to sustained investments in tractors and trailers.”

Daseke generated net cash from operations of $29.7 million, recording $4.5 million in cash capital expenditures (capex) with cash proceeds from equipment sales of $5.8 million during the first quarter. An additional $9.8 million in capex was financed with debt and capital leases. Free cash flow was $31 million in the period, down $6.1 million from the prior year quarter.

Moody’s free cash flow calculation includes financed capex and excludes proceeds from used equipment sales.

The report stated that a future upgrade could be in store if Daseke’s EBITDA margin reached at least 4% and the company achieved “consistently positive free cash flows.” Other factors for an upgrade include a debt leverage ratio under 4.5x and an interest coverage ratio of at least 3x.

Shares of DSKE are off 4% in midday trading.

Click for more FreightWaves articles by Todd Maiden.

Aleena martin

It’s confirm news because just buy shares