The container market continued to show strength in March as the pull forward ahead of the Lunar New Year continues to pay dividends at the ports.

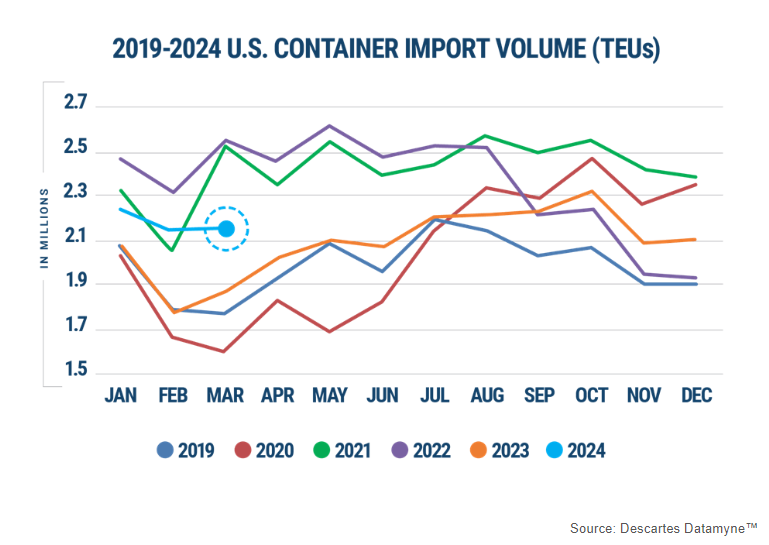

According to the monthly report by Descartes, U.S. container import volumes in March climbed by 0.4% from February and over 15% from March 2023. The year-over-year gains can be explained by the timing of the Lunar New Year: This year’s holiday occurred nearly three weeks later than in 2023.

Descartes reported that U.S. container import volumes in March totaled 2.145 million twenty-foot equivalent units during March, the third-highest March since 2019, trailing only the COVID-19 pandemic-induced surge in imports in 2021 and 2022.

The first half of the month experienced the strongest boost to imports. Descartes reported that total container imports in that period were over 22% higher than they were a year ago.

The Logistics Managers’ Index reported that inventory levels grew faster in the first half of March than the back half, lending credence to the growth in imports during the first half of the month.

Additionally, with the timing of the Lunar New Year later in February, the impacts started showing up domestically in the latter parts of March.

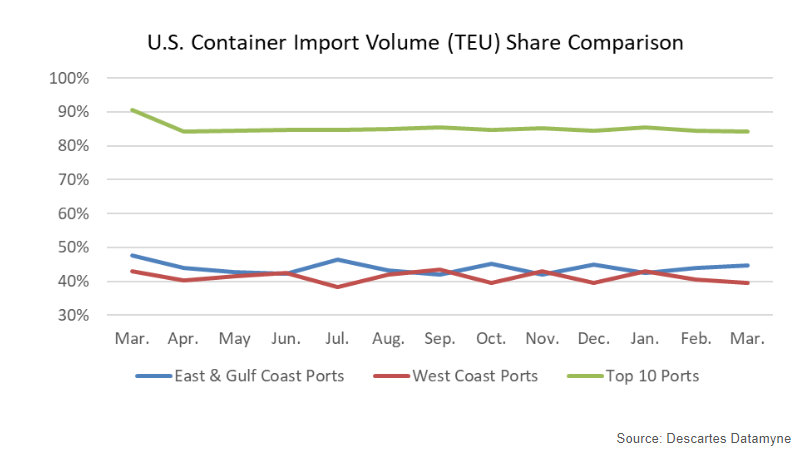

Despite talk of West Coast ports clawing back market share from East Coast ports due to challenges at the Panama Canal and ongoing labor negotiations with the United States Maritime Alliance (USMX) labor union, it has failed to materialize. In fact, according to the most recent Descartes report, the top five East Coast ports grew market share during March and now control over 44% of overall import market share.

The top 10 ports in total have lost share as a whole as supply chains have become more diversified the past few years. That continued in March. The total market share of container imports handled by the 10 largest ports in the country dipped by 0.3 percentage points month over month to 84.2%. This time last year, the 10 largest ports in the country handled over 90% of total import volume.

The ports where volume grew the most were actually on the West Coast, despite the top five ports relinquishing market share in March. The Ports of Oakland, California, and Tacoma, Washington, experienced the largest gains month over month, with imports growing by 6.6% and 18.9%, respectively.

The Port of Los Angeles saw import volumes decline by 7.8% m/m, as TEUs dropped by over 30,000 for the second consecutive month. While on a national basis the second half of the month was more challenging than the beginning, it was the opposite story at the Port of Los Angeles. The end of March and early April, imported TEUs reported by U.S. Customs and Border Protection highlight year-over-year growth after the Lunar New Year holiday-related lull in imports passed.

On the East Coast, it was more of a mixed bag. The Port of New York and New Jersey experienced growth of 4.5% m/m. Farther south, the ports of Norfolk, Virginia, and Charleston, South Carolina, saw import volumes grow by 5.6% and 4.9% m/m, respectively.

Descartes highlighted how the collapse of the Francis Scott Key Bridge in Baltimore at the end of the month did have an impact on overall import volumes. In total, the Port of Baltimore’s import volumes dropped by 15.7% m/m, according to the report.

What comes next?

The Inbound Ocean TEUs Volume Index, which measures the number of TEUs based on when the vessel departs overseas, recovered from the Lunar New Year, reaching near peak season 2023 levels. At present, the IOTI is 11% higher than it was this time last year. This continued strength compared to the prior year is an indication that import volume will continue on a positive growth trajectory.