Management from supply chain software-as-a-service provider Descartes noted several headwinds in the market currently but said it was confident the company will continue to perform.

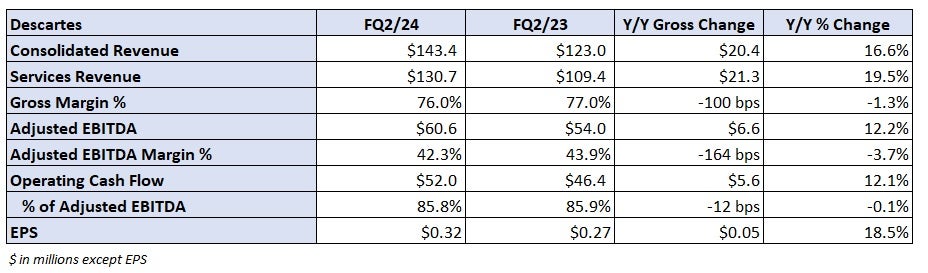

Descartes (NASDAQ: DSGX) reported earnings per share of 32 cents for the 2024 fiscal second quarter, ended July 31, after the market closed Wednesday. The result was a penny light of the consensus estimate but a nickel higher year over year (y/y).

CEO Ed Ryan said softer consumer demand and elevated retail inventories may weigh on fall replenishment cycles. Currently, shipment volumes are tepid, largely tracking pre-pandemic trends, and reduced volumes through the Panama Canal could impact freight flows in the near term.

“We’ll see what happens but we like our chances either way,” Ryan said.

The Canada-based company reported record revenue of $143 million, which was 17% higher y/y and exceeded management’s guidance of $120.5 million. Adjusted earnings before interest, taxes, depreciation and amortization totaled $61 million, which was 12% higher y/y and within management’s long-term annual guidance range of 10% to 15% growth. The company previously guided to $44.5 million in adjusted EBITDA for the quarter.

Cloud-based acquisitions fueled the growth.

Descartes acquired final-mile solutions provider GroundCloud in February, and in May it added Localz, an order management service.

The company guided fiscal third-quarter revenue of approximately $124 million with adjusted EBITDA of $46 million.

Descartes generated $52 million in operating cash flow during the quarter, ending the period with $227 million in cash and no debt. The company’s cash position increased $38 million from the year-ago period.

More FreightWaves articles by Todd Maiden

- Forward Air says ‘earned trust’ a must after Omni acquisition

- XPO holds volume gains in August

- August transportation prices decline at slowest pace in a year