Supply chain software provider Descartes said concerns over potential changes in trade policy are driving increased demand for its global trade intelligence offering.

“Every customer that moves multiple products to multiple countries is a potential target for this,” CEO Ed Ryan told analysts on a quarterly call Tuesday. He said companies need access to accurate trade and tariff rules to guarantee they are paying the correct rates. He described the changing landscape as a “massive opportunity.”

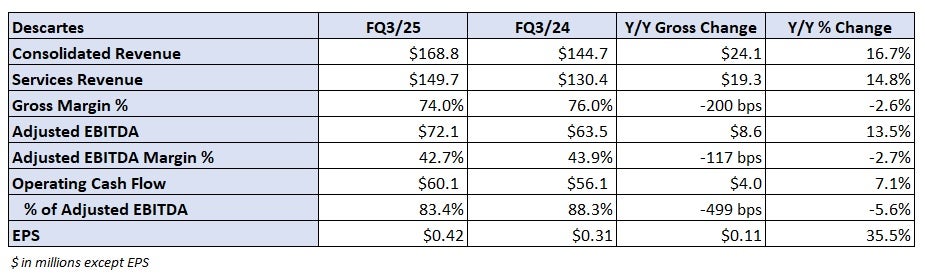

Descartes (NASDAQ: DSGX) reported earnings per share of 42 cents for its fiscal quarter ended Oct. 31. The result was in line with the consensus estimate and 11 cents higher year over year.

Record revenue of $168.8 million was up 16.7% y/y. Organic growth was up 10% y/y in the quarter.

Flat U.S. truck volumes were outpaced by strength in air cargo and ocean container shipments. Global trade has seen an uptick as many companies look to bring inventory into the country ahead of potential tariff changes.

Adjusted earnings before interest, taxes, depreciation and amortization of $72.1 million was also a new record and 13.5% higher y/y.

The Canada-based company generated $60.1 million in cash flow from operations in the period, a 7.1% y/y increase. During the quarter, Descartes used $22.5 million in cash to acquire MyCarrierPortal, which provides technology allowing brokers to accurately identify and authenticate carriers. It also used $110.2 million in cash to acquire omnichannel e-commerce solutions provider Sellercloud.

Descartes has made five acquisitions this year.

It ended the quarter with $181.3 million in cash and an untapped $350 million line of credit, which it will use to fund future acquisitions.

The company reiterated a goal to grow adjusted EBITDA by 10% to 15% annually through organic initiatives and acquisitions.

Management’s baseline calibration calls for $55 million in adjusted EBITDA in its fiscal fourth quarter ending Jan. 31.