Supply chain software-as-a-service provider Descartes said Wednesday that February was likely the low point for the cycle, noting demand trended up somewhat in March and April.

The company has seen ocean imports increase sequentially since February to a level that is in line with pre-pandemic levels as retailers have made progress selling through excess inventories. It also noted that China-originated orders increased in April but that it’s still too early to say if this is indicative of a new trend line.

“If I use April as an example, I’m optimistic about what we see in May,” CEO Ed Ryan told analysts on a Wednesday evening call. Ryan tempered the remarks somewhat, noting it’s still a “mixed-news economy at the moment.”

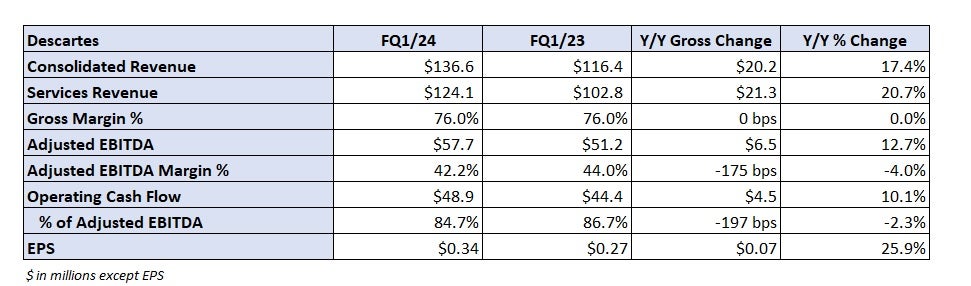

The Canada-based company reported earnings per share of 34 cents for the 2024 fiscal first quarter ended April 30 after the market closed, 7 cents higher year over year (y/y) and a penny ahead of the consensus estimate.

Descartes (NASDAQ: DSGX) reported revenue of $137 million, 17% higher y/y and better than management’s guidance of $117 million. Two acquisitions in the period partially contributed to the growth. A strong U.S. dollar resulted in a $2 million revenue headwind in the quarter.

Services revenue increased 21% y/y to $124 million, 9% higher on a same-store comparison.

Adjusted earnings before interest, taxes, depreciation and amortization came in at $58 million, $15 million better than the outlook provided a quarter ago. A 13% EBITDA growth rate was in line with management’s long-term guidance calling for growth of 10% to 15% annually.

Management expects fiscal second-quarter revenue of $120.5 million, with adjusted EBITDA of $44.5 million.

Ryan said customers that previously indicated they may slow project spending “continued to greenlight their logistics and supply chain investments” over the past six months.

“Most of our customers seem to be in pretty good shape,” he said. “Certainly, the volumes on our network continue to be strong, so we’re happy about that.”

Descartes generated $49 million in operating cash flow during the quarter, ending the period with $182 million in cash and no debt, down from a cash balance of $276 million at the end of the January quarter. The change was largely due to recent acquisitions of GroundCloud, a cloud-based final-mile solutions provider, and Localz, a cloud-based order management service.

More FreightWaves articles by Todd Maiden

- Teamsters approve strike at ABF Freight if needed

- No seasonal uptick in May forces Landstar to lower guidance

- J.B. Hunt, Schneider still waiting for intermodal demand to turn

G

Foreign people doing security at the truck stop, walk up to you and ask for a cigarette and if you give them one your arrested for some oridence then they take you somewhere to talk then put a bullet in your head claiming you were resisting. Claiming they’re doing security work , and when a US Veteran shows up they go into attack mode and keep Hustling you until you get angry enough they can shoot you claiming they’re doing security work