Supply chain software provider Descartes reported record quarterly results for its fiscal quarter ended July 31. The Canada-based company noted weak truck volumes and revenue pressure on parcel carriers as headwinds, which were offset by higher ocean import volumes.

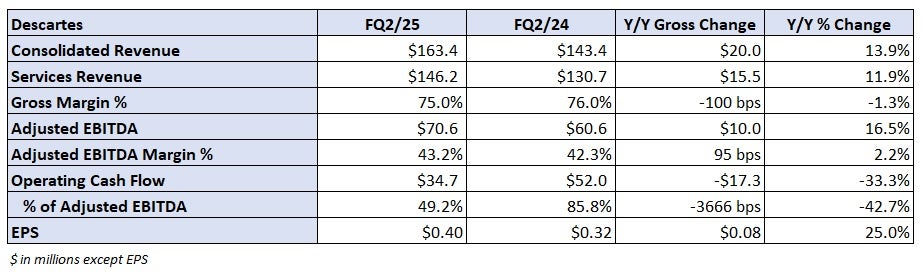

Descartes (NASDAQ: DSGX) reported earnings per share of 40 cents in the period, 8 cents higher year over year and 3 cents better than the consensus estimate.

Consolidated revenue increased 13.9% y/y to $163.4 million. Organic growth was up roughly 9% y/y in the period.

“Our Global Logistics Network is designed to help shippers, carriers and logistics services providers navigate an increasingly complex global trade landscape,” said CEO Ed Ryan in a news release. “Supply chains and logistics operations continue to struggle to manage a myriad of factors, including military conflicts, disruptions to trade routes, government sanctions, economic impact on shipping demand and material changes to taxes and tariffs.”

Adjusted earnings before interest, taxes, depreciation and amortization of $70.6 million was 16.5% higher y/y. The company reiterated a goal to grow the business by 10% to 15% annually through organic initiatives and acquisitions.

It acquired shipment management solutions provider BoxTop Technologies for $12.1 million in the quarter. The deal was funded with cash on hand.

Descartes generated $34.7 million in cash flow from operations in the period, a 33% y/y decline. The decline was tied to $25 million in earnout payments for better-than-expected financial performance at companies it previously acquired. It ended the quarter with $252.7 million in cash and an untapped $350 million line of credit, which it will use to pursue future acquisitions.

The company’s baseline calculation calls for $53.5 million in EBITDA in its fiscal third quarter.