You can look at the new earnings guidance of Hapag-Lloyd, the world’s fifth-largest shipping line, in two very different ways: by comparing it to wildly exceptional boom-time windfalls that will likely never be seen again, or by comparing it to historical norms.

On Thursday, Hapag-Lloyd announced guidance for earnings before interest, taxes, depreciation and amortization of $4.3 billion to $6.5 billion for full-year 2023.

That equates to a 68%-79% plunge versus 2022 EBITDA of $20.5 billion. That’s a huge percentage drop. It sounds ominous (and makes for a catchy headline). But both 2022 and 2021 were extreme outliers to the upside.

Even if Hapag-Lloyd ends up at the low point of its projected range, 2023 would be the third-best year in the company’s history.

Furthermore, the German shipping line is heading into the cyclical downturn with an unprecedented cash cushion.

At the end of 2019, pre-pandemic, Hapag-Lloyd had liquidity of $1.2 billion. At the end of 2022 — even after making multiple acquisitions — liquidity had ballooned to $17 billion.

Hapag-Lloyd has completely deleveraged its balance sheet. It’s now $13.4 billion net cash positive, with no net debt. At the end of 2019, it had $6.6 billion in net debt, at three times EBITDA.

Despite collapsing spot rates and schadenfreudian talk of “hard landings,” larger shipping lines like Hapag-Lloyd are a long way off from anything that even vaguely resembles financial distress.

2023 profitability will be ‘front-loaded’

The company reported net income of $3.3 billion in the fourth quarter of 2022, down 20% year on year and a 37% slide versus the all-time high hit in Q3 2022.

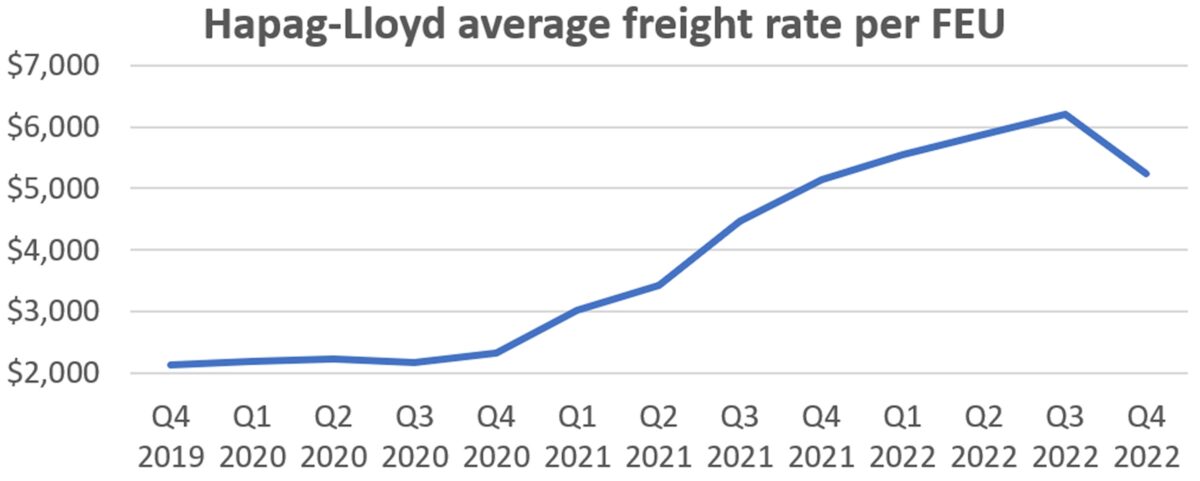

Freight rates (including both spot and contract rates) averaged $5,250 per forty-foot equivalent unit in Q4 2022, up 2% year on year.

Rates in the latest quarter were down 15% compared with the peak reached in Q3 2022. However, they were still 2.5 times average rates of $2,124 per FEU in Q4 2019, pre-pandemic.

“Declining spot rates were more than compensated for by our contract rates,” said Hapag-Lloyd CFO Mark Frese during a conference call with analysts on Thursday.

“However, despite our high share of contract business, we are not immune to market downturns. Our average freight rate clearly declined in Q4 compared to the previous quarter,” said Frese.

CEO Rolf Habben-Jansen said the support from contract rates will continue to erode this year. “Profitability in 2023 will be somewhat front-loaded because you still have some tailwind from the contracts that were closed last year,” he said.

Spot rates are already down to pre-COVID levels, said Habben-Jansen. “That is a problem, because when we look at unit costs these days, they are definitely elevated. This means that over time, [spot] rates will have to bounce back somewhat, because they won’t stay below unit costs for very long.”

Rebound expected later this year

“We’ve had a subdued market in the last couple of months,” he explained. Demand fell in the aftermath of Lunar New Year, as was traditionally the case before the pandemic. But demand did not follow the usual pattern of increasing prior to that holiday. It remained weak.

“What I think we see at the moment is subdued demand because of destocking. I expect this to continue a little bit longer as the destocking cycle is completed.

“We would expect a bit of a rebound in the course of the year. Exactly when is difficult to estimate … which is why we came up with a broad range in our outlook [EBITDA guidance].”

Newbuilding delivery delays predicted

Another big uncertainty is how the vessel supply situation will play out given the tidal wave of newbuilding tonnage about to hit the market.

Hapag-Lloyd does expect supply to outpace demand. Yet its supply-demand balance outlook is more balanced and less dire than some other sources’ projections. The ocean carrier makes large assumptions on both scrapping of older tonnage and slippage of new tonnage delivery dates.

Hapag-Lloyd projects supply and demand changes will roughly align this year, up 2% in both cases — but only if the 2.5 million twenty-foot equivalent units of gross capacity growth is whittled down to a net gain 500,000 TEUs. This would entail 1.1 million TEUs of slippage of 2023 deliveries to next year, plus 900,000 TEUs of scrapping.

If scrapping and slippage don’t reach those levels, capacity could rise as high as 8%, quadruple projected demand growth.

Hapag-Lloyd expects supply growth of 4% to outpace demand growth of 3% in 2024. But this assumes gross capacity gains of 4 million TEUs are brought down to just 1 million net TEUs by 2 million TEUs of slippage plus 1 million TEUs of scrapping. If not, capacity could increase by as much as 9%, triple projected demand growth.

Asked on the call why Hapag-Lloyd expects so much slippage of newbuilding delivery dates, Habben-Jansen said, “The yards are scaling up activity from a very low period to a very busy period. What we see is that it’s simply taking longer than some people would have hoped.

“There were issues around availability of materials although most of those have now been resolved,” he continued. “Also, when you look back over the last year and a half, there were all kinds of COVID-related restrictions at a number of yards. Those have caused delays.

“We’re not talking about delays of years. But even if everything moves back just three to six months, that has a material impact on the number of ships that are going to be delivered [in a given year].”

Click for more articles by Greg Miller

Related articles:

- Container lines still chartering ships despite drop in cargo demand

- ‘Colossal’ tidal wave of new container ships about to strike

- Container trade’s next turn: Price wars, cheap contracts, new ships

- Maersk: Container shipping contract rates will sink to spot levels

- Lag effect: Why liner profits stay high much longer than spot rates

- Container shipping’s ‘big unwind’: Spot rates near pre-COVID levels

- Here’s how container shipping lines can escape a crash in 2023