“Our largest export commodity continues to be air” is a frequent saying of Gene Seroka, executive director of the Port of Los Angeles. That’s certainly true at his port, where exports are containerized. Far more empty boxes leave than full ones, so they can be reloaded quickly in Asia.

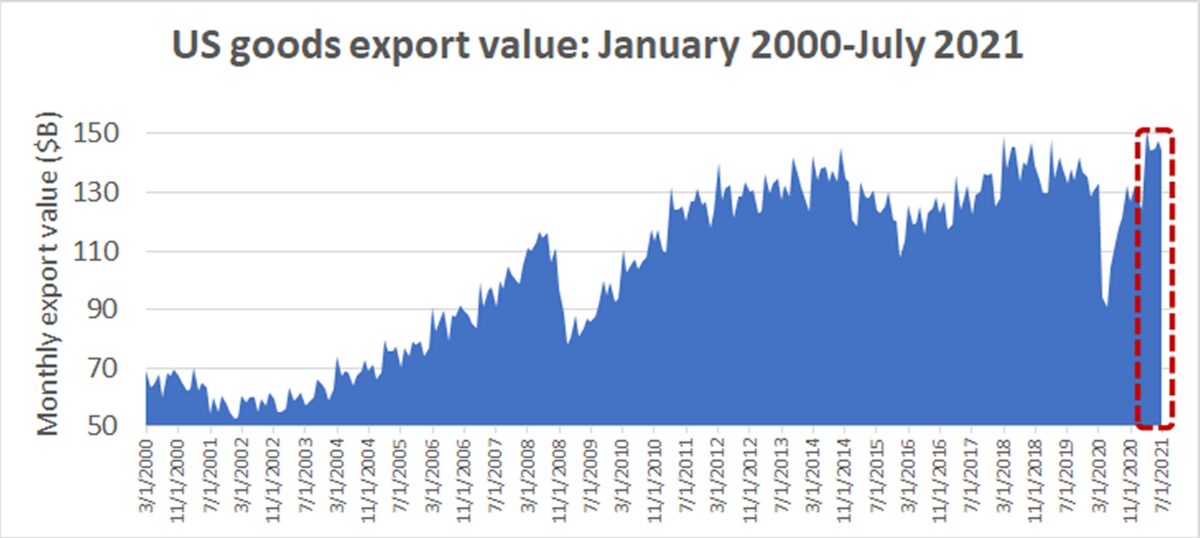

But look at the big picture and U.S. exports are actually rising — and on track for a record year. It’s just that more exports are being loaded aboard tankers and dry cargo vessels as opposed to container ships.

The value of U.S. goods exports in the first seven months of the year topped those in any previous January-July period, according to Census Bureau statistics, reaching $990 billion.

Outbound cargoes of soybeans, corn, coal, liquefied natural gas (LNG) and liquefied petroleum gas (LPG) are all up, while sales of crude and refined products are still healthy despite COVID fallout.

Agribulk

Smaller agricultural goods and foods exporters have been particularly hard hit by the shortage of export containers. Their plight is one of the drivers of legislation to reform the Shipping Act.

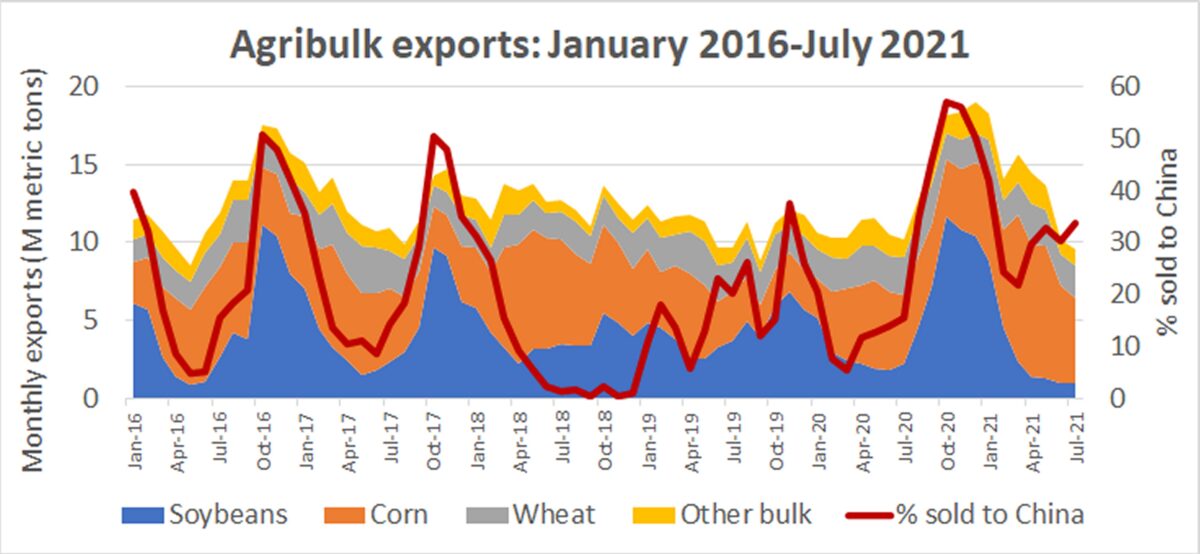

It’s a totally different story for agribulk cargoes shipped in dry cargo bulkers. Volumes have rebounded strongly since the Trump administration’s trade war, the swine flu outbreak in China and the early days of the pandemic.

Agribulk export sales began to surge last October, fueled by purchasing in China, according to data from the Department of Agriculture’s Foreign Agricultural Service. Exports in June-July (including soybeans, corn, wheat and other bulk goods) totaled 96 million metric tons, the highest total ever recorded in the first seven months of a year.

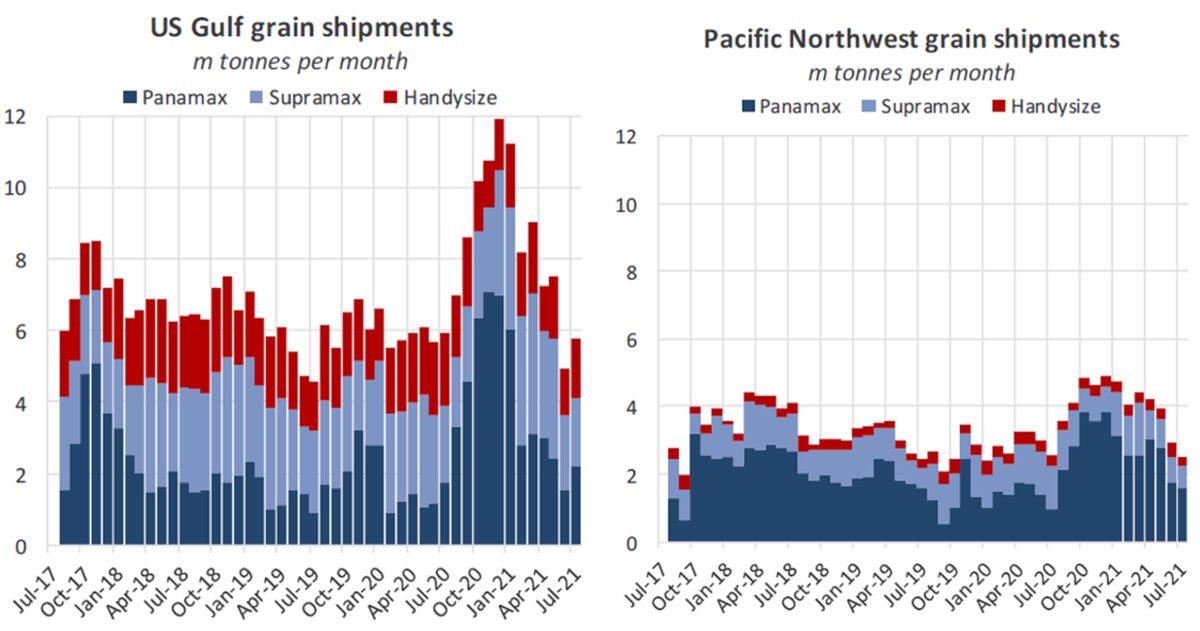

U.S. agribulk largely ships aboard Panamax (65,000-90,000 deadweight ton or DWT) and Supramax (45,000-60,000 DWT) bulkers. Data from Braemar ACM Shipbroking confirms a rise in Panamax and Supramax loadings coinciding with U.S. export sales.

Strong global volumes of agribulk — as well as coal and other commodities — have propelled Panamax and Supramax spot rates higher than they’ve been in over a decade, to $36,100 and $37,200 per day, respectively, as of Friday, according to Clarksons Platou Securities.

Natural gas

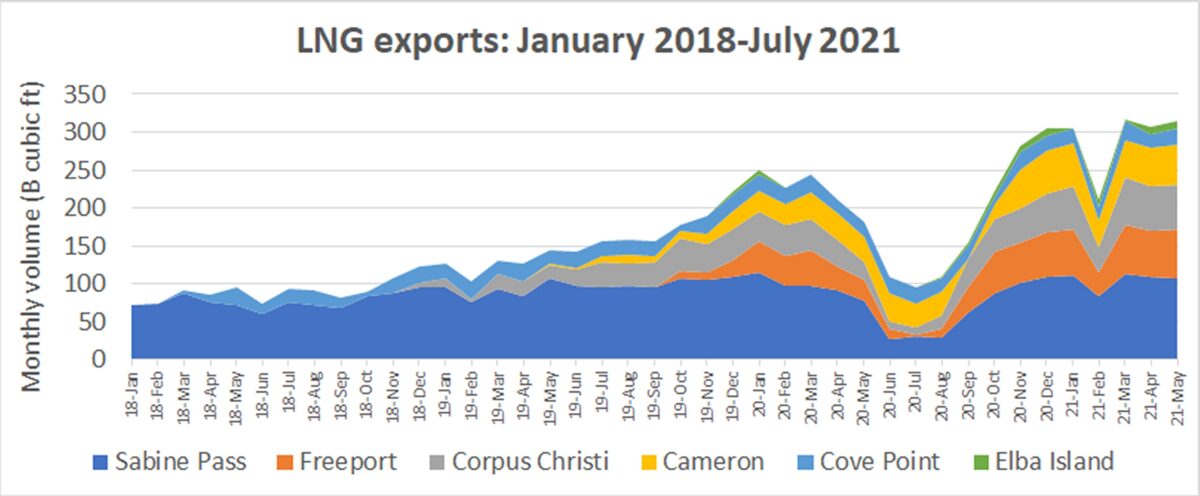

Natural gas is the biggest U.S. export success story in terms of sheer volume growth.

LNG export facilities that debuted in recent years saw volumes temporarily plummet last June-August due to COVID, but that setback was short-lived.

According to data from the Department of Energy (DOE), LNG exports totaled 2 trillion cubic feet in January-July, the best first seven months of the year ever by far, despite the hiccup caused by winter storm Uri in February. Volumes were up 54% from January-July 2020 and 118% from the same period in 2019. According to data from Argus Media, U.S. exports remained at those high levels in August and September.

Natural gas prices are now historically high in both Europe and Asia, where there is an worsening power shortage. The Japan-Korea Marker (JKM), had risen to over $34 per million British Thermal Units (MMBtu). The two European benchmarks, TTF Netherlands and the U.K. National Balancing Point (NBP), are very close to the JKM. The U.S. Henry Hub price is nearing $6 per MMBtu.

Flex LNG (NYSE: FLNG) estimated in a presentation published Thursday that a typical cargo could be purchased in the U.S. for $20 million and sold in Europe for $112 million and $128 million, respectively, equating to arbitrage upside net of shipping costs of $92 million to Europe and $108 million to Asia.

The prospects for U.S. LNG exports are so strong that domestic natural gas consumers are worried. On Sept. 17, the trade group Industrial Consumers of America urged the DOE to intervene and reduce LNG exports “to prevent a supply crisis and price spikes for consumers this winter.”

Coal

As with LNG, prices of thermal coal — coal used for power generation — are at all-time highs in Europe and Asia. Prices now top $200 per ton. Despite long-standing environmental concerns over burning coal for fuel, demand going into winter should drive more exports of U.S. coal.

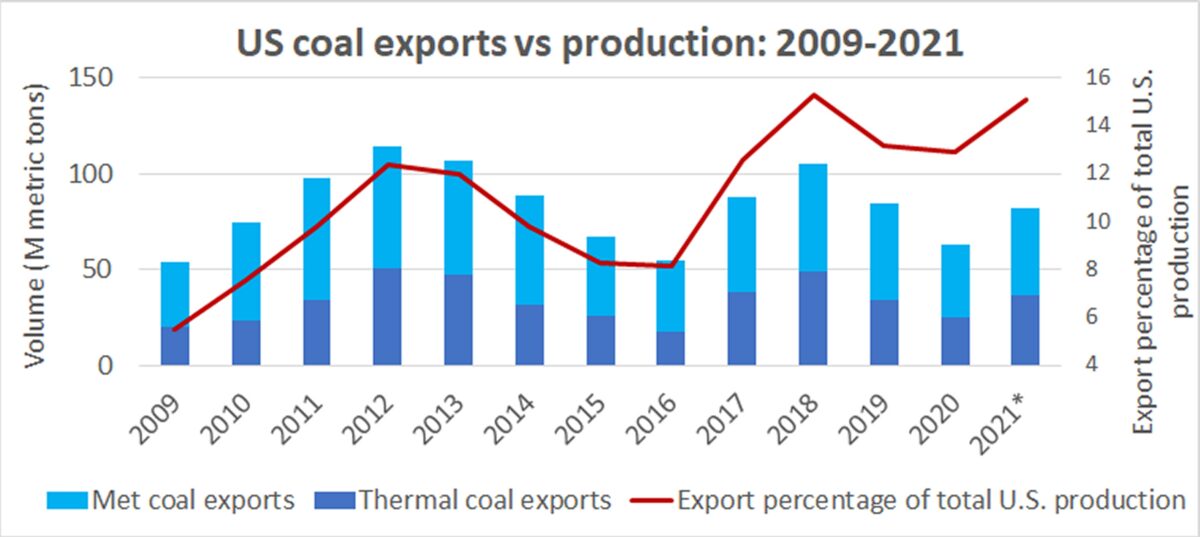

The U.S. Energy Information Administration (EIA) currently predicts the U.S. will export 82.1 million metric tons of coal in 2021, up 30% year-on-year and on par with pre-COVID levels in 2019. This year’s gains are being largely driven by thermal coal shipments, which the EIA expects to rise 49% year-on-year. Exports of metallurgical (met) coal — coal used to produce steel — are expected to rise 20%.

Outbound volumes will fall well short of the recent peak in 2018 (104.9 million metric tons) and the all-time high in 2012 (114.1 million). Even so, exports are increasingly important to America’s coal miners.

With domestic consumption constrained by environmental rules and competition from natural gas, exports’ share of total production is growing, from just 5.5% in 2009 to an estimated 15% this year, matching the all-time high in 2018.

LPG

The U.S. and Middle East are the world’s primary sources of LPG (the predominant LPG cargoes are propane and butane). LPG is transported in specialized tankers; U.S. cargoes to Asia ship aboard so-called very large gas carriers, vessels with capacity of around 84,000 cubic meters.

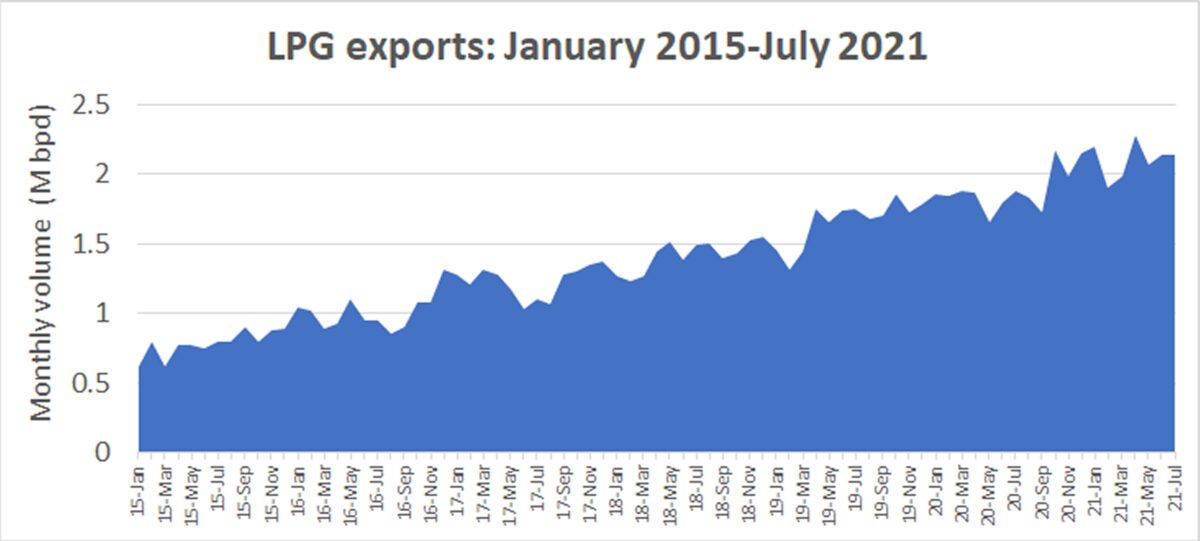

U.S. LPG exports are on the rise. According to EIA data, exports averaged 2.1 million barrels per day (bpd) in January-July, up 15% from the same period last year and up 32% from January-July 2019. Preliminary data from the EIA shows continued LPG export strength through September.

Crude oil and refined products

COVID has crude oil and refined products demand particularly hard, with crude and tanker rates still below all-in cash breakeven.

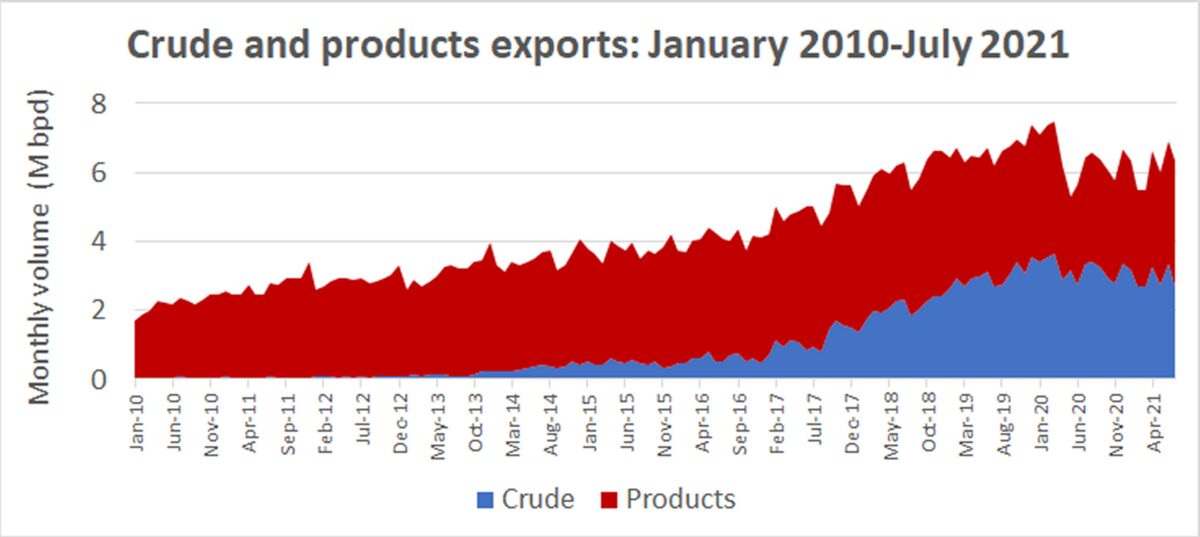

And yet, combined U.S. exports of crude and products in the first seven months of this year averaged 6.17 million bpd, according to EIA data. That’s the third best January-July period on record.

Combined crude and products exports averaged 6.51 million bpd in the first seven months of last year, when a collapse in pricing incentivized shippers to fill up tankers for floating storage, and 6.46 million bpd in January-July 2019. But even though 2021 exports are below 2019-2020 volumes, pricing is back up to 2018 levels, boosting petroleum sales’ effect on America’s trade balance.

U.S. exports play an outsized role in demand for very large crude carriers (VLCCs, tankers that carry 2 million barrels) because the voyage distance from the U.S. Gulf to China (via Cape of Good Hope) is 2.5 times as long as the voyage to China from the Middle East. As a result, U.S. exports soak up more VLCC capacity.

U.S. crude exports averaged 2.95 million bpd in the first half, despite COVID-constrained global demand and refiners tapping inventories. Preliminary data from the EIA shows crude and product exports holding firm through September.

Click for more articles by Greg Miller