(PHOTO: SHUTTERSTOCK)

Story by FreightWaves’ Zach Strickland

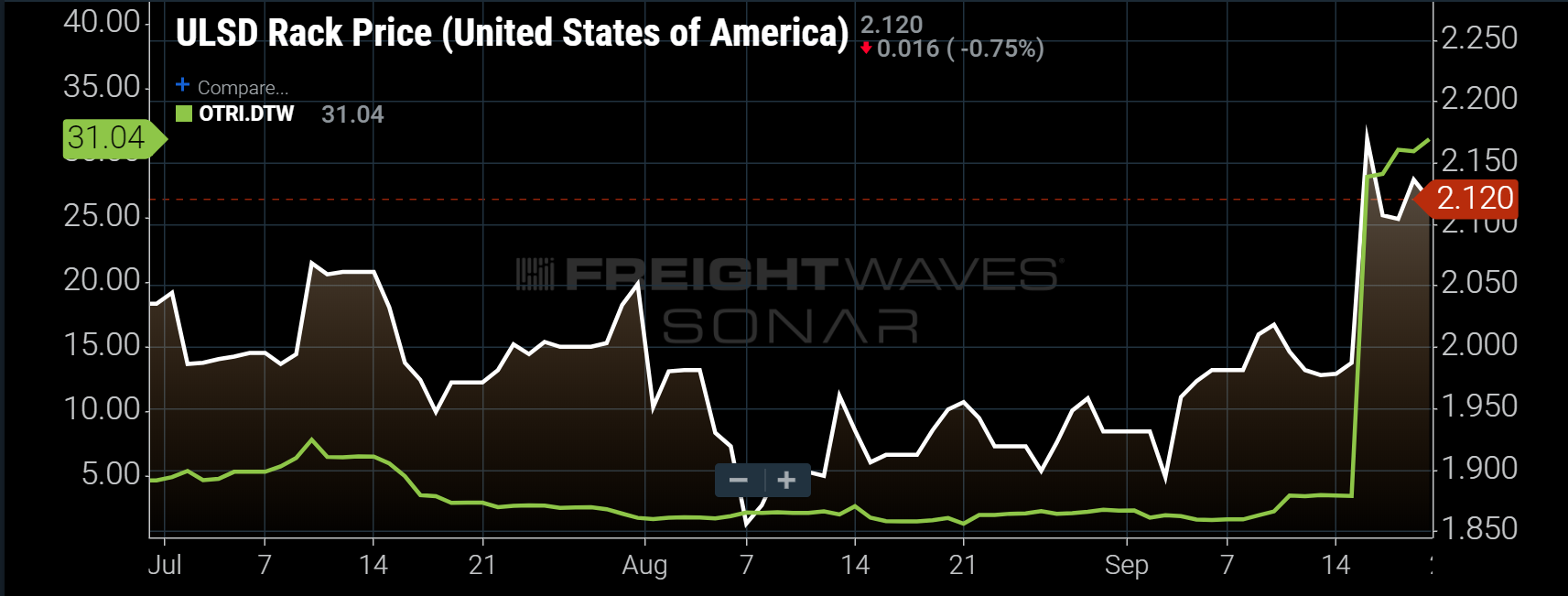

Chart of the Week: Ultra-Low Sulfur Diesel Rack Price – USA, Outbound Tender Rejection Index – Detroit (SONAR: ULSDR.USA, OTRI.DTW)

Like an earthquake, the two major stories of the week hit trucking hard with the fallout yet to be fully measured as neither are fully resolved. The attack on Saudi Arabian oil production and the General Motors labor strike had an immediate impact to the freight market as wholesale diesel prices jumped $0.16/gallon on Monday (not including taxes), while outbound rejection rates spiked out of the Detroit market. Both events were quick and severe, but in the long run, several concerns for the trucking sector still exist.

Automotive Turmoil

On September 15 nearly 50,000 United Auto Workers (UAW) went on strike, which slowed the flow of parts from U.S. plants to General Motors (GM) facilities. The near-term impact was quick and somewhat obvious as carriers avoided the Detroit drama by rejecting freight movements in and around the area, anticipating long lines and delays at consignees. Some of these carriers are potentially union carriers who want to support the UAW, but that level of detail is not available in the data.

Detroit’s August automotive production has grown 6.7% since last year with 153,210 units. Image: SONAR Auto production tree map

Detroit is the largest producer of domestically produced consumer vehicles in the U.S. and GM is a big part of that market’s economy. There are many parts manufacturers in the area that supply the assembly plants that move on trucks.

Earlier in the week U.S. based Martin Transportation Systems temporarily laid off approximately 100 Canadian employees in relation to the strike as it hauls freight for GM between the U.S. and Canada facilities. All these outcomes are short-lived, but the implication for the coming months are still awaiting the results of the ongoing negotiation, which at the time of this article were still ongoing.

The automotive sector represents under 2% of the total market share value of goods being moved via surface transportation in the U.S. including rail. That does not include the raw materials such as metals that are moved prior to production, however. It is a much larger portion of the for hire dry van carrier market which excludes most of the energy commodities such as gas and oil.

The real issue is sudden change. Trucking operators are typically not flexible as operations require some level of consistency to remain efficient and competitive. The cost to shift focus is typically too great to overcome for carriers who typically operate around a 5% operating margin.

Niche markets such as auto parts haulers are specialized in a relatively small amount of lanes hauling on a strict schedule reliably. Their overhead costs are also adapted to a higher paying type of freight as most of the automotive sector operates on just-in-time processes, where product arrives close to the time of assembly and is not stored for long.

Diesel Price Uncertainty

The attack on Saudi Arabian oil facilities caused wholesale prices of diesel to jump on Monday, which will compress carrier margins who buy off the “rack” and base their fuel surcharges on the Department of Energy’s (DOE) Monday release of the average retail price of diesel.

The DOE number is not as reactive as the wholesale or rack price, which responds rapidly to spot market prices on the commodities exchange. Over time, they do approach each other, but rapid changes will increase or decrease the spread between the two values. Rapidly increasing wholesale prices has an adverse effect on carriers as the pass-thru cost is based on the slower moving retail number.

The net impact to carrier’s based on a 6.5 mile-per-gallon average is roughly 2.4 cents per mile of margin compression. This amount does not seem substantial, but when carriers are only making $0.01 – $0.02 for every dollar spent, every penny counts.

In the long run there are potential pros and cons to the recent event. One pro is increased demand for American oil, which will stimulate the domestic economy. Foreign countries, who were using Saudi oil, are now aware of the vulnerability of the infrastructure to attack, which will force them to consider alternative sources.

The con is the fact diesel is still exposed to oil market volatility due to speculation. More uncertainty over supply, means there is more potential for violent price swings impacting carrier cost structures.

About the Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real-time. Each week a Market Expert will post a chart, along with commentary live on the front-page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry in real time.

The FreightWaves data science and product teams are releasing new data sets each week and enhancing the client experience.

To request a SONAR demo click here.