The price of ultra low sulfur diesel on the CME commodity exchange has tacked on more than 45 cents in just two trading days.

The sharp increase is being fueled in part by extremely tight inventories of both diesel and jet fuel. Jet and diesel are both distillates, and the strong price of jet fuel relative to crude and other products in recent days has raised fears that production at refineries will shift heavily toward the more profitable manufacture of jet and away from diesel.

Ultra low sulfur diesel on CME rose 25.4 cents a gallon Wednesday, a day after the price rose 19.67 cents a gallon. While the settlement Wednesday of $3.7184 a gallon is still well under the March 24 price of $4.1534, the highest price in the history of the contract, the two-day gains are significant.

However, in the crazy volatility that has marked oil and diesel trading recently, those two increases aren’t even close to the biggest one-day gain — 51.58 cents per gallon on March 8. Even as a two-day gain, the 45.07 cents per gallon is not on the level of the almost 50-cent two-day gain March 17 and 18.

Total stocks of 6.466 million barrels of jet fuel in the East Coast’s PADD 1 region, reported by the Energy Information Administration Wednesday, are the lowest in more than 30 years. The New York harbor market last week climbed to a value that translated to prices well above $7 a gallon.

Meanwhile, national inventories of ultra low sulfur diesel, at just over 100 million barrels, are the lowest they have been since November 2019.

The result in the market is that while ULSD rose 7.33% Wednesday, U.S. crude benchmark West Texas Intermediate climbed just 3.65%, global crude benchmark Brent was up 3.96%, and RBOB gasoline, an unfinished gasoline blendstock that is the proxy market for finished gasoline, was up 4.36%.

It’s a continuation of a trend in which diesel has soared relative to crude benchmarks, propelled by Russia’s significant role as a global supplier of diesel.

There is some signs of easing elsewhere. Physical diesel in the Gulf Coast was assessed by S&P Global Commodities, which includes the legacy Platts business, at 7.75 cts/g over the CME price Wednesday. At its peak, on March 31, it was 17.25 cts.

Settlements for the day put the spread between ULSD and Brent at about $47.40 a barrel. That is not a recent high; it topped $50 a barrel for several days in mid-March. But that spread a year ago averaged less than $16 a barrel.

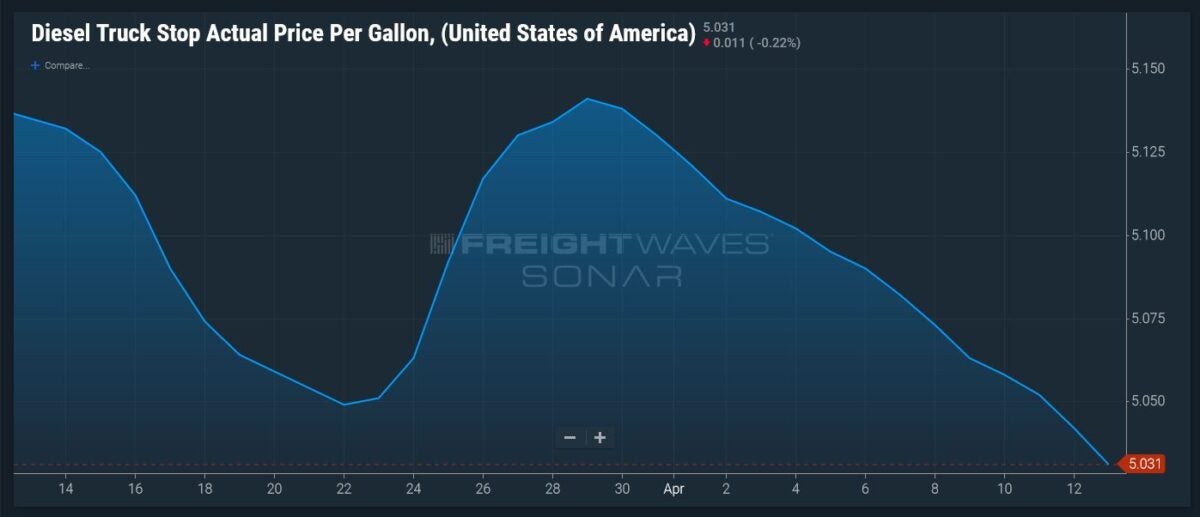

The trend in retail prices has been down, but with wholesale prices set to climb on the back of the increase in futures prices, that downward trend may be reversed.

A comparison of average retail diesel prices at all Pilot Flying J outlets, calculated on the basis of the spreadsheets of prices the chain publishes on its website, shows that prices have dropped about 10.4 cents per gallon companywide since April 4.

The DTS.USA data series in FreightWaves SONAR shows an average daily retail diesel price of $5.031 a gallon Wednesday. Its high-water mark was $5.141, on March 29.

Wholesale prices, according to the ULSDR.USA data series in SONAR, moved up to $3.796 a gallon Wednesday from $3.632 one day earlier. However, the Wednesday price would have reflected numbers at the start of the day, so it would not have moved yet to take into account the big increase on CME later that day.

The weekly EIA report also reflected a possible softening in diesel demand, which would align with reports of slower freight volume. The five-year average for the first full week of April, excluding the pandemic-impacted 2020 figure, is 4.128 million barrels a day. But the data for last week was 3.484 million.

More articles by John Kingston

TIA survey says 3PLs’ revenue up over 10% quarter over quarter

3PLs close to getting key Customs designation for cross-border trade

TIA panel to freight brokerages: Limit risk as buyers flow into market