Commentary

On Tuesday, digital freight broker Convoy staked their claim in the freight market by doing something that few have had either the ability to or desire to do before: automate detention.

Sure, many brokers have processes in place to ensure that drivers get paid when shippers delay them, but those require drivers jump through hoops to collect it. in a typical spot load, the broker requires the driver to contact them over the phone or through email inform the broker they stuck on a load. Sometimes, brokers require drivers to submit paperwork to demonstrate that they arrived on-time. It’s a hassle and many drivers just give up.

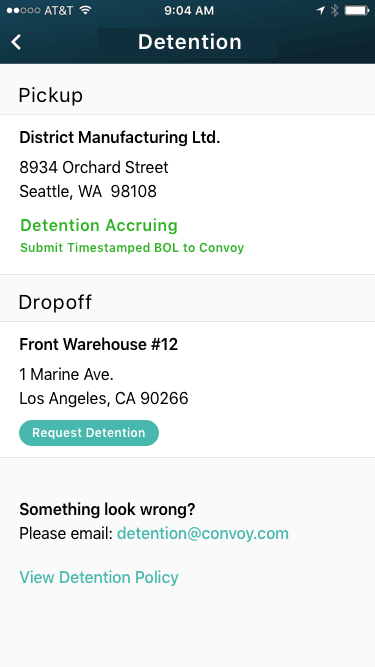

But Convoy recognized an opportunity. They created an detention processing system that pays out automatically as long as the driver is using the app.

This does a few things- it treats the driver with respect as a business owner and demonstrates good faith; creates a dedicated pool of drivers that will be more likely to haul for Convoy in the future; and most importantly, it forces the drivers to use the Convoy app.

The later is most important. The hardest thing about creating a digital brokerage is ensuring that drivers will use it and will be loyal and not “cheating on you” with other apps. The only way in a digital world to pull this off is to create a “top of wallet” experience- i.e. becoming the first place a driver goes to look for loads. If Convoy is able to create a quality experience for drivers without making their life more frustrating, they will have a huge edge for capacity.

Additionally, Convoy has been hell bent on trying to get drivers to use their app rather than calling in, knowing that the cost to manage a load is far less when it is automated through tech vs. voice. If they can stream the circle of service elements through the app, they will create an efficient process for handling freight.

On the surface it appears that Dan Lewis and company are reckless with their investor loot- but our analysis shows that this is incorrect.

We estimate that even if Convoy is forced to eat 100% of the detention on all loads that are detained (i.e. is not able to collect from shippers), the new policy will cost them an average of $8.75 for every load in their network.

If 100% of the transactions become digital, they will gain far more advantages than they will spend. Even the third-party load tracking players charge as much as $5.00/load to freight brokers for tracking loads.

According to whisper numbers in the market, Convoy finished 2017 handling north of 10,000 loads a month. At those levels, their quest for digitization and transparency will have an estimated exposure of $875,000 (or less than 1% of the gross billing on a load). With most loads costing 6-8% for handling and processing, cutting any of the manual procedures out of a load will increase margins and allow the company to compete with more favorable economics.

The good news for Dan and the Convoy team is that shippers are more willing to pay for detention if they can secure capacity. If they can demonstrate that their app has circle of service technology built into it and is an accurate reflection of what happened, they are likely to have zero issues recovering.

We expect that Convoy will soon gain competition in the market from other players offering a similar guarantee, but their automated work-flow is hard for most companies to copy overnight.