The year of the capacity crunch is getting real. With the economy continuing to grow by about 2% annually, one thing that could be slowing its growth is from the very people who deliver the goods. FreightWaves has frequently pointed out how much freight is moved through the U.S.—70% of the nation’s freight.

It’s not just carriers, big or small or in-between, that are having trouble finding quality candidates. The percentage of small businesses not able to fill open positions hit 36% in June, according to the NFIB Research Center, the highest level on record. The organization found in their most recent report that 21% of small business owners cited trouble finding qualified workers as the single-most important business problem.

FreightWaves has also covered best-case approaches to not only attracting drivers, but also in keeping them around once they land. Many in the fragmented industry still don’t even want to call the issue a “shortage.” Owner operators, for their part, have long said that the real issue is a labor issue: pay them more.

In fact, many carriers have also started raising pay, offering sign-on bonuses and numerous other incentives. But working against this is that trucking doesn’t have the “cool factor” it once possessed. ELDs and other telematics are making life on the road feel way too regulated. Gone are the days when drivers were “king of the road” or “trucker cowboys.” That’s why many carriers are trying to work with the new systems in order to increase predictability and efficiency for drivers. Familiar lanes, knowing where to park, and when you’re going to be home, are big pluses for most long haulers.

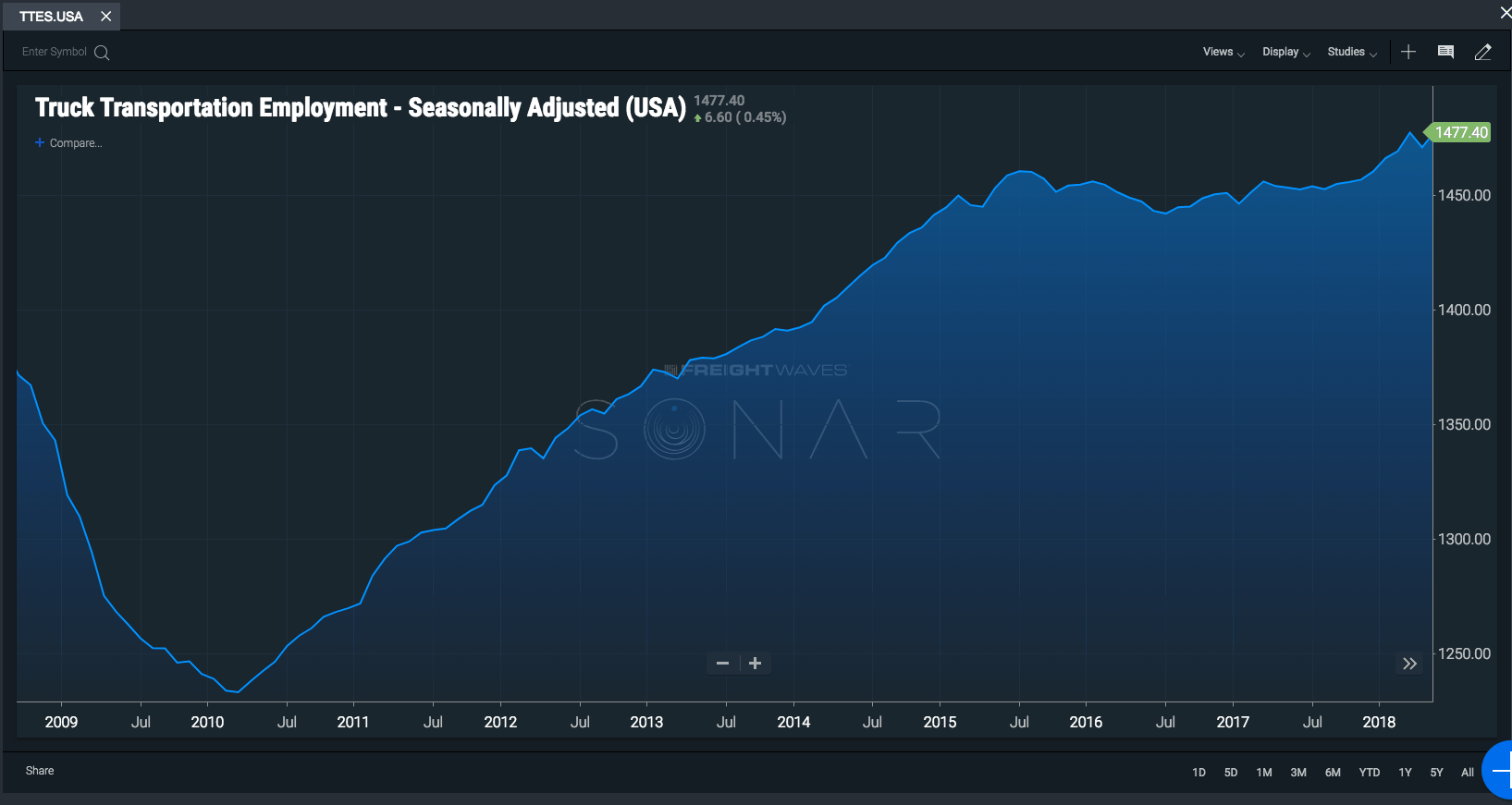

At the same time, trucking employment has grown for several consecutive years, ever since the Great Recession. Few have seen freight levels with such tight and prolonged capacity such as what we’re seeing.

Is there a solution, and, if so, what is it?

“I don’t really see any solution to the driver problem, unless the economy slows and the unemployment rate rises,” John Steele, CFO of Werner Enterprises, told a conference in June.

And for all the growth in trucking, as FreightWaves has recently examined, it’s not keeping pace with manufacturing, and just barely with retail. Trucking has actually fallen as a share of total U.S. employment, says Rob Martin, economist at UBS. He says that while the tight market has raised freight costs for shippers, competition between online and traditional retailers has so far kept a lid on consumer prices.

FreightWaves spoke with a couple of guys who are dedicated to solving the intractable issue, Craig Jablonski and Ben Onnie, CEO and COO of CDL Marketing. CDL Marketing works on digital strategies to encompass every aspect of online recruiting, and they look at ways that can “make trucking cool again.”

“For our parent’s generation it was all about how cars were cool, and there were muscle cars, and all that,” says Onnie. “Nobody in our generation cares about that anymore. In the past, trucks were really cool. What are you driving? What’s your equipment? Now having the newest truck isn’t enough. Have you seen those old orientation videos from 1997? They’re awful.”

“This issue is a tough one to talk about. There’s so many different angles,” says Onnie. “I’m 34-years-old, and I grew up without the tech. The kids these days, all they care about is the tech. For the younger crowd, especially for the over-the-road sector, you want it to be as high tech as possible, and when they’re on the road, as comfortable as possible. Maybe some kind of streaming service, or a cool way to play video games. From the branding side, some of the bigger carriers have more creative approaches. Show off that content on the social platforms, more stuff in a day-in-the-life. Making it cool in a different way. Some places have no branding at all.”

Regional and local guys aren’t immune to the tightening, either, says Jablonski. “We’re hearing from them as well. We’re working with more private fleets than ever, even if they’re home at night. These guys, however, they’re paying properly. There’s even guys making six figures if they’re willing to work hard. These guys have to touch freight, but they’re home at night.”

Also, they say carriers should focus on the career path aspect of driving. “People want a good work-life balance where they can actually make a decent living. And I still think there are some carriers out there that are still underpaying and also not branding,” says Jablonski.

“It’s a combination of things,” Onnie points out. “Attracting them with creative ways especially on the platforms that the younger generation is on. Paying 3% plus a few thousand dollars for a sign-on bonus isn’t enough. That’s basically keeping up with inflation. Right now with the good economy you can get a good job almost anywhere and be home.”

“It’s not just the big carriers, but there’s still a big group of the 100-500 trucks, their branding and their incentives are just average. They’re not doing anything creative. I wonder if the gigantic players just don’t even know what to do, but certainly they’re not paying enough,” says Jablonski.

Bringing in the right talent may be about highlighting the tech, and focusing on the career path. The flat screen and the ports for your gaming and a streaming package for when you’re not driving. Is it enough to solve an industry based on tight margins in a growing economy? So far, the answer, unfortunately, is no.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.

Tim

There’s a lot more to it if you think about it.

1 Life is extremely fast paced anymore

2 everyone seems to want high dollar pay for little work

3 most don’t want to spend so much time away from home & family

4 traffic is horrible. Everyone wants to be first there’s just no respect for other people on the road. & that starts with self respect to be curtious to fellow drivers including the jerks that drive like animals. Remember it’s always the truck drivers fault. Be defencive not offensive

5 if you want good pay & short hours you have to be willing to do what it takes. No free rides.

6 yes regulations are overboard but if you look at the big picture guys are running ragged to make a living. You get tired you make mistakes. Know your limitations if you need a rest. Take a rest. Tomorrow is another day.

7 equipment is expensive. Take care of it don’t abuse it. It’ll last longer & make it more profitable hard driving & risks cause unwanted wear

8. I could go on & on. Bottom line. Take care of yourself your equipment (your’s or company owned) be safe be smart do what’s right even if others don’t. It’s up to each of us as an individual to do what matter.

RESPECT. SHOULD BREED RESPECT. NOT RAGE

Mike gruben

The problem today in the industry is poor training and lack of professionalism with the bigger carriers. Its all about a warm body in the seat. Us older guys are getting out because it is an embarrassment to be associated with all these flip flop wearing non professionals that dont know how to drive or have any courtesy for their fellow drivers and Werner Is one of the worst. Train professionals and the industry will get better. I demand professionals and if not your fired.

Ron

It was fun back in the 80’s we had campfires and socialized. We could smoke pot and laugh you would hear us having a blast in the truckstops on the cb radio. We had party row after a long and hard week that’s exactly what we needed. Then Barbara Walters came out and trashed every driver. The DOT took a survey on only the self adjusting brakes Barbara got ahold of it and said 90% of all the trucks have faulty brakes. She came into the 76 in South Holland and picked out the dirtiest trucker in the restaurant and did her interview. They trashed the Santee truckstop and Jersey City truckstop publicity on 60 minutes portraying filthy nasty truckers. Then Bill Clinton pressed the CDL on us with high priced licenses and NAFTA that drove Freight rates down while the economy rose.

Brian

One way to solve the shortage is to pay more alot more. If we are the heartbeat of American commerce. Then think of us as the cardiologist for that heart.

James Bailey

If they want to make trucking cool again, Donald Trump needs to keep his promise of getting the government off our backs instead of lying in bed with the ATA. What a joke this guy is….

Colin Ruskin

At DriverEngagement.com we focus exclusively on Driver Retention. We have created a purpose built Driver facing solution to help improve retention. There is lots that can be done, just need a willingness to change, and a corporate focus to say this really matters.

Rick

Regarding "Making truck driving cool again"…

I am a healthcare professional with fantasies of driving when retired. May be too old by then, who knows. But the ONLY thing that turns me off is when I go to truck stops in my car and I see drivers overweight, beat-up looking, dirty-looking, tired-looking. Really makes me think…

To be cool again, the drivers should represent healthy, rested, clean, fit.

Just some comments from an observer…